Question: 13. AMS Company has unexpectedly generated a one-time extra $5 million in cash flow this year. After announcing the extra cash flow, AMS stock price

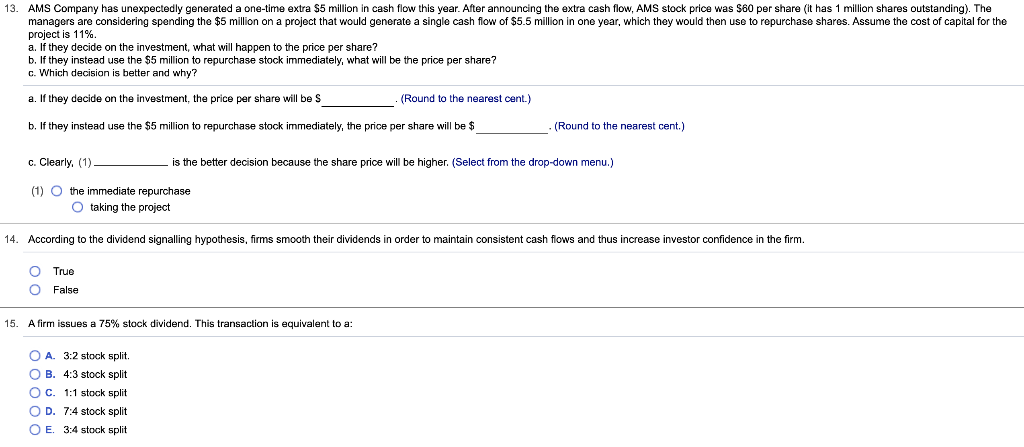

13. AMS Company has unexpectedly generated a one-time extra $5 million in cash flow this year. After announcing the extra cash flow, AMS stock price was $60 per share (it has 1 million shares outstanding). The managers are considering spending the $5 million on a project that would generate a single cash flow of $5.5 million in one year, which they would then use to repurchase shares. Assume the cost of capital for the 11% a. If they decide on the investment, what will happen to the price per share? b. If they instead use the $5 million to repurchase stock immediately, what will be the price per share? c. Which decision is better and why? project is 1 a. If they decide on the investment, the price per share will be s (Round to the nearest cent.) b. If they instead use the $5 million to repurchase stock immediately, the price per share will be $ (Round to the nearest cent.) c. Clearly. (1 is the better decision because the share price will be higher. (Select from the drop-down menu.) (1) O the immediate repurchase O taking the project 14. According to the dividend signalling hypothesis, firms smooth their dividends in order to maintain consistent cash flows and thus increase investor confidence in the firm. O True O False 15. A firm issues a 75% stock dividend. This transaction is equivalent to a: OA. 3:2 stock split. OB. 4:3 stock split O C. 1:1 stock split OD. 7:4 stock split O E. 3:4 stock split 13. AMS Company has unexpectedly generated a one-time extra $5 million in cash flow this year. After announcing the extra cash flow, AMS stock price was $60 per share (it has 1 million shares outstanding). The managers are considering spending the $5 million on a project that would generate a single cash flow of $5.5 million in one year, which they would then use to repurchase shares. Assume the cost of capital for the 11% a. If they decide on the investment, what will happen to the price per share? b. If they instead use the $5 million to repurchase stock immediately, what will be the price per share? c. Which decision is better and why? project is 1 a. If they decide on the investment, the price per share will be s (Round to the nearest cent.) b. If they instead use the $5 million to repurchase stock immediately, the price per share will be $ (Round to the nearest cent.) c. Clearly. (1 is the better decision because the share price will be higher. (Select from the drop-down menu.) (1) O the immediate repurchase O taking the project 14. According to the dividend signalling hypothesis, firms smooth their dividends in order to maintain consistent cash flows and thus increase investor confidence in the firm. O True O False 15. A firm issues a 75% stock dividend. This transaction is equivalent to a: OA. 3:2 stock split. OB. 4:3 stock split O C. 1:1 stock split OD. 7:4 stock split O E. 3:4 stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts