Question: 13. The preemptive right is important to shareholders because it a. allows managers to buy additional shares below the current market price. b. will result

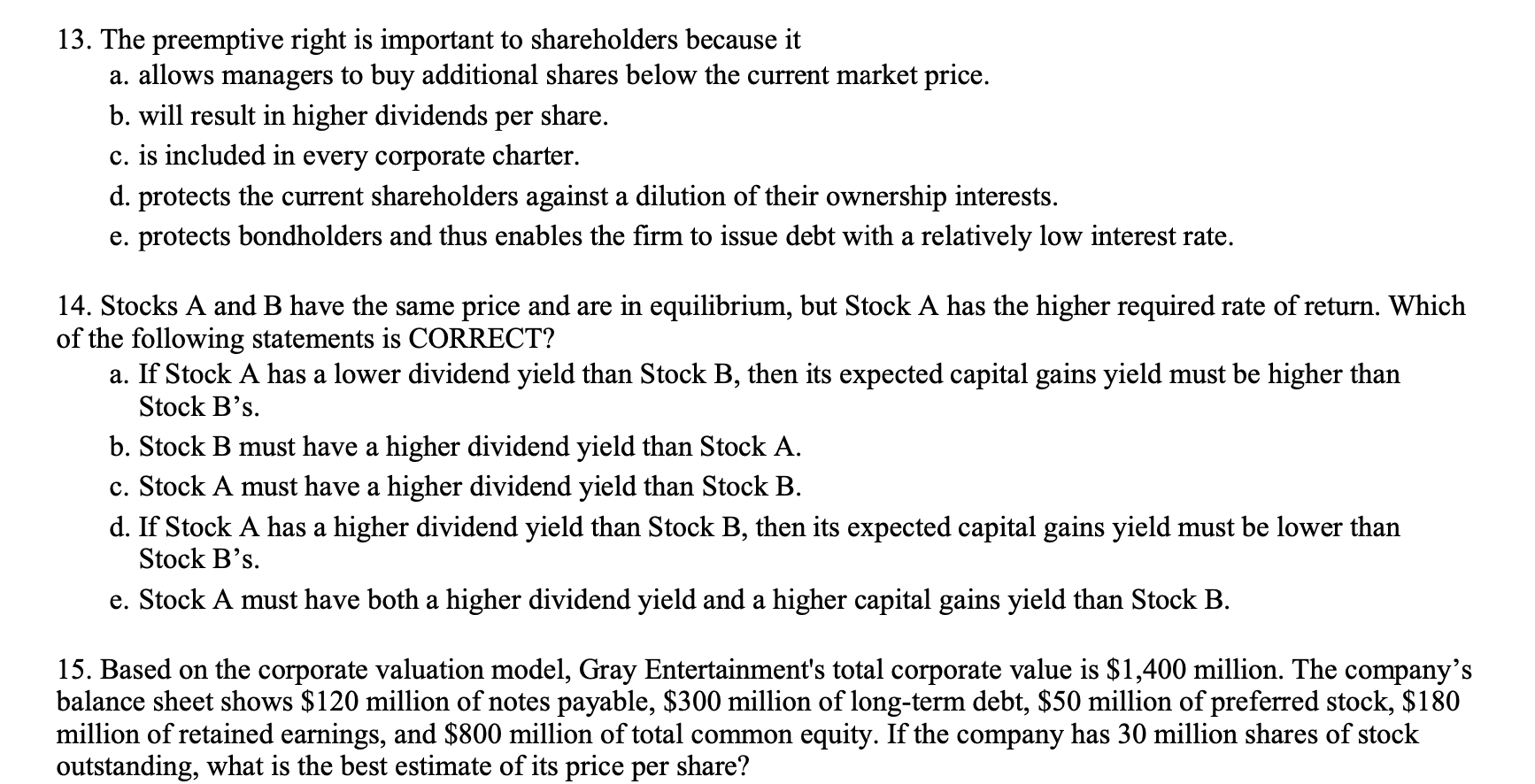

13. The preemptive right is important to shareholders because it a. allows managers to buy additional shares below the current market price. b. will result in higher dividends per share. c. is included in every corporate charter. d. protects the current shareholders against a dilution of their ownership interests. e. protects bondholders and thus enables the firm to issue debt with a relatively low interest rate. 14. Stocks A and B have the same price and are in equilibrium, but Stock A has the higher required rate of return. Which of the following statements is CORRECT? a. If Stock A has a lower dividend yield than Stock B, then its expected capital gains yield must be higher than Stock B's. b. Stock B must have a higher dividend yield than Stock A. c. Stock A must have a higher dividend yield than Stock B. d. If Stock A has a higher dividend yield than Stock B, then its expected capital gains yield must be lower than Stock B's. e. Stock A must have both a higher dividend yield and a higher capital gains yield than Stock B. 15. Based on the corporate valuation model, Gray Entertainment's total corporate value is $1,400 million. The company's balance sheet shows $120 million of notes payable, $300 million of long-term debt, $50 million of preferred stock, $180 million of retained earnings, and $800 million of total common equity. If the company has 30 million shares of stock outstanding, what is the best estimate of its price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts