Question: 13. When computing diluted earnings per share, convertible securities that are not considered common stock equivalents are: (a) (b) Ignored. Recognized only if they

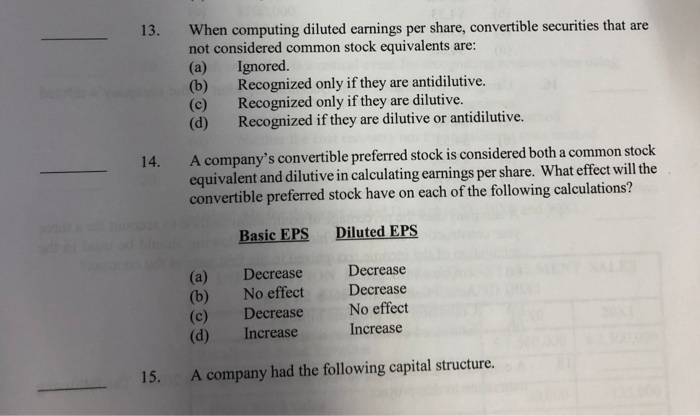

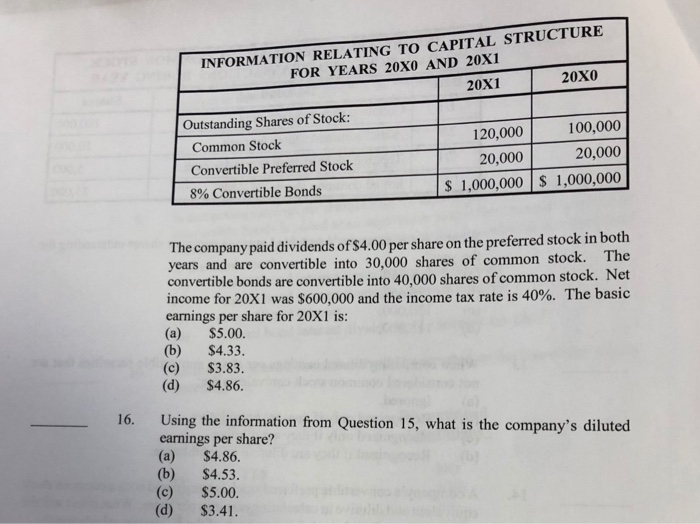

13. When computing diluted earnings per share, convertible securities that are not considered common stock equivalents are: (a) (b) Ignored. Recognized only if they are antidilutive. (c) Recognized only if they are dilutive. (d) Recognized if they are dilutive or antidilutive. A company's convertible preferred stock is considered both a common stock equivalent and dilutive in calculating earnings per share. What effect will the convertible preferred stock have on each of the following calculations? 14. Basic EPS Diluted EPS () (b) (c) (d) Decrease No effect Decrease Decrease No effect Decrease Increase Increase 15. A company had the following capital structure. INFORMATION RELATING TO CAPITAL STRUCTURE FOR YEARS 20X0 AND 20X1 200 20X1 Outstanding Shares of Stock: 120,000 100,000 Common Stock 20,000 20,000 Convertible Preferred Stock 8% Convertible Bonds $ 1,000,000 | $ 1,000,000 The company paid dividends of $4.00 per share on the preferred stock in both years and are convertible into 30,000 shares of common stock. The convertible bonds are convertible into 40,000 shares of common stock. Net income for 20X1 was $600,000 and the income tax rate is 40%. The basic earnings per share for 20X1 is: (a) (b) (c) (d) $5.00. $4.33. $3.83. $4.86. Using the information from Question 15, what is the company's diluted earnings per share? () (b) (c) (d) 16. $4.86. $4.53. $5.00. $3.41.

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

13 c recognised only if they are dilutive 14 a decrease decrease 15 b 433 Assumed tha... View full answer

Get step-by-step solutions from verified subject matter experts