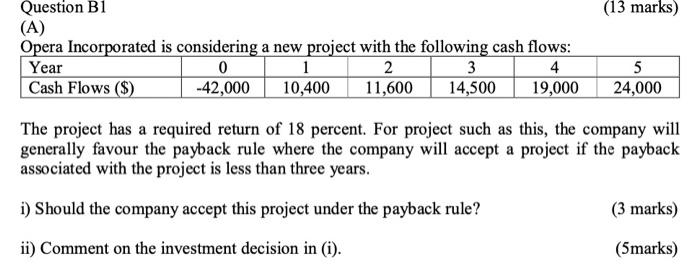

Question: (13 marks) Question B1 (A) Opera Incorporated is considering a new project with the following cash flows: Year 0 1 2 3 4 Cash Flows

(13 marks) Question B1 (A) Opera Incorporated is considering a new project with the following cash flows: Year 0 1 2 3 4 Cash Flows ($) -42,000 10,400 11,600 14,500 19,000 5 24,000 The project has a required return of 18 percent. For project such as this, the company will generally favour the payback rule where the company will accept a project if the payback associated with the project is less than three years. i) Should the company accept this project under the payback rule? (3 marks) ii) Comment on the investment decision in (i). (5marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts