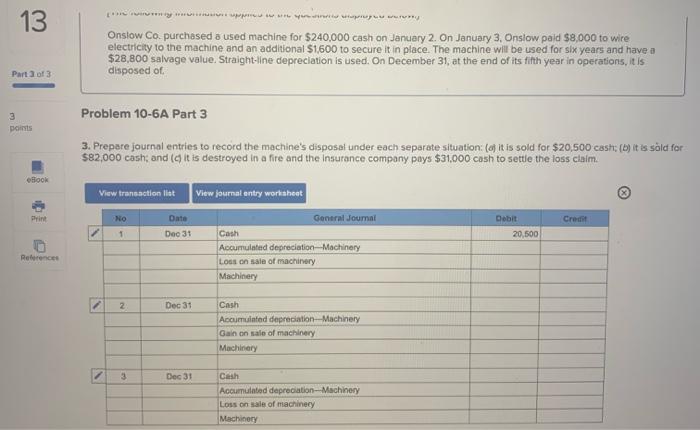

Question: 13 Tiny w Onslow Co. purchased a used machine for $240,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to

13 Tiny w Onslow Co. purchased a used machine for $240,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to the machine and an additional $1,600 to secure it in place. The machine will be used for six years and have a $28,800 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of Part 3 of 3 Problem 10-6A Part 3 points 3. Prepare journal entries to record the machine's disposal under each separate situation: (oh it is sold for $20,500 cash (b) it is sold for $82,000 cash and (dit is destroyed in a fire and the Insurance company pays $31,000 cash to settle the loss claim. Book View transaction list Print No Date Credit Debit 20,500 1 View journal entry worksheet General Joumat Cash Accumulated depreciation Machinery Lots on sale of machinery Machinery Dec 31 Reference 2 2 Dec 31 Cash Accumulated depreciation Machinery Gain on sale of machinery Machinery 3 Dec 31 Cash Accumulated depreciation Machinery Loss on sale of machinery Machinery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts