Question: 13 Question completion Status: 4 Moving to another question will save this response. Questions As the number of securities in a portfolio is increased, what

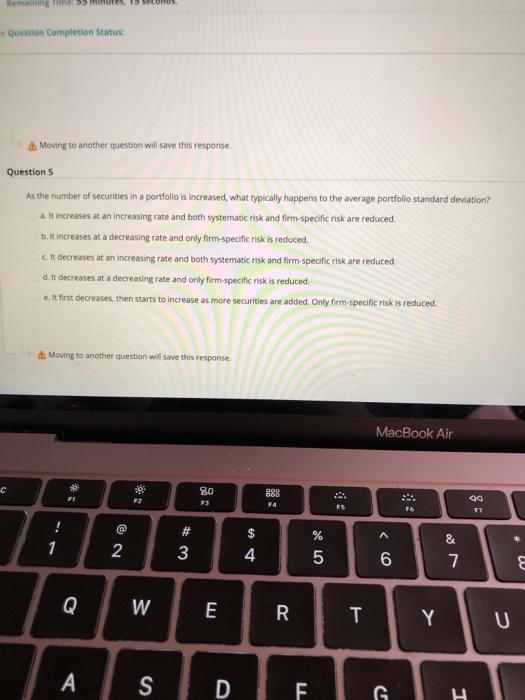

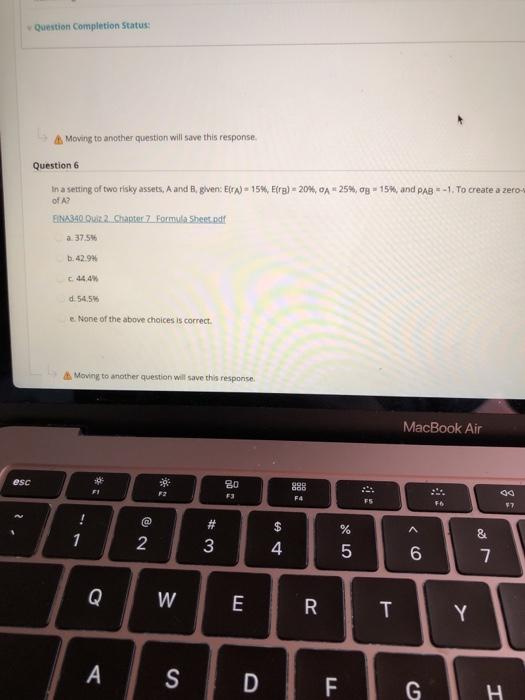

13 Question completion Status: 4 Moving to another question will save this response. Questions As the number of securities in a portfolio is increased, what typically happens to the average portfolio standard deviation? a. It increases at an increasing rate and both systematic risk and firm-specific risk are reduced. b. it increases at a decreasing rate and only firm-specific risk is reduced c. It decreases at an increasing rate and both systematic risk and firm-specific risk are reduced d. It decreases at a decreasing rate and only firm specific risk is reduced. e. It first decreases, then starts to increase as more securities are added, Only firm specific risk is reduced. A Moving to another question will save this response MacBook Air C 80 F3 888 F4 :8 FS 8 F? @ # A ! 1 & * 2 3 $ 4 % 5 6 7 E Q W E R T Y A S DF F G Question Completion Status: Moving to another question will save this response Question 6 In a setting of two risky assets, A and given:EA = 15% Elra) = 20%, CA 25%, og -15%, and PAB =-1. To create a zero- of A? EINA3400U22.Chapter 7 Formula Sheetody a 37.5 1.42.9% t. 444 d. 54.5% None of the above choices is correct Moving to another question will save this response MacBook Air esc - F! BO 888 F4 FS F6 7 @ $ A & 1 # 3 2 4 % 5 6 7 Q W E R T Y A S D F G H . Close Window Question 6 of 8 Save Answer 1.25 points , and PAB=-1. To create a zero-variance portfolio (perfect hedge) based on A and B, how much should be the weight Question 6 of 8 MacBook Air Dil DD FO F10 F FN2 F8 F7 & 7 ( 9 ) 0 + 11 8 } Y 0 { [ P ] 11 H J K L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts