Question: 13 14 15 no need for explain, just correction Additional subsequent expenditures that result in future economic benefits and can be reliably measured should be

13

14

15

no need for explain, just correction

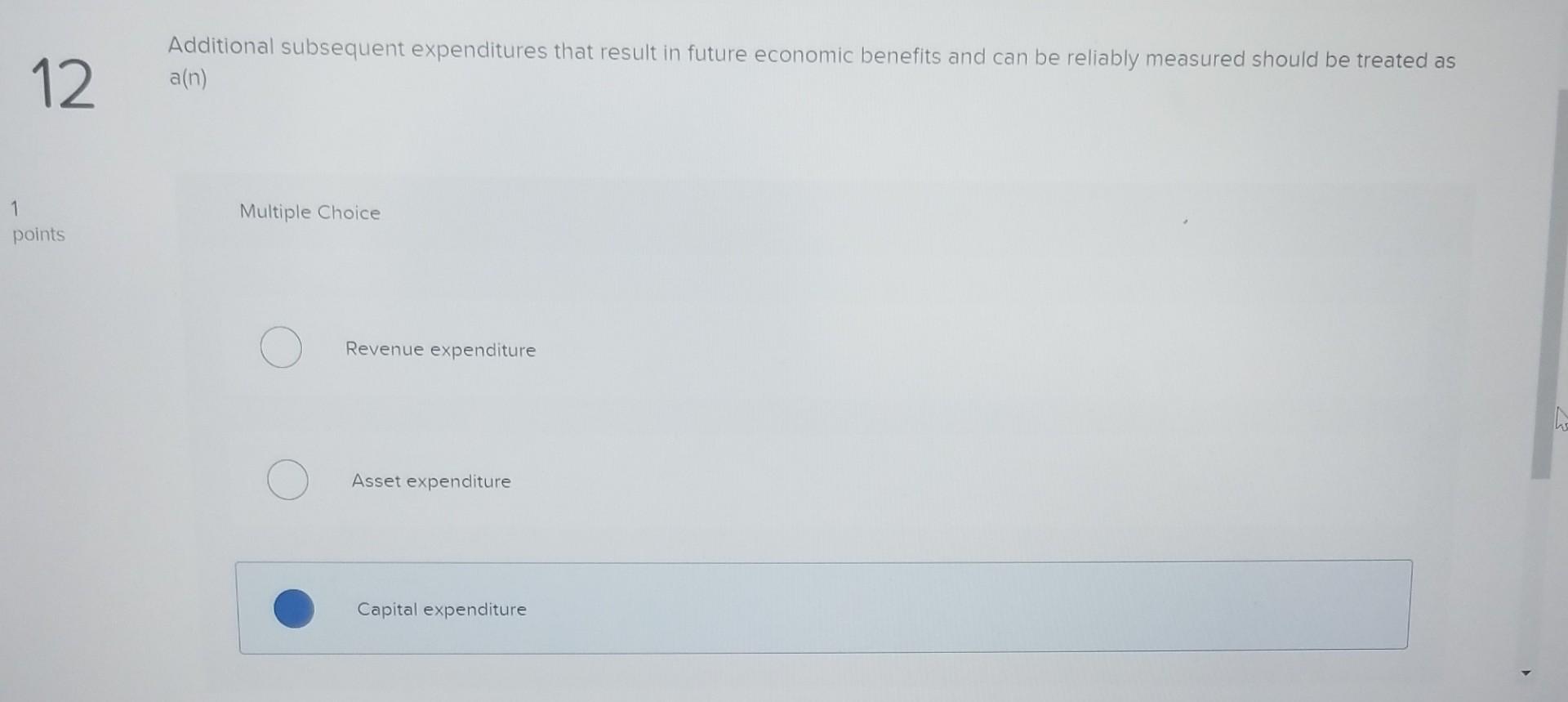

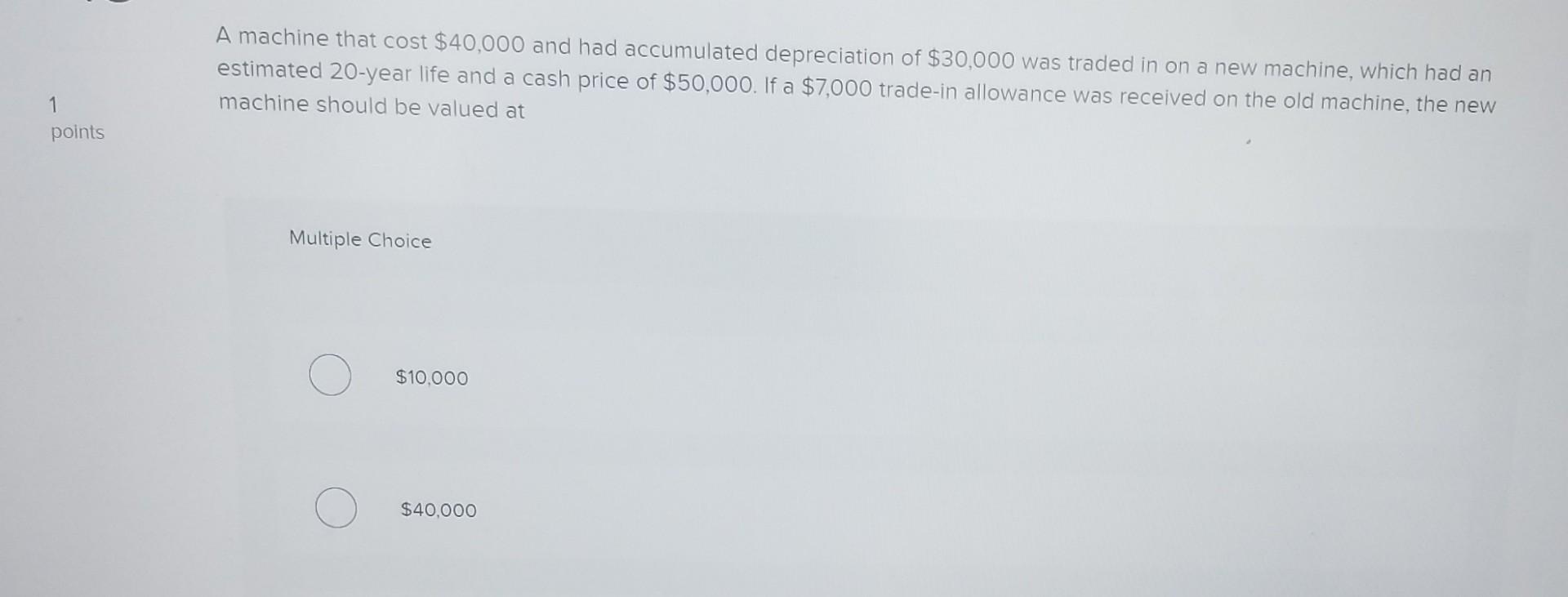

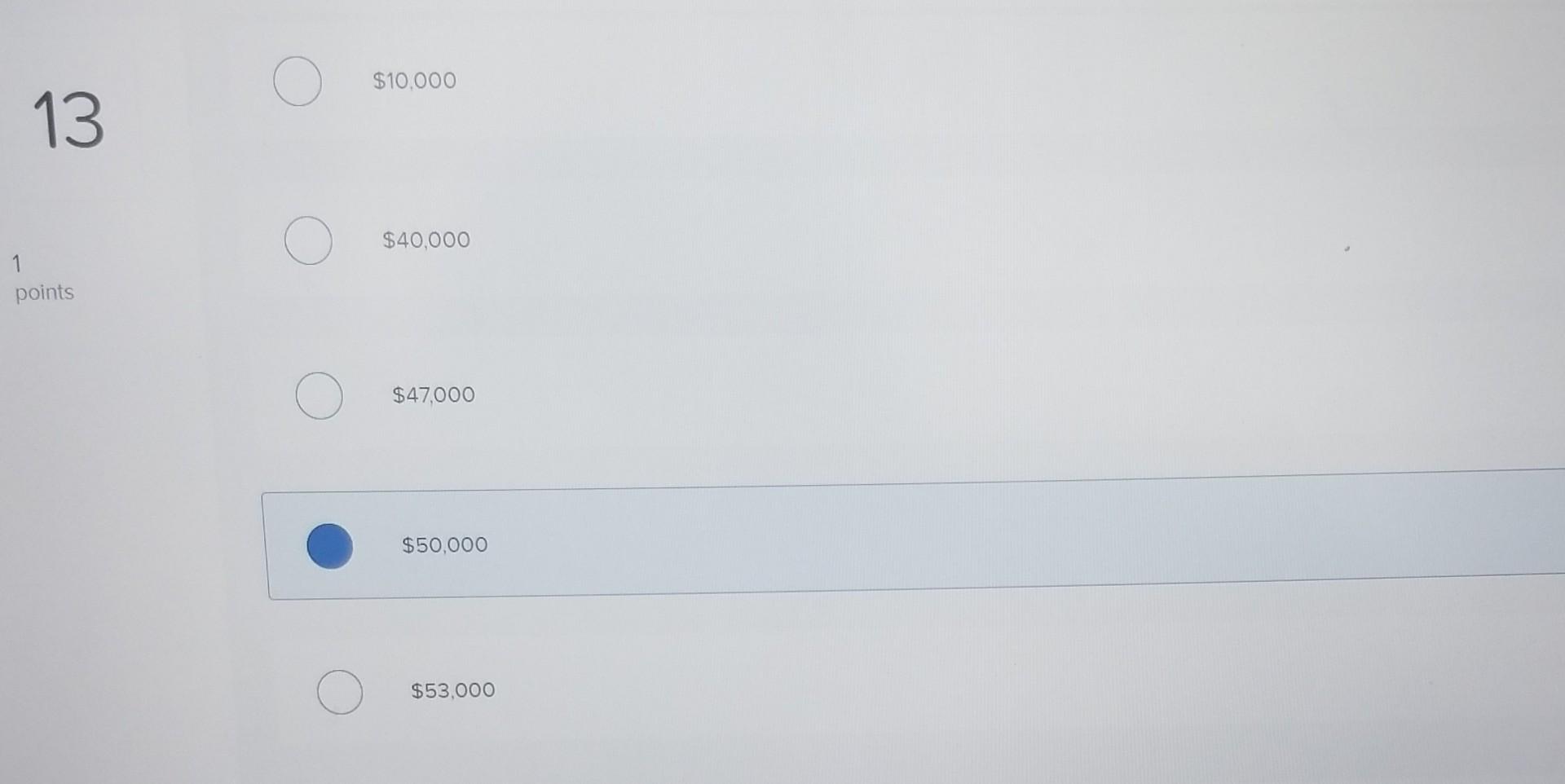

Additional subsequent expenditures that result in future economic benefits and can be reliably measured should be treated as a(n) Multiple Choice Revenue expenditure Asset expenditure Capital expenditure Asset expenditure Capital expenditure Contributed capital expenditure Balance sheet expenditure A machine that cost $40,000 and had accumulated depreciation of $30,000 was traded in on a new machine, which had an estimated 20-year life and a cash price of $50,000. If a $7,000 trade-in allowance was received on the old machine, the new machine should be valued at Multiple Choice $10,000 $40,000 $10,000 $40,000 points ( $47,000 $50,000 $53,000 Revenue expenditures Multiple Choice Are additional costs related to property, plant and equipment that do not materially increase the asset's life Are balance sheet expenditures Extend the asset's useful life Are additional costs related to property, plant and equipment that do not materially increase the asset's life Are balance sheet expenditures points Extend the asset's useful life Benefit future periods Are debited to asset accounts Intangible assets 1 points Multiple Choice Are rights, privileges, and competitive advantages to the owner, used in operations, having no physical substance Are rights, privileges, and competitive advantages to the owner, used in operations, having no physical substance Include patents, leaseholds, and land improvements Can be amortized Are rights, privileges, and competitive advantages to the owner, used in operations, having no physical substance and can be amortized All of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts