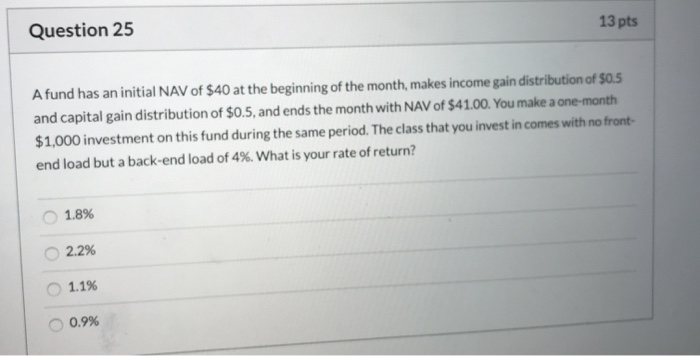

Question: 13 pts Question 25 A fund has an initial NAV of $40 at the beginning of the month, makes income gain distribution of $0.5 and

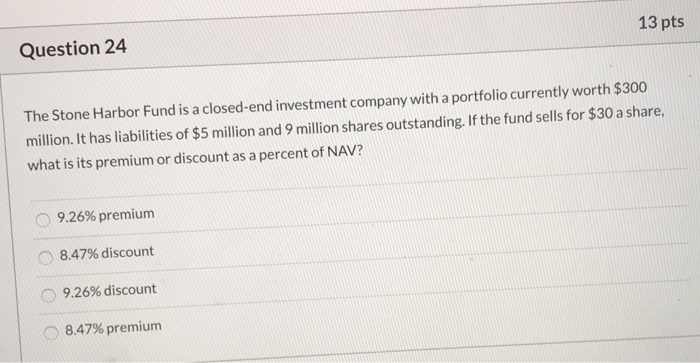

13 pts Question 25 A fund has an initial NAV of $40 at the beginning of the month, makes income gain distribution of $0.5 and capital gain distribution of $0.5, and ends the month with NAV of $41.00. You make a one-month $1,000 investment on this fund during the same period. The class that you invest in comes with no front- end load but a back-end load of 4%. What is your rate of return? 1.8% 2.2% 1.1% 0.9% 13 pts Question 24 The Stone Harbor Fund is a closed-end investment company with a portfolio currently worth $300 million. It has liabilities of $5 million and 9 million shares outstanding. If the fund sells for $30 a share, what is its premium or discount as a percent of NAV? 9.26% premium 8.47% discount 9.26% discount 8.47% premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts