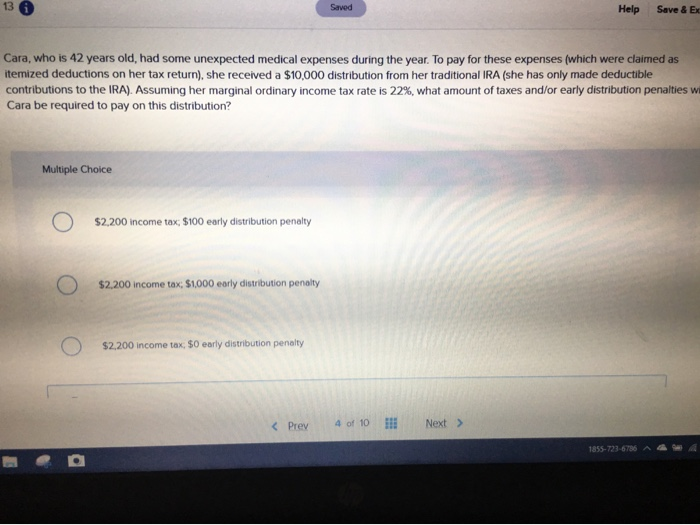

Question: 13 Saved Help Save & Ex Cara, who is 42 years old, had some unexpected medical expenses during the year. To pay for these expenses

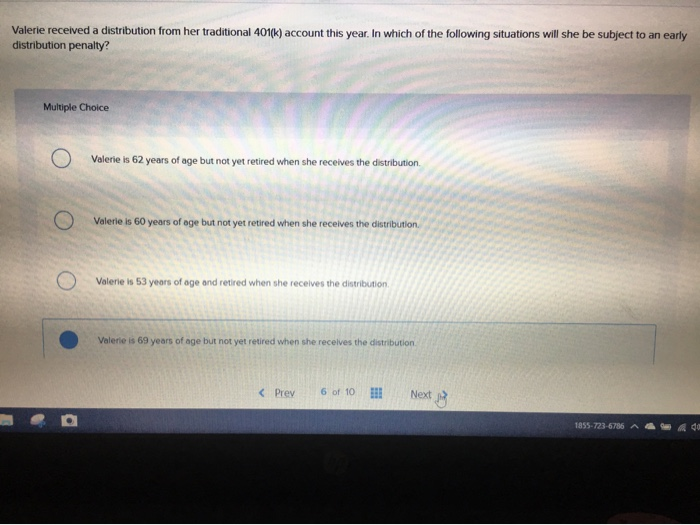

13 Saved Help Save & Ex Cara, who is 42 years old, had some unexpected medical expenses during the year. To pay for these expenses (which were claimed as itemized deductions on her tax return), she received a $10,000 distribution from her traditional IRA (she has only made deductible contributions to the IRA). Assuming her marginal ordinary income tax rate is 22 %, what amount of taxes and/or early distribution penalties w Cara be required to pay on this distribution? Multiple Choice $2,200 income tax; $100 early distribution penalty $2,200 income tax $1,000 early distribution penalty $2,200 income tax, $0 early distribution penalty 1855-723-6786 Valerie received a distribution from her traditional 401(k) account this year, In which of the following situations will she be subject to an early distribution penalty? Multiple Choice Valerie is 62 years of age but not yet retired when she receives the distribution. Valerie is 60 years of oge but not yet retired when she receives the distributlon Valerie is 53 years of age and retired when she receives the distribution. Valerie is 69 years of age but not yet retired when she recelves the distribution 6 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts