Question: 13. C 14. A 15. D. 16. ??? Suppose Exxon Mobil wants to launch a big project to invest in a process to do hydraulic

13. C

14. A

15. D.

16. ???

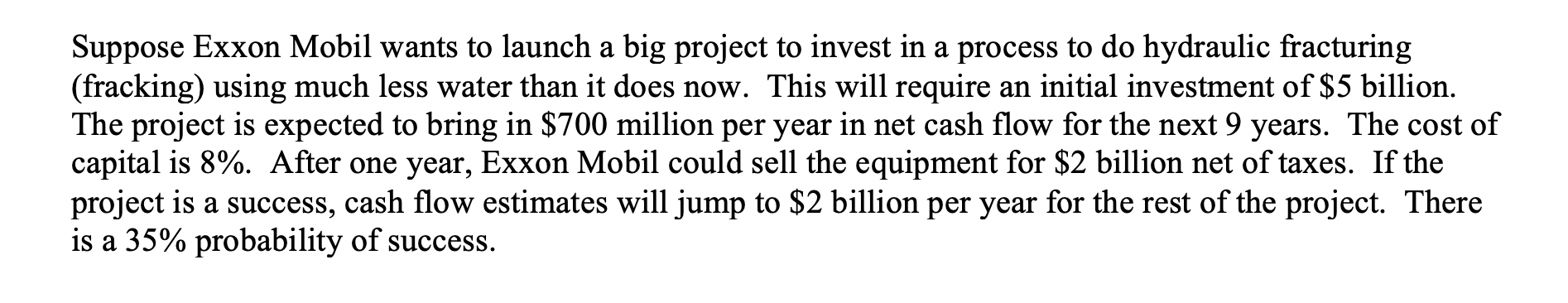

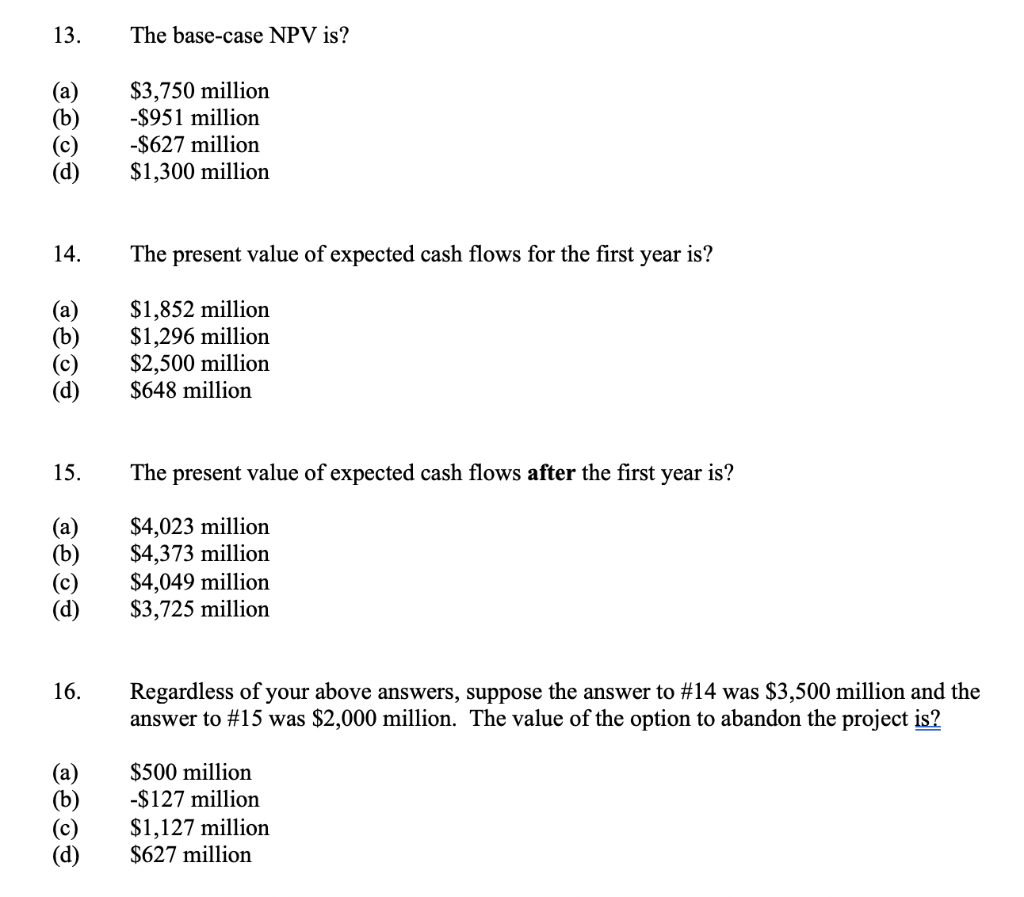

Suppose Exxon Mobil wants to launch a big project to invest in a process to do hydraulic fracturing (fracking) using much less water than it does now. This will require an initial investment of $5 billion. The project is expected to bring in $700 million per year in net cash flow for the next 9 years. The cost of capital is 8%. After one year, Exxon Mobil could sell the equipment for $2 billion net of taxes. If the project is a success, cash flow estimates will jump to $2 billion per year for the rest of the project. There is a 35% probability of success. 13. The base-case NPV is? (a) $3,750 million -$951 million $627 million $1,300 million 14. The present value of expected cash flows for the first year is? (a) $1,852 million $1,296 million $2,500 million $648 million 15. The present value of expected cash flows after the first year is? (a) (b) (C) (d) $4,023 million $4,373 million $4,049 million $3,725 million 16. Regardless of your above answers, suppose the answer to #14 was $3,500 million and the answer to #15 was $2,000 million. The value of the option to abandon the project is? $500 million -$127 million $1,127 million $627 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts