Question: 13) You write one MBI July 139 call contract (equaling 100 shares) for a premium of $17. You hold the option until the expiration date,

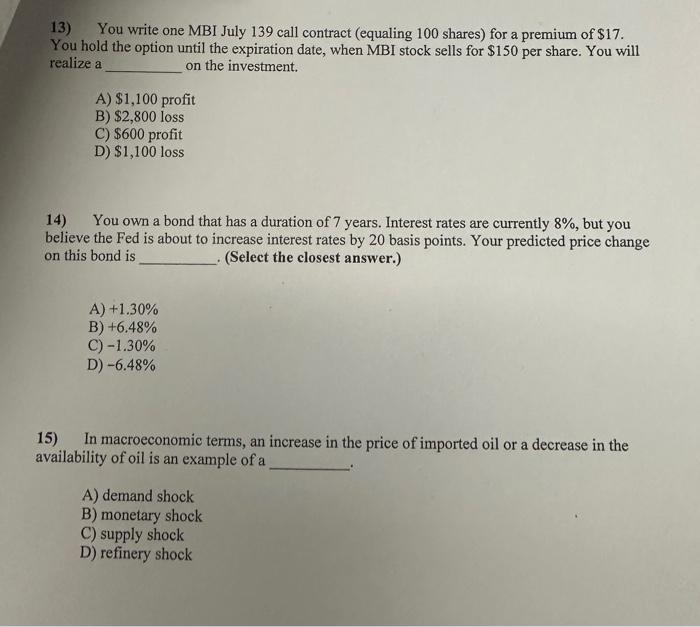

13) You write one MBI July 139 call contract (equaling 100 shares) for a premium of $17. You hold the option until the expiration date, when MBI stock sells for $150 per share. You will realize a on the investment. A) $1,100 profit B) $2,800 loss C) $600 profit D) $1,100 loss 14) You own a bond that has a duration of 7 years. Interest rates are currently 8%, but you believe the Fed is about to increase interest rates by 20 basis points. Your predicted price change on this bond is (Select the closest answer.) A) +1.30% B) +6.48% C) 1.30% D) 6.48% 15) In macroeconomic terms, an increase in the price of imported oil or a decrease in the availability of oil is an example of a A) demand shock B) monetary shock C) supply shock D) refinery shock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts