Question: 1-3 Help me to answer this in 1 and a half - 2 hours please give me a correct answer 1. Which of the following

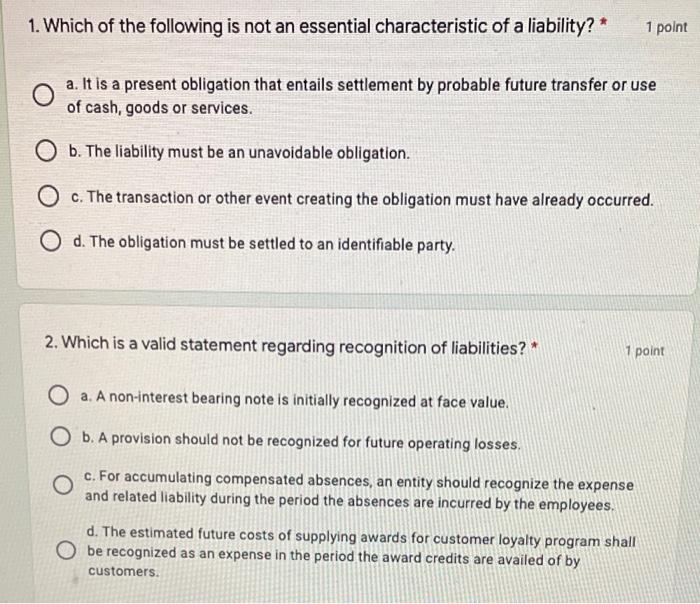

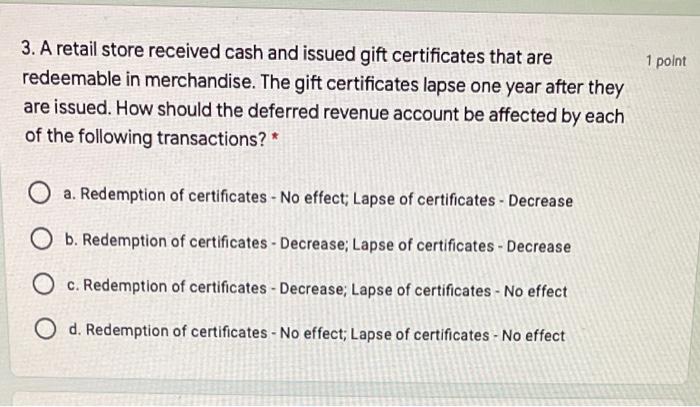

1. Which of the following is not an essential characteristic of a liability? * 1 point O a. It is a present obligation that entails settlement by probable future transfer or use of cash, goods or services. O b. The liability must be an unavoidable obligation. O c. The transaction or other event creating the obligation must have already occurred. O d. The obligation must be settled to an identifiable party. 2. Which is a valid statement regarding recognition of liabilities? * 1 point O a. A non-interest bearing note is initially recognized at face value. O b. A provision should not be recognized for future operating losses. c. For accumulating compensated absences, an entity should recognize the expense and related liability during the period the absences are incurred by the employees. d. The estimated future costs of supplying awards for customer loyalty program shall O be recognized as an expense in the period the award credits are availed of by customers. 1 point 3. A retail store received cash and issued gift certificates that are redeemable in merchandise. The gift certificates lapse one year after they are issued. How should the deferred revenue account be affected by each of the following transactions?* a. Redemption of certificates - No effect; Lapse of certificates - Decrease b. Redemption of certificates - Decrease; Lapse of certificates - Decrease O c. Redemption of certificates - Decrease: Lapse of certificates - No effect O d. Redemption of certificates - No effect; Lapse of certificates - No effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts