Question: 13 5 points eBook IT Hint Ask Exercise 8-20A (Static) Computing and recording goodwill LO 8-10 Arizona Corporation acquired the business Data Systems for $320,000

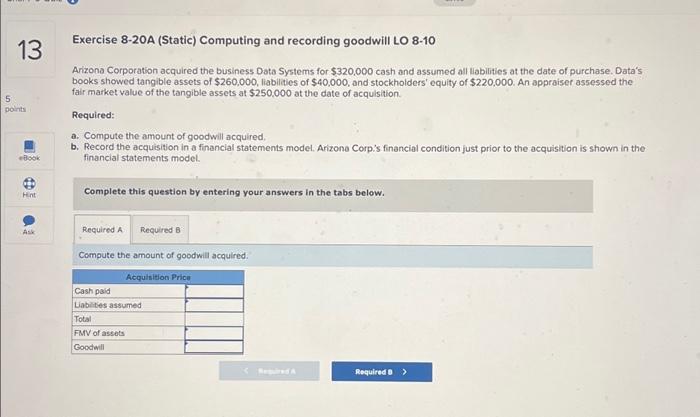

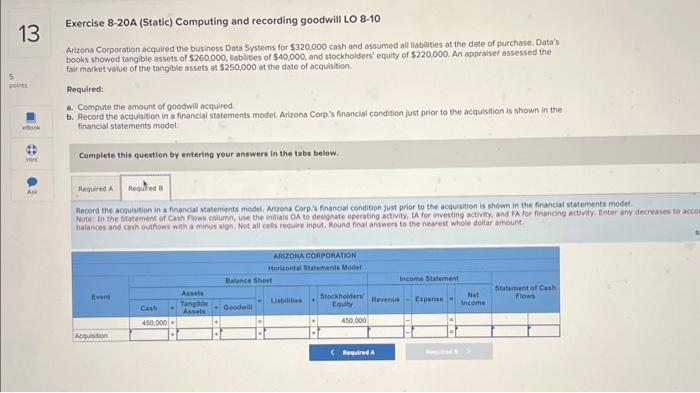

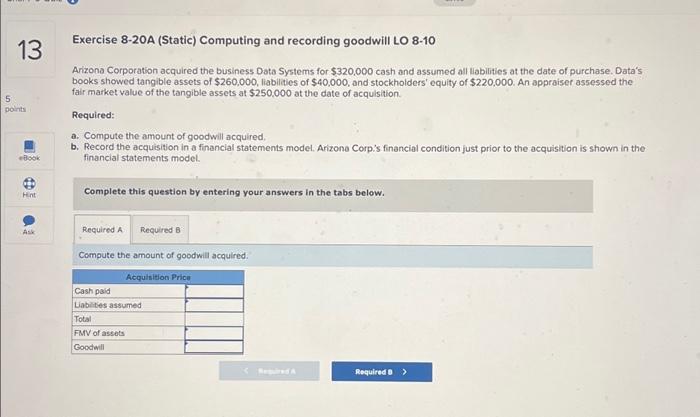

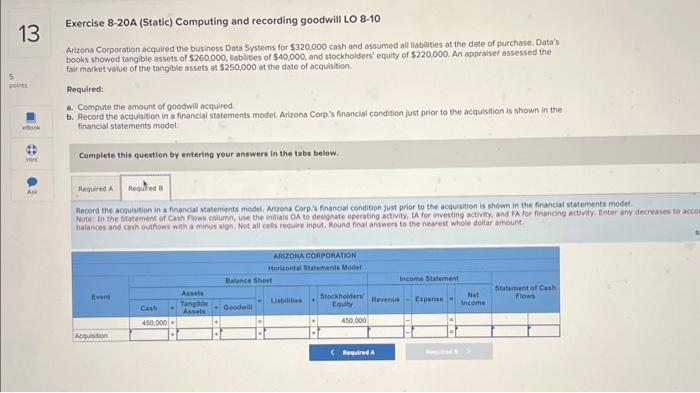

13 5 points eBook IT Hint Ask Exercise 8-20A (Static) Computing and recording goodwill LO 8-10 Arizona Corporation acquired the business Data Systems for $320,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $260,000, liabilities of $40,000, and stockholders' equity of $220,000. An appraiser assessed the fair market value of the tangible assets at $250,000 at the date of acquisition. Required: a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model. Arizona Corp.'s financial condition just prior to the acquisition is shown in the financial statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of goodwill acquired. Acquisition Price Cash paid Liabilities assumed Total FMV of assets Goodwill

Exercise 8-20A (Static) Computing and recording goodwill LO 8-10 Arizona Corporation acquired the business Data Systems for $320,000 cash and assumed all llabilities at the date of purchase. Data's books showed tangible assets of $260,000, liabilities of $40,000, and stockholders' equity of $220,000. An appraiser assessed the fair market value of the tangible assets at $250,000 at the date of acquisition. Required: a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model. Arizone Corp's financial condition just prior to the acquisition is shown in the financial statements model. Complete this question by entering your answers in the tabs below. Compute the amount of goodwill acquired. Exercise 8-20A (Static) Computing and recording goodwill LO 8-10 Arzona Corporation acquired the business. Data Systems for $320,000 cash and assumed all liabitios at the date of purchase, Data's books showed tangibile assets of $260.000, liablities of $40,000, and stockholders' equily of $220.000. An appraiser assessed the fait market valie of the tangible assets at $250,000 at the dote of acquisition. Required: a. Compute the amount of goodwili acquired b. Record the acquisition in a financial statements modeL. Artrono Corp's financial condition just prior to the acquistion is shown in the financisl statements model. Complete this question by entering your answers in the tabs below. Aecord the acquistion in a financal vatements medti. Arizena Corps s financial concition just prior to the acquisition is shown in the financiai statements modet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock