Question: 13. Bud exchanges a business use machine with an adiusted basi value of $30,000 for another business use machine with a fair market value of

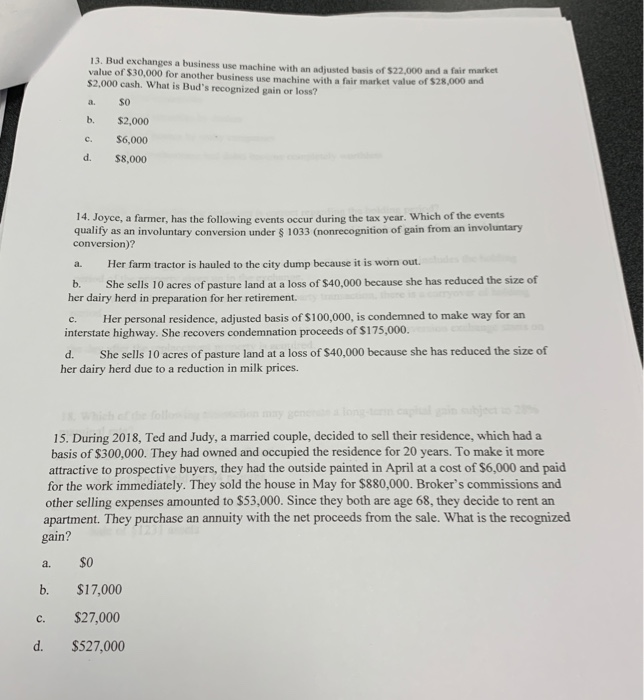

13. Bud exchanges a business use machine with an adiusted basi value of $30,000 for another business use machine with a fair market value of $28,000 and s of $22,000 and a fair market $2,000 cash. What is Bud's recognized gain or loss? a. b. $2,000 c. $6,000 d. $8,000 14. Joyce, a farmer, has the following events occur during the tax year. Which of the events qualify as an involuntary conversion under 1033 (nonrecognition of gain from an involuntary conversion)? a. Her farm tractor is hauled to the city dump because it is worn out. b. She sells 10 acres of pasture land at a loss of $40,000 because she has reduced the size of her dairy herd in preparation for her retirement. c. Her personal residence, adjusted basis of $100,000, is condemned to make way for an interstate highway. She recovers condemnation proceeds of $175,000 d. She sells 10 acres of pasture land at a loss of $40,000 because she has reduced the size of her dairy herd due to a reduction in milk prices 15. During 2018, Ted and Judy, a married couple, decided to sell their residence, which had a basis of $300,000. They had owned and occupied the residence for 20 years. To make it more attractive to prospective buyers, they had the outside painted in April at a cost of $6,000 and paid for the work immediately. They sold the house in May for $880,000. Broker's commissions and other selling expenses amounted to $53,000. Since they both are age 68, they decide to rent an apartment. They purchase an annuity with the net proceeds from the sale. What is the recognized gain a. SO b. $17,000 c. $27,000 d. $527,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts