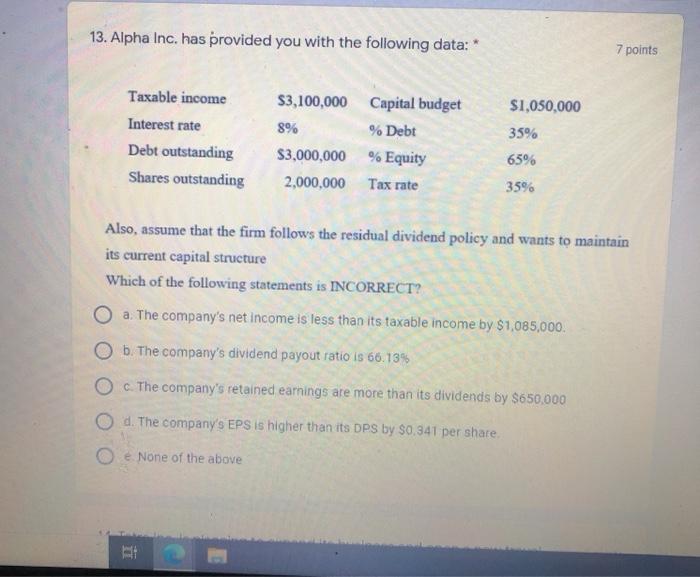

Question: 13. Alpha Inc. has provided you with the following data: * 7 points 8% Taxable income Interest rate Debt outstanding Shares outstanding $3,100,000 Capital budget

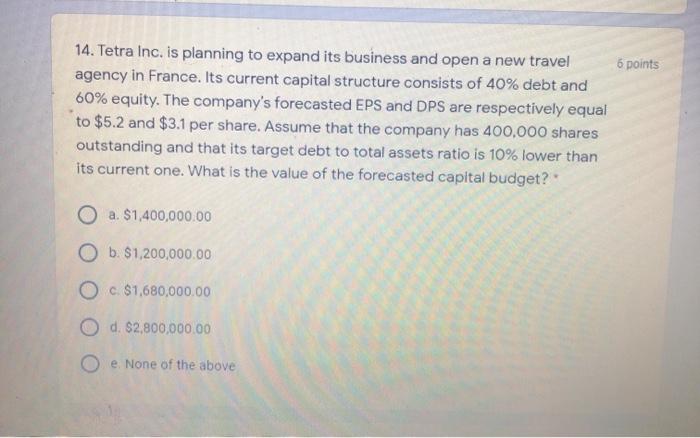

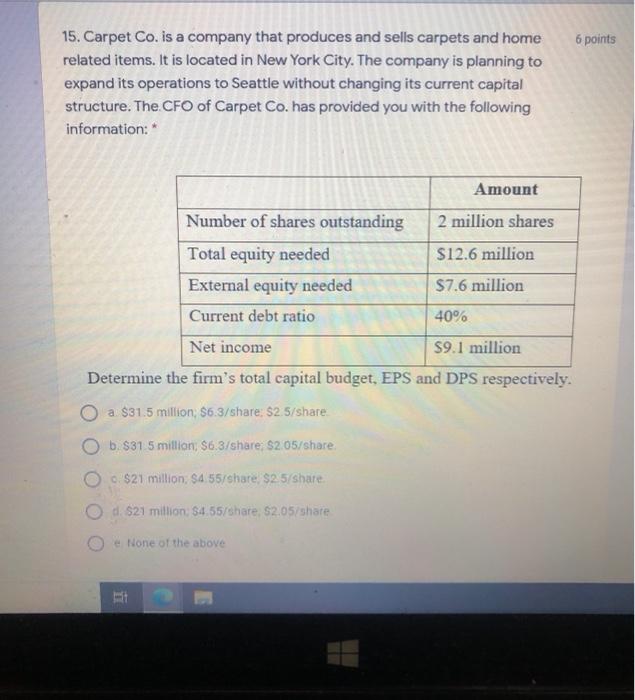

13. Alpha Inc. has provided you with the following data: * 7 points 8% Taxable income Interest rate Debt outstanding Shares outstanding $3,100,000 Capital budget % Debt $3,000,000 % Equity 2,000,000 Tax rate $1,050,000 35% 65% 35% Also, assume that the firm follows the residual dividend policy and wants to maintain its current capital structure Which of the following statements is INCORRECT? O a. The company's net income is less than its taxable income by $1,085,000. O b. The company's dividend payout ratio is 66.13% O c The company's retained earnings are more than its dividends by $650.000 O d. The company's EPS is higher than its DPS by $0.341 per share. None of the above 6 points 14. Tetra Inc. is planning to expand its business and open a new travel agency in France. Its current capital structure consists of 40% debt and 60% equity. The company's forecasted EPS and DPS are respectively equal to $5.2 and $3.1 per share. Assume that the company has 400,000 shares outstanding and that its target debt to total assets ratio is 10% lower than its current one. What is the value of the forecasted capital budget? O a $1,400,000.00 O b. $1,200,000.00 O c. $1,680,000.00 O d. $2,800,000.00 O e None of the above 6 points 15. Carpet Co. is a company that produces and sells carpets and home related items. It is located in New York City. The company is planning to expand its operations to Seattle without changing its current capital structure. The CFO of Carpet Co. has provided you with the following information: Amount Number of shares outstanding 2 million shares Total equity needed $12.6 million External equity needed $7.6 million Current debt ratio 40% Net income $9.1 million Determine the firm's total capital budget, EPS and DPS respectively. O a $31.5 million $6.3/share: $2.5/share O b.$315 million $6.3/share $2.05/share, $21 million $4.55/share, $2.5 Share O d. $21 million $4.55/share, $2.05/share None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts