Question: 13. Cash flows for two projects are presented below. Assume that the appropriate risk- adjusted cost of capital is 12%. Calculate the NPV, IRR, and

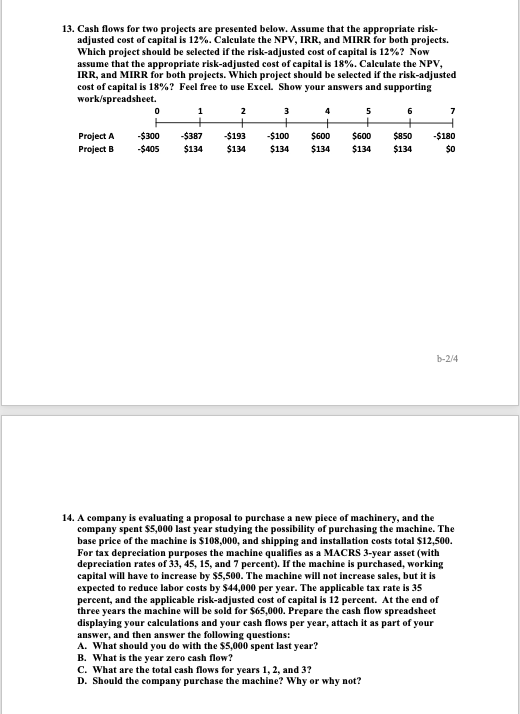

13. Cash flows for two projects are presented below. Assume that the appropriate risk- adjusted cost of capital is 12%. Calculate the NPV, IRR, and MIRR for both projects. Which project should be selected if the risk-adjusted cost of capital is 12%? Now assume that the appropriate risk-adjusted cost of capital is 18%. Caleulate the NPV, IRR, and MIRR for both projects. Which project should be selected if the risk-adjusted cost of capital is 18%? Feel free to use Excel. Show your answers and supporting work/spreadsheet 0 1 2 3 4 5 7 Project A Project B -$300 -$405 $387 $134 $193 $134 $100 $134 $600 $134 $600 $134 $850 $134 -$180 $0 -214 14. A company is evaluating a proposal to purchase a new piece of machinery, and the company spent $5,000 last year studying the possibility of purchasing the machine. The base price of the machine is $108,000, and shipping and installation costs total $12,500. For tax depreciation purposes the machine qualifies as a MACRS 3-year asset (with depreciation rates of 33, 45, 15, and 7 percent). If the machine is purchased, working capital will have to increase by $5,500. The machine will not increase sales, but it is expected to reduce labor costs by S44,000 per year. The applicable tax rate is 35 percent, and the applicable risk-adjusted cost of capital is 12 percent. At the end of three years the machine will be sold for $65,000. Prepare the cash flow spreadsheet displaying your caleulations and your cash flows per year, attach it as part of your answer, and then answer the following questions: A. What should you do with the $5,000 spent last year? B. What is the year zero cash flow? c. What are the total cash flows for years 1, 2, and 3? D. Should the company purchase the machine? Why or why not? 13. Cash flows for two projects are presented below. Assume that the appropriate risk- adjusted cost of capital is 12%. Calculate the NPV, IRR, and MIRR for both projects. Which project should be selected if the risk-adjusted cost of capital is 12%? Now assume that the appropriate risk-adjusted cost of capital is 18%. Caleulate the NPV, IRR, and MIRR for both projects. Which project should be selected if the risk-adjusted cost of capital is 18%? Feel free to use Excel. Show your answers and supporting work/spreadsheet 0 1 2 3 4 5 7 Project A Project B -$300 -$405 $387 $134 $193 $134 $100 $134 $600 $134 $600 $134 $850 $134 -$180 $0 -214 14. A company is evaluating a proposal to purchase a new piece of machinery, and the company spent $5,000 last year studying the possibility of purchasing the machine. The base price of the machine is $108,000, and shipping and installation costs total $12,500. For tax depreciation purposes the machine qualifies as a MACRS 3-year asset (with depreciation rates of 33, 45, 15, and 7 percent). If the machine is purchased, working capital will have to increase by $5,500. The machine will not increase sales, but it is expected to reduce labor costs by S44,000 per year. The applicable tax rate is 35 percent, and the applicable risk-adjusted cost of capital is 12 percent. At the end of three years the machine will be sold for $65,000. Prepare the cash flow spreadsheet displaying your caleulations and your cash flows per year, attach it as part of your answer, and then answer the following questions: A. What should you do with the $5,000 spent last year? B. What is the year zero cash flow? c. What are the total cash flows for years 1, 2, and 3? D. Should the company purchase the machine? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts