Question: 13 and 14 i keep getting wrong need help with them 13. Assume you sold the May $120 call for $8.757 days before expiration. It

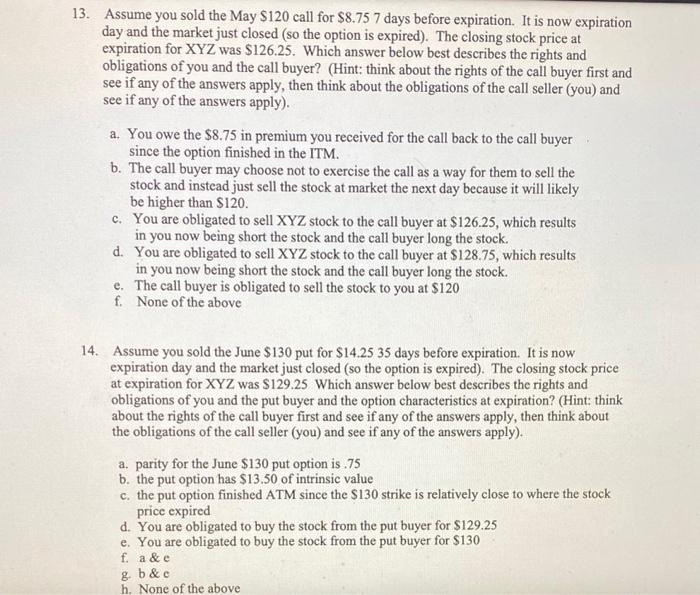

13. Assume you sold the May $120 call for $8.757 days before expiration. It is now expiration day and the market just closed (so the option is expired). The closing stock price at expiration for XYZ was $126.25. Which answer below best describes the rights and obligations of you and the call buyer? (Hint: think about the rights of the call buyer first and see if any of the answers apply, then think about the obligations of the call seller (you) and see if any of the answers apply). a. You owe the $8.75 in premium you received for the call back to the call buyer since the option finished in the ITM. b. The call buyer may choose not to exercise the call as a way for them to sell the stock and instead just sell the stock at market the next day because it will likely be higher than $120. c. You are obligated to sell XYZ stock to the call buyer at $126.25, which results in you now being short the stock and the call buyer long the stock. d. You are obligated to sell XYZ stock to the call buyer at $128.75, which results in you now being short the stock and the call buyer long the stock. e. The call buyer is obligated to sell the stock to you at $120 f. None of the above 14. Assume you sold the June $130 put for $14.2535 days before expiration. It is now expiration day and the market just closed (so the option is expired). The closing stock price at expiration for XYZ was $129.25 Which answer below best describes the rights and obligations of you and the put buyer and the option characteristics at expiration? (Hint: think about the rights of the call buyer first and see if any of the answers apply, then think about the obligations of the call seller (you) and see if any of the answers apply). a. parity for the June $130 put option is . 75 b. the put option has $13.50 of intrinsic value c. the put option finished ATM since the $130 strike is relatively close to where the stock price expired d. You are obligated to buy the stock from the put buyer for $129.25 e. You are obligated to buy the stock from the put buyer for $130 f. a \& e g. b&c h. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts