Question: 13. Crane Ltd. expects cash flows from a new project to be $25,000 per year for the next 5 years. The project will require an

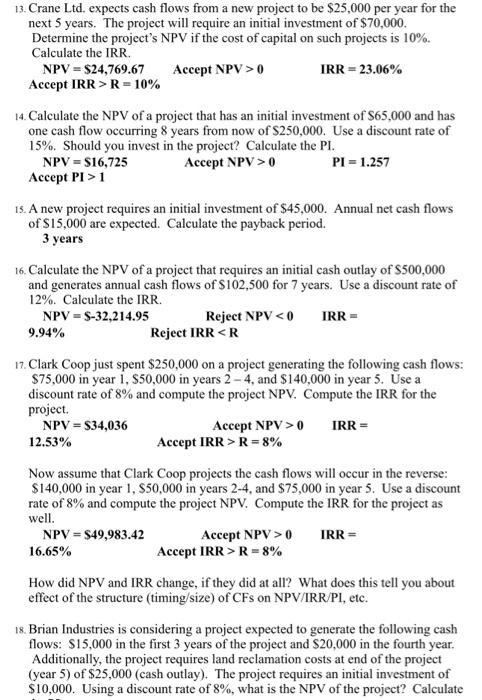

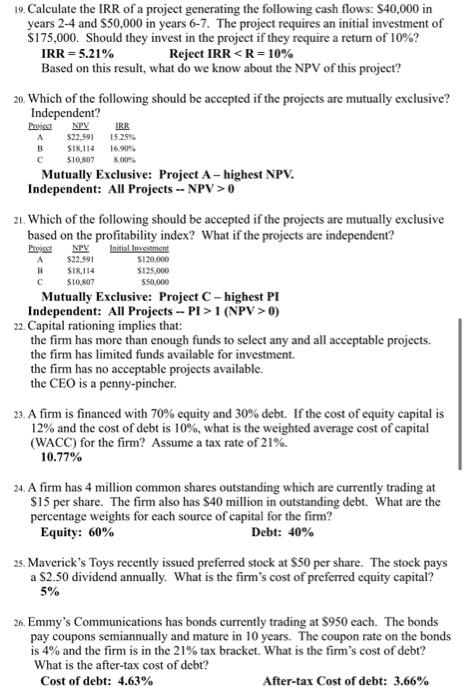

13. Crane Ltd. expects cash flows from a new project to be $25,000 per year for the next 5 years. The project will require an initial investment of $70,000. Determine the project's NPV if the cost of capital on such projects is 10%. Calculate the IRR. NPV =$24,769.67 Accept NPV >0 IRR =23.06% Accept IRR >R=10% 14. Calculate the NPV of a project that has an initial investment of $65,000 and has one cash flow occurring 8 years from now of $250,000. Use a discount rate of 15%. Should you invest in the project? Calculate the PI. NPV=$16,725AcceptPI>1AcceptNPV>0PI=1.257 15. A new project requires an initial investment of $45,000. Annual net cash flows of $15,000 are expected. Calculate the payback period. 3 years 16. Calculate the NPV of a project that requires an initial cash outlay of $500,000 and generates annual cash flows of $102,500 for 7 years. Use a discount rate of 12%. Calculate the IRR. NPV=S32,214.959.94%RejectNPV0AcceptIRR>R=8%IRR= Now assume that Clark Coop projects the cash flows will occur in the reverse: $140,000 in year 1,$50,000 in years 24, and $75,000 in year 5 . Use a discount rate of 8% and compute the project NPV. Compute the IRR for the project as well. NPV=$49,983.42AcceptNPV>0IRR=16.65%AcceptIRR>R=8% How did NPV and IRR change, if they did at all? What does this tell you about effect of the structure (timing/size) of CFs on NPV/IRR/PI, etc. 18. Brian Industries is considering a project expected to generate the following cash flows: $15,000 in the first 3 years of the project and $20,000 in the fourth year. Additionally, the project requires land reclamation costs at end of the project (year 5) of $25,000 (cash outlay). The project requires an initial investment of $10,000. Using a discount rate of 8%, what is the NPV of the project? Calculate 19. Calculate the IRR of a project generating the following cash flows: $40,000 in years 24 and $50,000 in years 6-7. The project requires an initial investment of $175,000. Should they invest in the project if they require a return of 10% ? IRR =5.21% Reject IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts