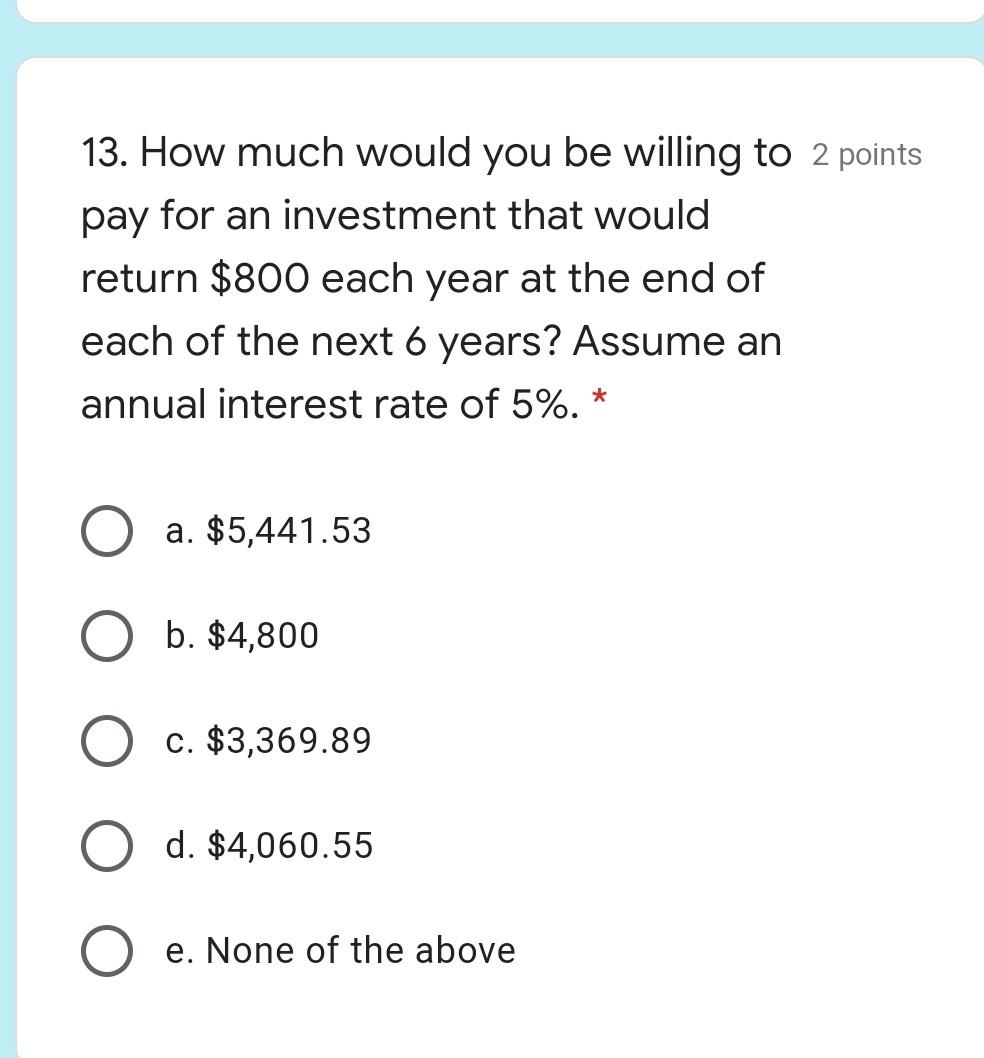

Question: 13. How much would you be willing to 2 points pay for an investment that would return $800 each year at the end of each

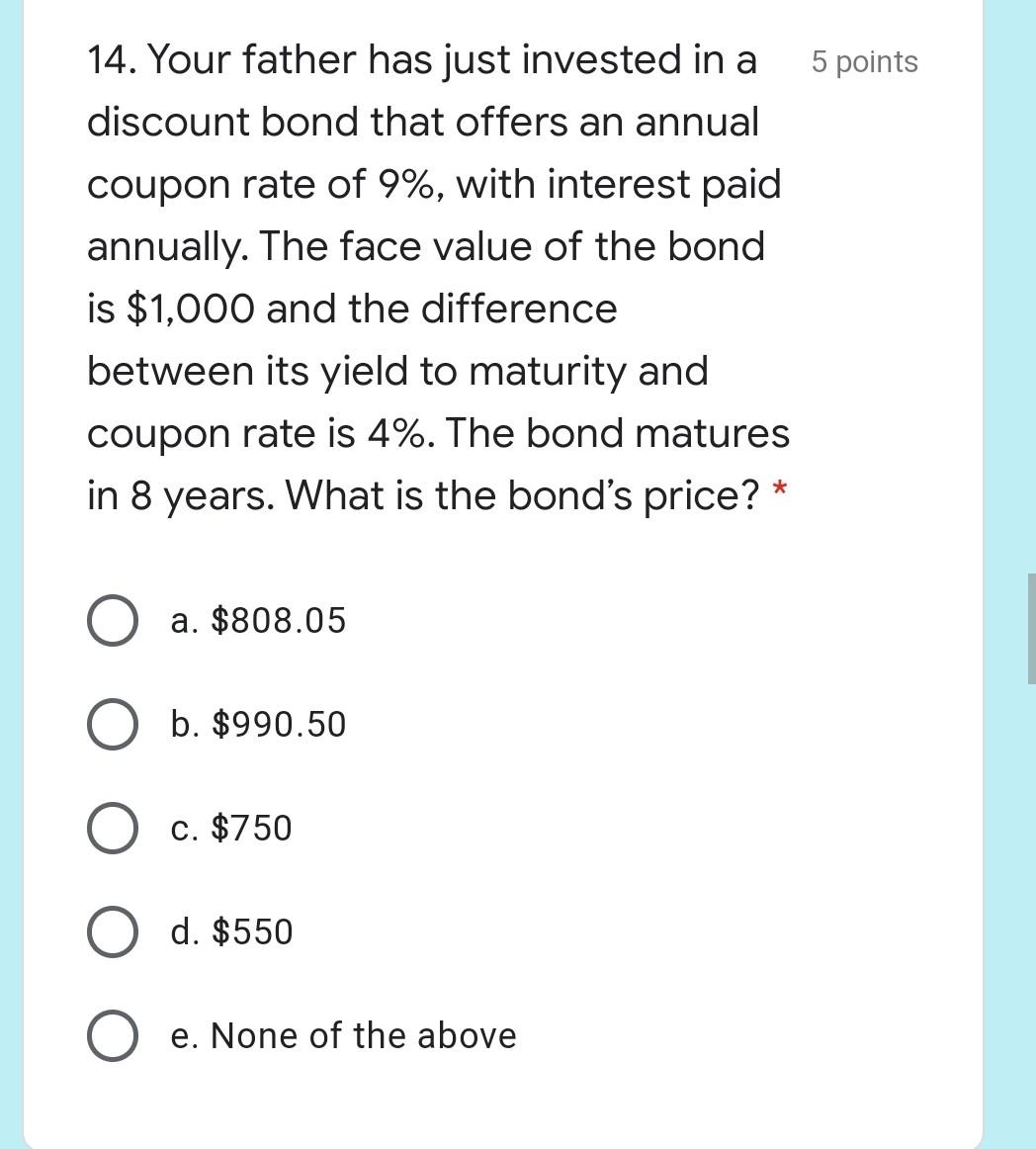

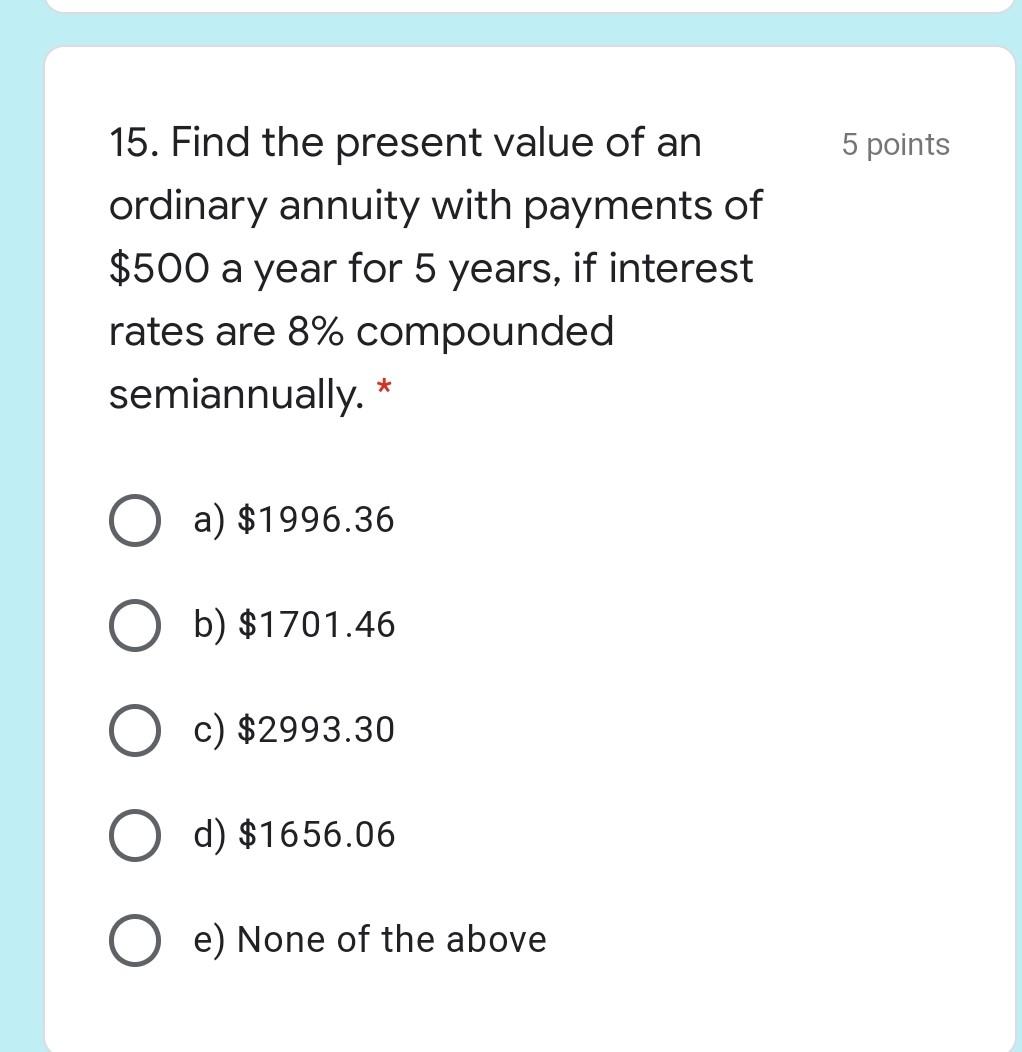

13. How much would you be willing to 2 points pay for an investment that would return $800 each year at the end of each of the next 6 years? Assume an * annual interest rate of 5%. a. $5,441.53 b. $4,800 c. $3,369.89 d. $4,060.55 e. None of the above 5 points 14. Your father has just invested in a discount bond that offers an annual coupon rate of 9%, with interest paid annually. The face value of the bond is $1,000 and the difference between its yield to maturity and coupon rate is 4%. The bond matures in 8 years. What is the bond's price? a. $808.05 b. $990.50 c. $750 d. $550 e. None of the above 5 points 15. Find the present value of an ordinary annuity with payments of $500 a year for 5 years, if interest rates are 8% compounded semiannually. * O a) $1996.36 O b) $1701.46 c) $2993.30 d) $1656.06 e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts