Question: 1/3 Case Study 1 Operating Transactions, Special Topics, and Financial Statements The City of Morse's General Fund had the following post-closing trial balance at June

1/3

1/3

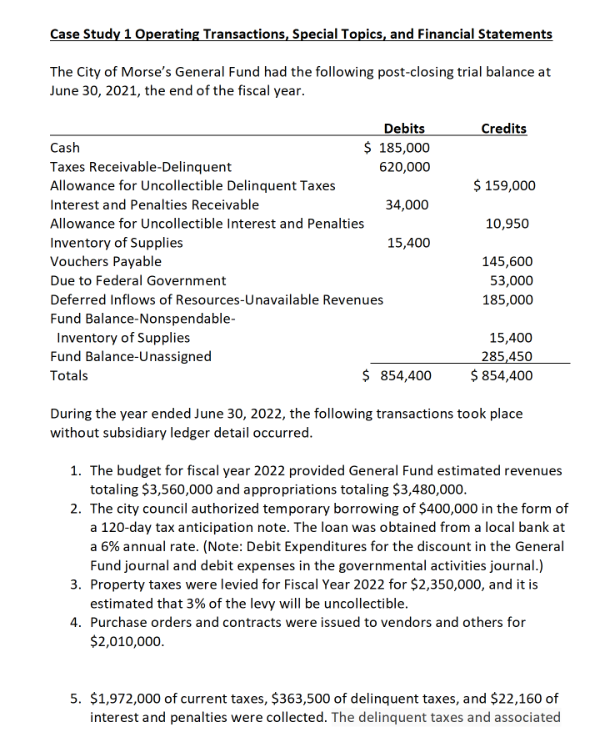

Case Study 1 Operating Transactions, Special Topics, and Financial Statements The City of Morse's General Fund had the following post-closing trial balance at June 30,2021 , the end of the fiscal year. During the year ended June 30,2022 , the following transactions took place without subsidiary ledger detail occurred. 1. The budget for fiscal year 2022 provided General Fund estimated revenues totaling $3,560,000 and appropriations totaling $3,480,000. 2. The city council authorized temporary borrowing of $400,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a 6% annual rate. (Note: Debit Expenditures for the discount in the General Fund journal and debit expenses in the governmental activities journal.) 3. Property taxes were levied for Fiscal Year 2022 for $2,350,000, and it is estimated that 3% of the levy will be uncollectible. 4. Purchase orders and contracts were issued to vendors and others for $2,010,000. 5. $1,972,000 of current taxes, $363,500 of delinquent taxes, and $22,160 of interest and penalties were collected. The delinquent taxes and associated Case Study 1 Operating Transactions, Special Topics, and Financial Statements The City of Morse's General Fund had the following post-closing trial balance at June 30,2021 , the end of the fiscal year. During the year ended June 30,2022 , the following transactions took place without subsidiary ledger detail occurred. 1. The budget for fiscal year 2022 provided General Fund estimated revenues totaling $3,560,000 and appropriations totaling $3,480,000. 2. The city council authorized temporary borrowing of $400,000 in the form of a 120-day tax anticipation note. The loan was obtained from a local bank at a 6% annual rate. (Note: Debit Expenditures for the discount in the General Fund journal and debit expenses in the governmental activities journal.) 3. Property taxes were levied for Fiscal Year 2022 for $2,350,000, and it is estimated that 3% of the levy will be uncollectible. 4. Purchase orders and contracts were issued to vendors and others for $2,010,000. 5. $1,972,000 of current taxes, $363,500 of delinquent taxes, and $22,160 of interest and penalties were collected. The delinquent taxes and associated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts