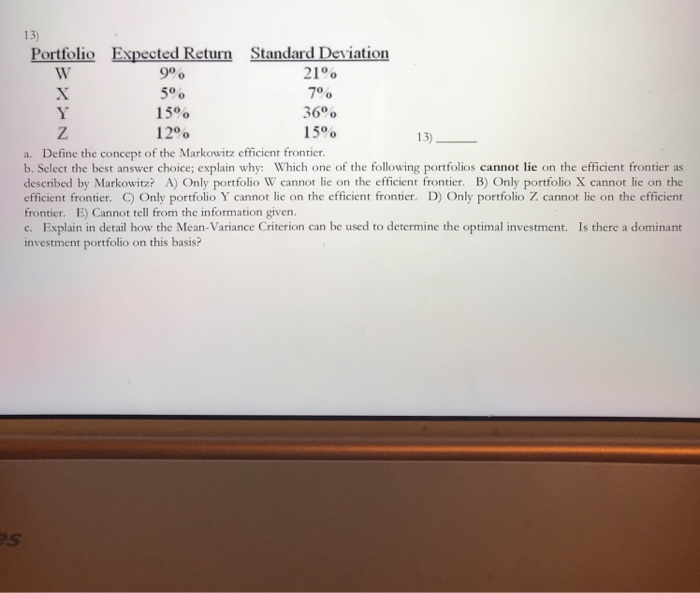

Question: 13) Portfolio Expected Return Standard Deviation 9% 5% 15% 12% 21% 7% 36% 1500 13 a. Define the concept of the Markowitz efficient frontier b.

13) Portfolio Expected Return Standard Deviation 9% 5% 15% 12% 21% 7% 36% 1500 13 a. Define the concept of the Markowitz efficient frontier b. Select the best answer choice; explain why: Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz? A) Only portfolio W cannot lie on the efficient frontier. B) Only portfolio X cannot lie on the efficient frontier. C) Only portfolio Y cannot lie on the efficient frontier. D) Only portfolio Z cannot lie on the efficient frontier. E) Cannot tell from the information given. c. Explain in detail how the Mean-Variance Criterion can be used to determine the optimal investment. Is there a dominant investment portfolio on this basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts