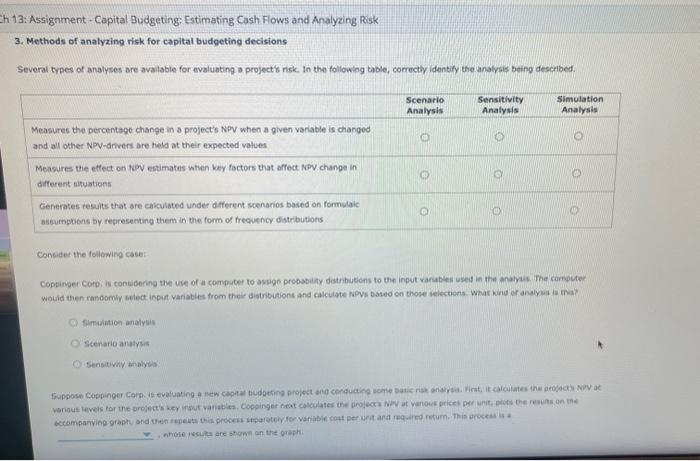

Question: 13: Assignment - Capital Budgeting: Estimating Cash Flows and Analyzing Risk 3. Methods of analyzing risk for capital budgeting decisions Several types of analyses are

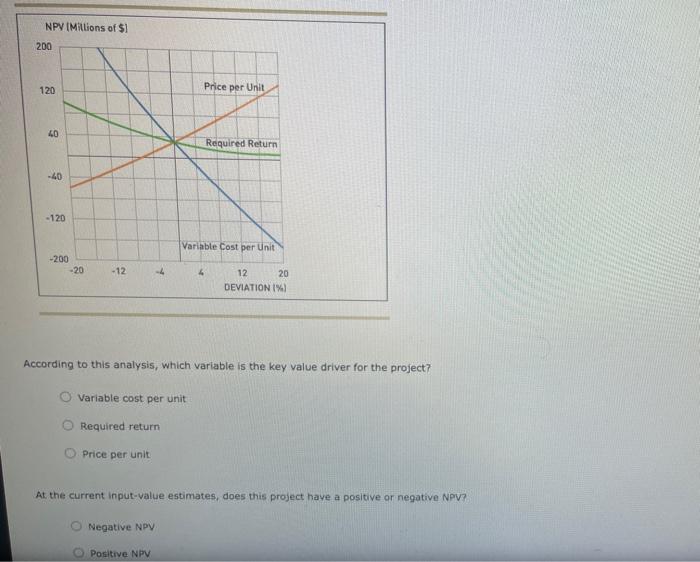

13: Assignment - Capital Budgeting: Estimating Cash Flows and Analyzing Risk 3. Methods of analyzing risk for capital budgeting decisions Several types of analyses are available for evaluating a project's risk. in the following table, correctly identify the analysis being described. Consider the fellowing case: Copsinger corpi is considering the use of a computer to avpgn probsbidy distnbveons to the input rariables used in the malyis. The carpputer would then ranoomiy salect indit variaties from their distributions and calcuate Novs based on those selections. What wind of analyial is tha? Simbiation analysis Scenario antives Sensitiving andiyds anowe wssuifa dere shonef on the gruph. According to this analysis, which variable is the key value driver for the project? Variable cost per unit Required return Price per unit At the current input-value estimates, does this project haye a positive or negative NPV? Negative NPY Positive NPV At the current input-value estimates, does this project have a positive or negotive NpV? Negative wPV Posishe Npe Bocision trees ace a visual reptesersation of the sequential choices that financial decisioh makers face when making captal budgeting and inveitment decisigns. True on Faise: Tyeicaiy the beginting of the project is rigkier than tater stages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts