Question: 13. Werner von Braun, CFA, is considering adding exposure to hedge funds to his portfolio of traditional investments. Based on historical mean and standard deviation

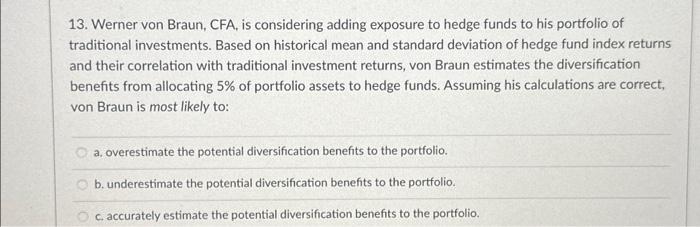

13. Werner von Braun, CFA, is considering adding exposure to hedge funds to his portfolio of traditional investments. Based on historical mean and standard deviation of hedge fund index returns and their correlation with traditional investment returns, von Braun estimates the diversification benefits from allocating 5% of portfolio assets to hedge funds. Assuming his calculations are correct, von Braun is most likely to: a, overestimate the potential diversification benefits to the portfolio. b. underestimate the potential diversification benefits to the portfolio. c. accurately estimate the potential diversification benefits to the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts