Question: 1.3 Study the information provided below and answer the following questions: 1.3.1 Prepare the Asset Disposal account in the general ledger. Close off the account.

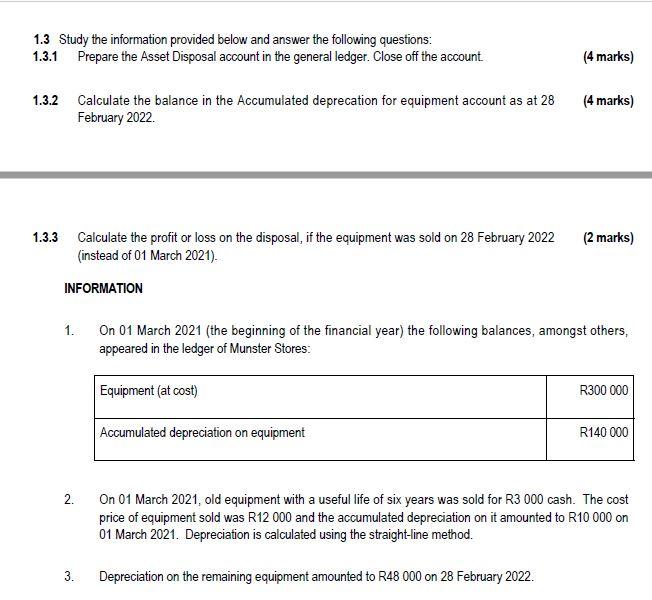

1.3 Study the information provided below and answer the following questions: 1.3.1 Prepare the Asset Disposal account in the general ledger. Close off the account. (4 marks) 1.3.2 Calculate the balance in the Accumulated deprecation for equipment account as at 28 (4 marks) February 2022. 1.3.3 Calculate the profit or loss on the disposal, if the equipment was sold on 28 February 2022 (2 marks) (instead of 01 March 2021). INFORMATION 1. On 01 March 2021 (the beginning of the financial year) the following balances, amongst others, appeared in the ledger of Munster Stores: 2. On 01 March 2021 , old equipment with a useful life of six years was sold for R3000 cash. The cost price of equipment sold was R12 000 and the accumulated depreciation on it amounted to R10 000 on 01 March 2021. Depreciation is calculated using the straight-line method. 3. Depreciation on the remaining equipment amounted to R48 000 on 28 February 2022. 1.3 Study the information provided below and answer the following questions: 1.3.1 Prepare the Asset Disposal account in the general ledger. Close off the account. (4 marks) 1.3.2 Calculate the balance in the Accumulated deprecation for equipment account as at 28 (4 marks) February 2022. 1.3.3 Calculate the profit or loss on the disposal, if the equipment was sold on 28 February 2022 (2 marks) (instead of 01 March 2021). INFORMATION 1. On 01 March 2021 (the beginning of the financial year) the following balances, amongst others, appeared in the ledger of Munster Stores: 2. On 01 March 2021 , old equipment with a useful life of six years was sold for R3000 cash. The cost price of equipment sold was R12 000 and the accumulated depreciation on it amounted to R10 000 on 01 March 2021. Depreciation is calculated using the straight-line method. 3. Depreciation on the remaining equipment amounted to R48 000 on 28 February 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts