Question: 13. A tax bracket refers to: a. Your standard deduction amount as a single or married thing jointy (Mrn) tax poper b. The total amount

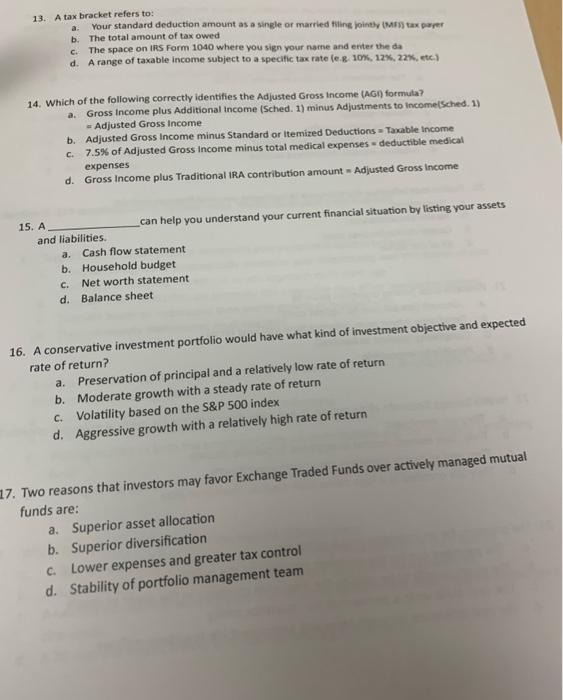

13. A tax bracket refers to: a. Your standard deduction amount as a single or married thing jointy (Mrn) tax poper b. The total amount of tax owed c. The space on IRS form 1040 where you sign your name and enter the da d. A range of taxable income subject to a specific tax rate (e. 8. 10%,12,22%, etc) 14. Which of the following correctly identifies the Adjusted Gross income (AGn) formuta? a. Gross income plus Additional income (Sched. 1) minus Adjustments to income(Sched. 1) a Adjusted Gross Income b. Adjusted Gross Income minus Standard or Itemized Deductions = Taxable income c. 7.5\% of Adjusted Gross income minus total medical expenses = deductible medical d. Gross income plus Traditional IRA contribution amount = Adjusted Gross income expenses 15. A can help you understand your current financial situation by listing your assets and liabilities. a. Cash flow statement b. Household budget c. Net worth statement d. Balance sheet 16. A conservative investment portfolio would have what kind of investment objective and expected a. Preservation of principal and a relatively low rate of return rate of return? b. Moderate growth with a steady rate of return c. Volatility based on the S\&P 500 index d. Aggressive growth with a relatively high rate of return 17. Two reasons that investors may favor Exchange Traded Funds over actively managed mutual funds are: a. Superior asset allocation b. Superior diversification c. Lower expenses and greater tax control d. Stability of portfolio management team

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts