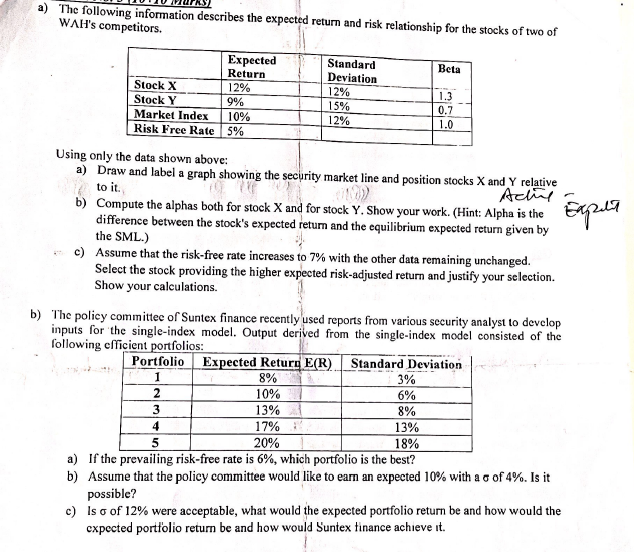

Question: 1.3 Expert a) The following information describes the expected return and risk relationship for the stocks of two of WAH's competitors. Expected Standard Beta Return

1.3 Expert a) The following information describes the expected return and risk relationship for the stocks of two of WAH's competitors. Expected Standard Beta Return Deviation Stock X 12% 12% Stock Y 9% 15% 0.7 Market Index 10% 12% 1.0 Risk Free Rate 5% Using only the data shown above: a) Draw and label a graph showing the security market line and position stocks X and Y relative to it. Acil b) Compute the alphas both for stock X and for stock Y. Show your work. (Hint: Alpha is the difference between the stock's expected retum and the equilibrium expected return given by the SML.) c) Assume that the risk-free rate increases to 7% with the other data remaining unchanged. Select the stock providing the higher expected risk-adjusted return and justify your selection. Show your calculations. b) The policy committee of Suntex finance recently used reports from various security analyst to develop inputs for the single-index model. Output derived from the single-index model consisted of the following efficient portfolios: Portfolio Expected Returg E(R) Standard Deviation 3% 10% 6% 3 13% 8% 4 17% 13% 5 20% 18% a) If the prevailing risk-free rate is 6%, which portfolio is the best? b) Assume that the policy committee would like to eam an expected 10% with a c of 4%. Is it possible? c) Is o of 12% were acceptable, what would the expected portfolio return be and how would the cxpected portfolio return be and how would Suntex tinance achieve it. 1 2 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts