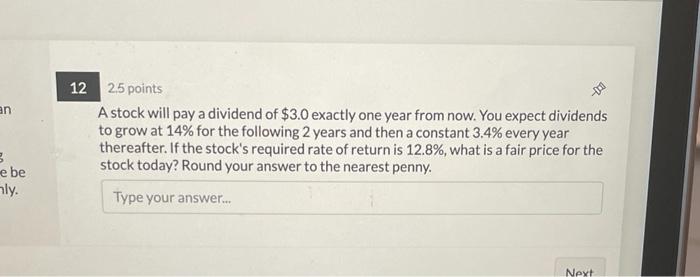

Question: 13 an 12 25 points A stock will pay a dividend of $3.0 exactly one year from now. You expect dividends to grow at 14%

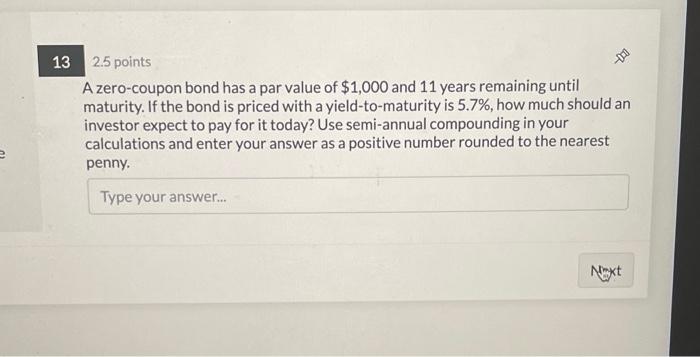

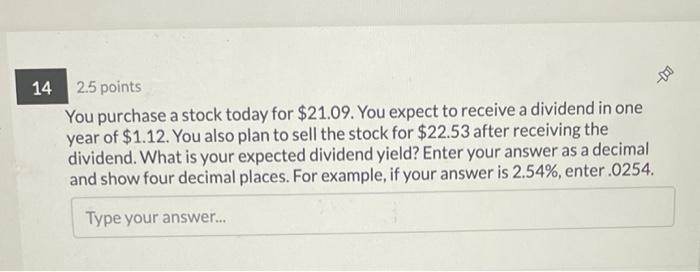

13 an 12 25 points A stock will pay a dividend of $3.0 exactly one year from now. You expect dividends to grow at 14% for the following 2 years and then a constant 3.4% every year thereafter. If the stock's required rate of return is 12.8%, what is a fair price for the stock today? Round your answer to the nearest penny. Type your answer... e be nly. Next 13 2.5 points A zero-coupon bond has a par value of $1,000 and 11 years remaining until maturity. If the bond is priced with a yield-to-maturity is 5.7%, how much should an investor expect to pay for it today? Use semi-annual compounding in your calculations and enter your answer as a positive number rounded to the nearest penny. Type your answer... Next 14 -1.0 2.5 points You purchase a stock today for $21.09. You expect to receive a dividend in one year of $1.12. You also plan to sell the stock for $22.53 after receiving the dividend. What is your expected dividend yield? Enter your answer as a decimal and show four decimal places. For example, if your answer is 2.54%, enter.0254. Type your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts