Question: 13. A 20 -year, 6 percent semiannual coupon bond has a yield to maturity of 6.85%. What is the current price of this bond (approximately)?

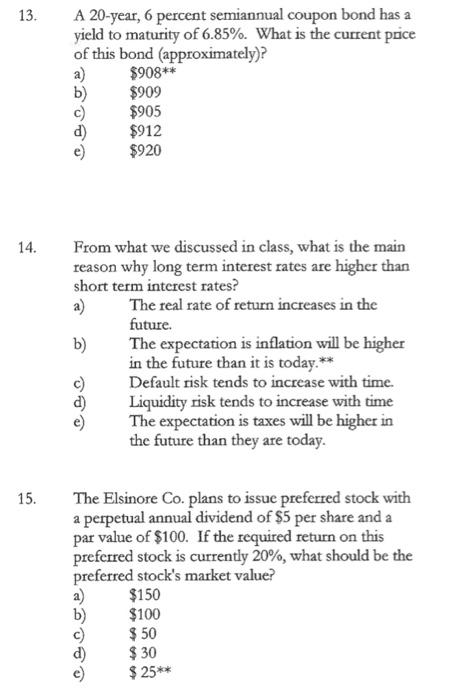

13. A 20 -year, 6 percent semiannual coupon bond has a yield to maturity of 6.85%. What is the current price of this bond (approximately)? a) $908 b) $909 c) $905 d) $912 e) $920 14. From what we discussed in class, what is the main reason why long term interest rates are higher than short term interest rates? a) The real rate of return increases in the future. b) The expectation is inflation will be higher in the future than it is today. ** c) Default risk tends to increase with time. d) Liquidity risk tends to increase with time e) The expectation is taxes will be higher in the future than they are today. 15. The Elsinore Co. plans to issue preferred stock with a perpetual annual dividend of $5 per share and a par value of $100. If the required return on this preferred stock is currently 20%, what should be the preferred stock's market value? a) $150 b) $100 c) $50 d) $30 e) $25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts