Question: 1.3 Use the information given below to calculate the value of closing inventory as at 31 May 2022 and the value of issues during

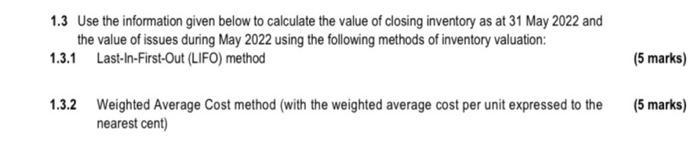

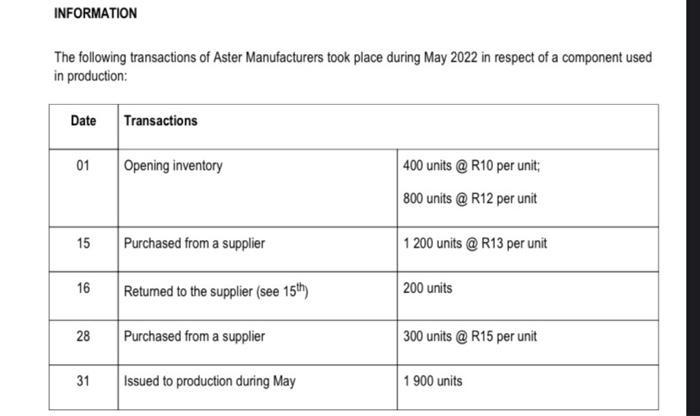

1.3 Use the information given below to calculate the value of closing inventory as at 31 May 2022 and the value of issues during May 2022 using the following methods of inventory valuation: 1.3.1 Last-In-First-Out (LIFO) method 1.3.2 Weighted Average Cost method (with the weighted average cost per unit expressed to the nearest cent) (5 marks) (5 marks) INFORMATION The following transactions of Aster Manufacturers took place during May 2022 in respect of a component used in production: Date 01 15 16 28 31 Transactions Opening inventory Purchased from a supplier Returned to the supplier (see 15th) Purchased from a supplier Issued to production during May 400 units @ R10 per unit; 800 units @ R12 per unit 1 200 units @ R13 per unit 200 units 300 units @ R15 per unit 1900 units

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

131 LastInFirstOut LIFO methodClosing inventory 300 units R15 per unit purchased on 28th ... View full answer

Get step-by-step solutions from verified subject matter experts