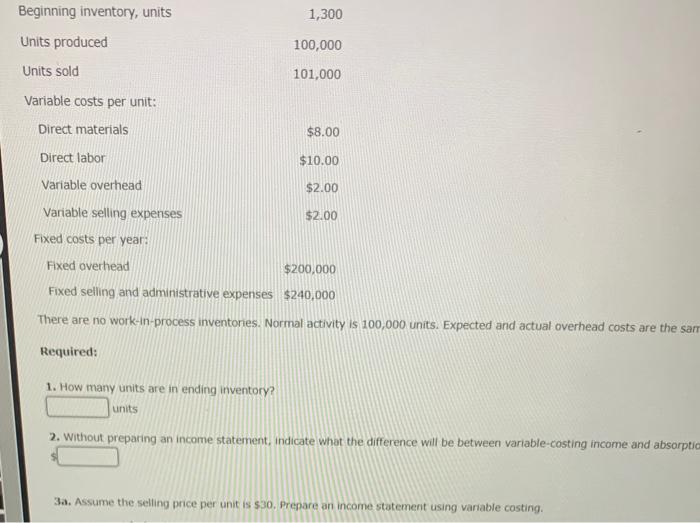

Question: 1,300 100,000 Beginning inventory, units Units produced Units sold Variable costs per unit: Direct materials 101,000 $8.00 Direct labor $10.00 Variable overhead $2.00 Variable selling

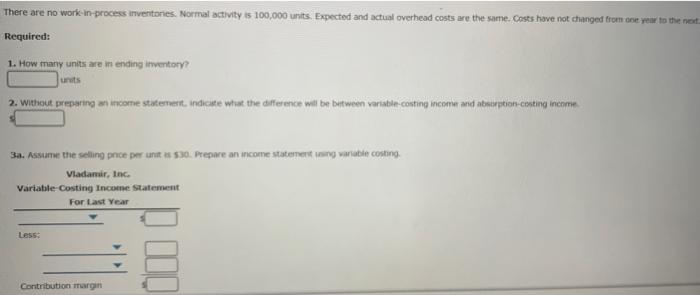

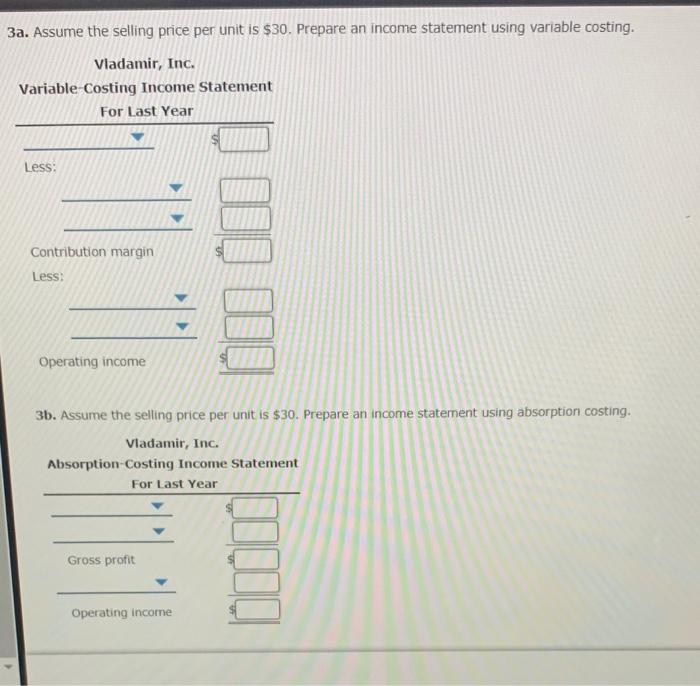

1,300 100,000 Beginning inventory, units Units produced Units sold Variable costs per unit: Direct materials 101,000 $8.00 Direct labor $10.00 Variable overhead $2.00 Variable selling expenses $2.00 Fixed costs per year: Fixed overhead $200,000 Fixed selling and administrative expenses $240,000 There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the sarr Required: 1. How many units are in ending inventory? units 2. Without preparing an income statement indicate what the difference will be between variable-costing income and absorptic 3a. Assume the selling price per unit is $30. Prepare an income statement using variable costing. There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from deve you to the rest Required: 1. How many units are in ending inventory? units 2. Without preparing an income statement indicate what the difference wil be between variable-costing income and absorption contingencom 3a. Assume the selling price per unit $30. Prepare an income statement og variable costing Vladamir, Inc Variable Costing Income statement For Last Year Less: Contribution margin 3a. Assume the selling price per unit is $30. Prepare an income statement using variable costing. Vladamir, Inc. Variable Costing Income Statement For Last Year Less: Contribution margin Less Operating income 3b. Assume the selling price per unit is $30. Prepare an income statement using absorption costing. Vladamir, Inc. Absorption Costing Income Statement For Last Year Gross profit Operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts