Question: 13. How many contracts would be required to properly hedge a position where the p of two assets is .905, the o of the asset

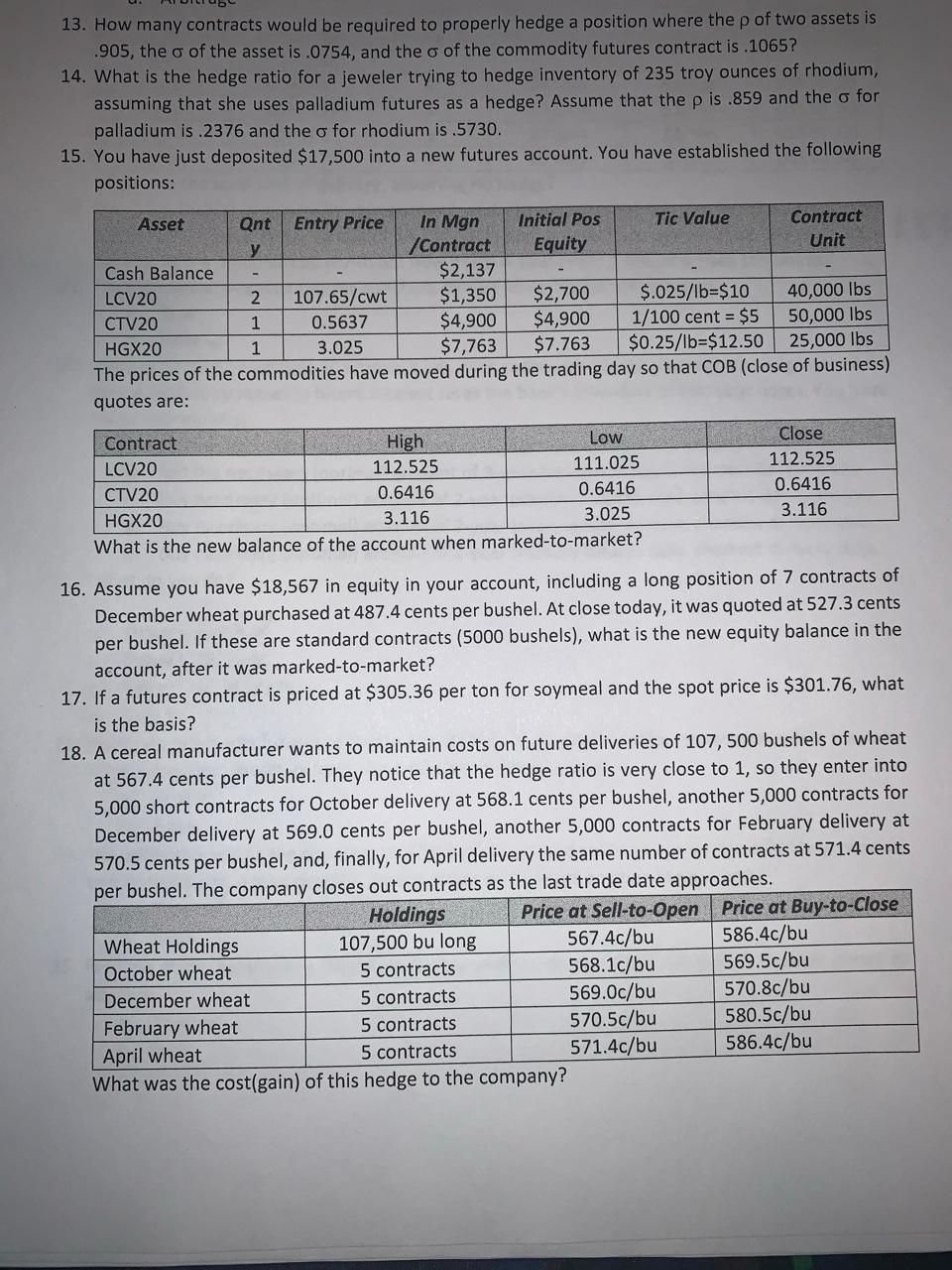

13. How many contracts would be required to properly hedge a position where the p of two assets is .905, the o of the asset is .0754, and the o of the commodity futures contract is.1065? 14. What is the hedge ratio for a jeweler trying to hedge inventory of 235 troy ounces of rhodium, assuming that she uses palladium futures as a hedge? Assume that the p is .859 and the o for palladium is.2376 and the o for rhodium is.5730. 15. You have just deposited $17,500 into a new futures account. You have established the following positions: Asset Qnt Entry Price In Mgn Initial Pos Tic Value Contract /Contract Equity Unit Cash Balance $2,137 LCV20 2 107.65/cwt $1,350 $2,700 $.025/Ib=$10 40,000 lbs CTV20 1 0.5637 $4,900 $4,900 1/100 cent = $5 50,000 lbs HGX20 1 3.025 $7,763 $7.763 $0.25/lb=$12.50 25,000 lbs The prices of the commodities have moved during the trading day so that COB (close of business) quotes are: Contract High Low LCV20 112.525 111.025 CTV20 0.6416 0.6416 HGX20 3.116 What is the new balance of the account when marked-to-market? Close 112.525 0.6416 3.116 3.025 16. Assume you have $18,567 in equity in your account, including a long position of 7 contracts of December wheat purchased at 487.4 cents per bushel. At close today, it was quoted at 527.3 cents per bushel. If these are standard contracts (5000 bushels), what is the new equity balance in the account, after it was marked-to-market? 17. If a futures contract is priced at $305.36 per ton for soymeal and the spot price is $301.76, what is the basis? 18. A cereal manufacturer wants to maintain costs on future deliveries of 107,500 bushels of wheat at 567.4 cents per bushel. They notice that the hedge ratio is very close to 1, so they enter into 5,000 short contracts for October delivery at 568.1 cents per bushel, another 5,000 contracts for December delivery at 569.0 cents per bushel, another 5,000 contracts for February delivery at 570.5 cents per bushel, and, finally, for April delivery the same number of contracts at 571.4 cents per bushel. The company closes out contracts as the last trade date approaches. Holdings Price at Sell-to-Open Price at Buy-to-Close Wheat Holdings 107,500 bu long 567.4c/bu 586.4c/bu October wheat 5 contracts 568.1c/bu 569.5c/bu December wheat 5 contracts 569.0c/bu 570.8c/bu February wheat 5 contracts 570.5c/bu 580.5c/bu April wheat 5 contracts 571.4c/bu 586.4c/bu What was the cost(gain) of this hedge to the company? 13. How many contracts would be required to properly hedge a position where the p of two assets is .905, the o of the asset is .0754, and the o of the commodity futures contract is.1065? 14. What is the hedge ratio for a jeweler trying to hedge inventory of 235 troy ounces of rhodium, assuming that she uses palladium futures as a hedge? Assume that the p is .859 and the o for palladium is.2376 and the o for rhodium is.5730. 15. You have just deposited $17,500 into a new futures account. You have established the following positions: Asset Qnt Entry Price In Mgn Initial Pos Tic Value Contract /Contract Equity Unit Cash Balance $2,137 LCV20 2 107.65/cwt $1,350 $2,700 $.025/Ib=$10 40,000 lbs CTV20 1 0.5637 $4,900 $4,900 1/100 cent = $5 50,000 lbs HGX20 1 3.025 $7,763 $7.763 $0.25/lb=$12.50 25,000 lbs The prices of the commodities have moved during the trading day so that COB (close of business) quotes are: Contract High Low LCV20 112.525 111.025 CTV20 0.6416 0.6416 HGX20 3.116 What is the new balance of the account when marked-to-market? Close 112.525 0.6416 3.116 3.025 16. Assume you have $18,567 in equity in your account, including a long position of 7 contracts of December wheat purchased at 487.4 cents per bushel. At close today, it was quoted at 527.3 cents per bushel. If these are standard contracts (5000 bushels), what is the new equity balance in the account, after it was marked-to-market? 17. If a futures contract is priced at $305.36 per ton for soymeal and the spot price is $301.76, what is the basis? 18. A cereal manufacturer wants to maintain costs on future deliveries of 107,500 bushels of wheat at 567.4 cents per bushel. They notice that the hedge ratio is very close to 1, so they enter into 5,000 short contracts for October delivery at 568.1 cents per bushel, another 5,000 contracts for December delivery at 569.0 cents per bushel, another 5,000 contracts for February delivery at 570.5 cents per bushel, and, finally, for April delivery the same number of contracts at 571.4 cents per bushel. The company closes out contracts as the last trade date approaches. Holdings Price at Sell-to-Open Price at Buy-to-Close Wheat Holdings 107,500 bu long 567.4c/bu 586.4c/bu October wheat 5 contracts 568.1c/bu 569.5c/bu December wheat 5 contracts 569.0c/bu 570.8c/bu February wheat 5 contracts 570.5c/bu 580.5c/bu April wheat 5 contracts 571.4c/bu 586.4c/bu What was the cost(gain) of this hedge to the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts