Question: 13. Arbitrage: Covered interest 1. 2. 3 4. 5. STEP: 2 of 5 Suppose you observe that the 90-day interest rate across the eurozone is

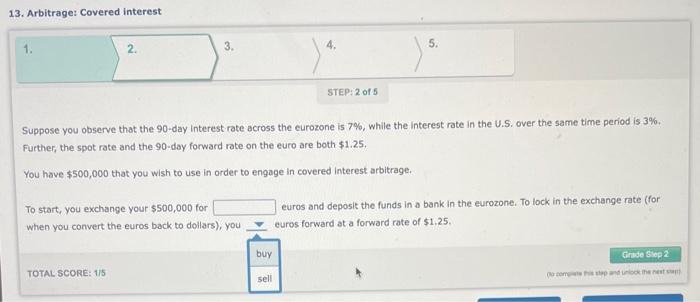

13. Arbitrage: Covered interest 1. 2. 3 4. 5. STEP: 2 of 5 Suppose you observe that the 90-day interest rate across the eurozone is 7%, while the interest rate in the U.S. over the same time period is 3%. Further, the spot rate and the 90-day forward rate on the euro are both $1.25 You have $500,000 that you wish to use in order to engage in covered interest arbitrage. To start, you exchange your $500,000 for when you convert the euros back to dollars), you euros and deposit the funds in a bank in the eurozone. To lock in the exchange rate (for euros forward at a forward rate of $1.25. buy Grade Step 2 TOTAL SCORE: 1/5 sell como the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts