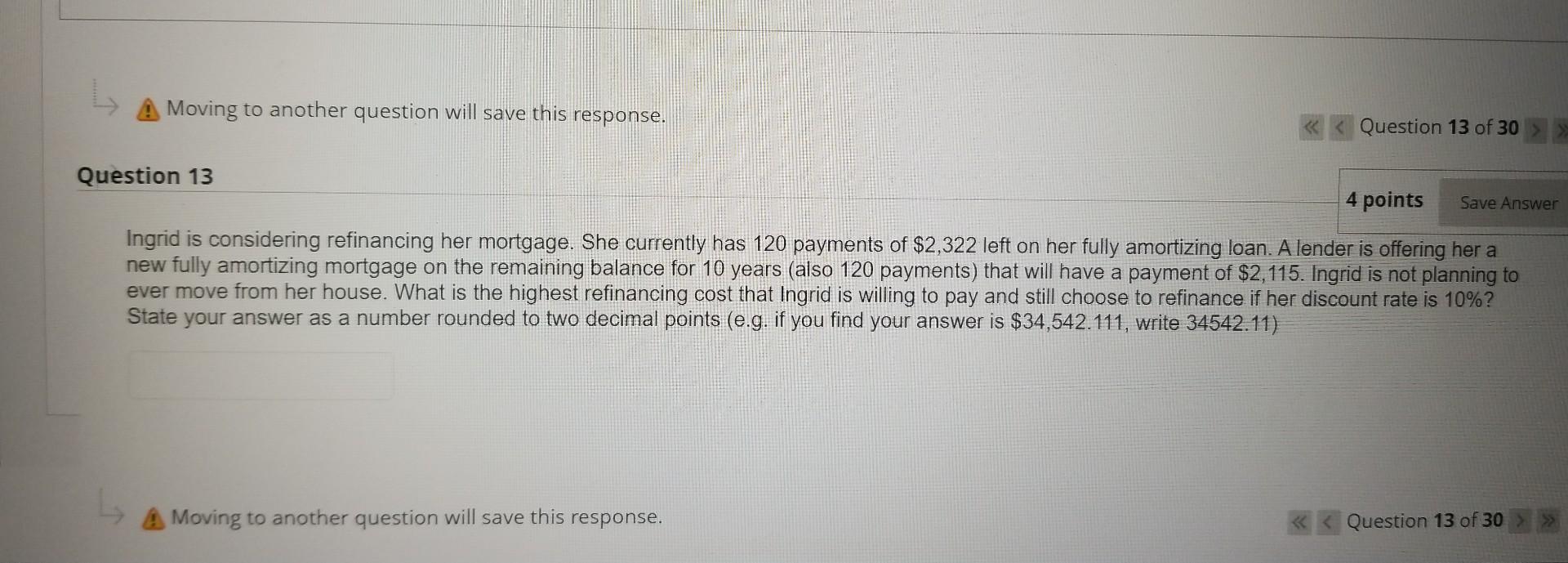

Question: 13 14 help Moving to another question will save this response. Question 13 of 30 uestion 13 4 points Ingrid is considering refinancing her mortgage.

13

14

help

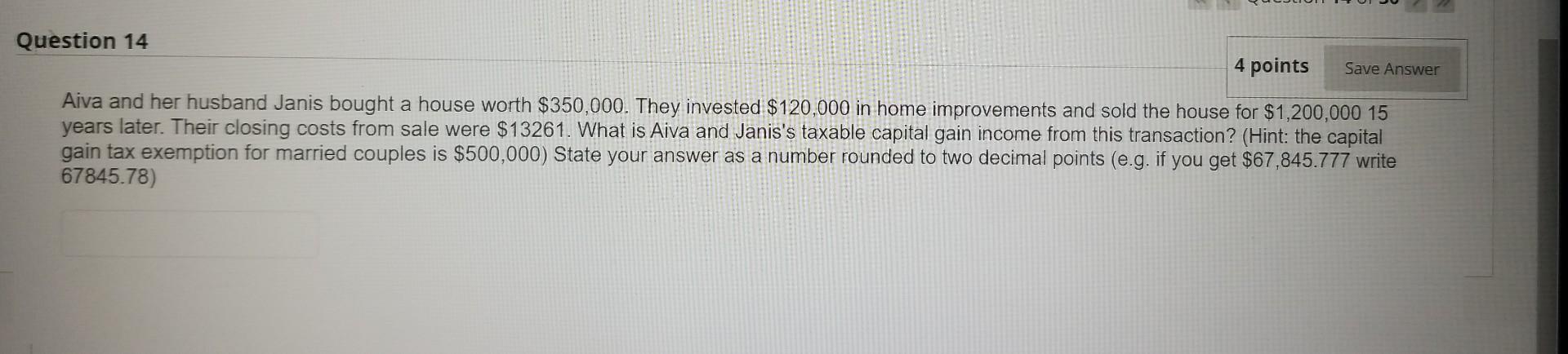

Moving to another question will save this response. Question 13 of 30 uestion 13 4 points Ingrid is considering refinancing her mortgage. She currently has 120 payments of $2,322 left on her fully amortizing loan. A lender is offering her a new fully amortizing mortgage on the remaining balance for 10 years (also 120 payments) that will have a payment of $2,115. Ingrid is not planning to ever move from her house. What is the highest refinancing cost that Ingrid is willing to pay and still choose to refinance if her discount rate is 10% ? State your answer as a number rounded to two decimal points (e.g. if you find your answer is $34,542.111, write 34542.11 ) Moving to another question will save this response. Question 13 of 30 Aiva and her husband Janis bought a house worth $350,000. They invested $120,000 in home improvements and sold the house for $1,200,00015 years later. Their closing costs from sale were $13261. What is Aiva and Janis's taxable capital gain income from this transaction? (Hint: the capital gain tax exemption for married couples is $500,000 ) State your answer as a number rounded to two decimal points (e.g. if you get $67,845.777 write 67845.78)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts