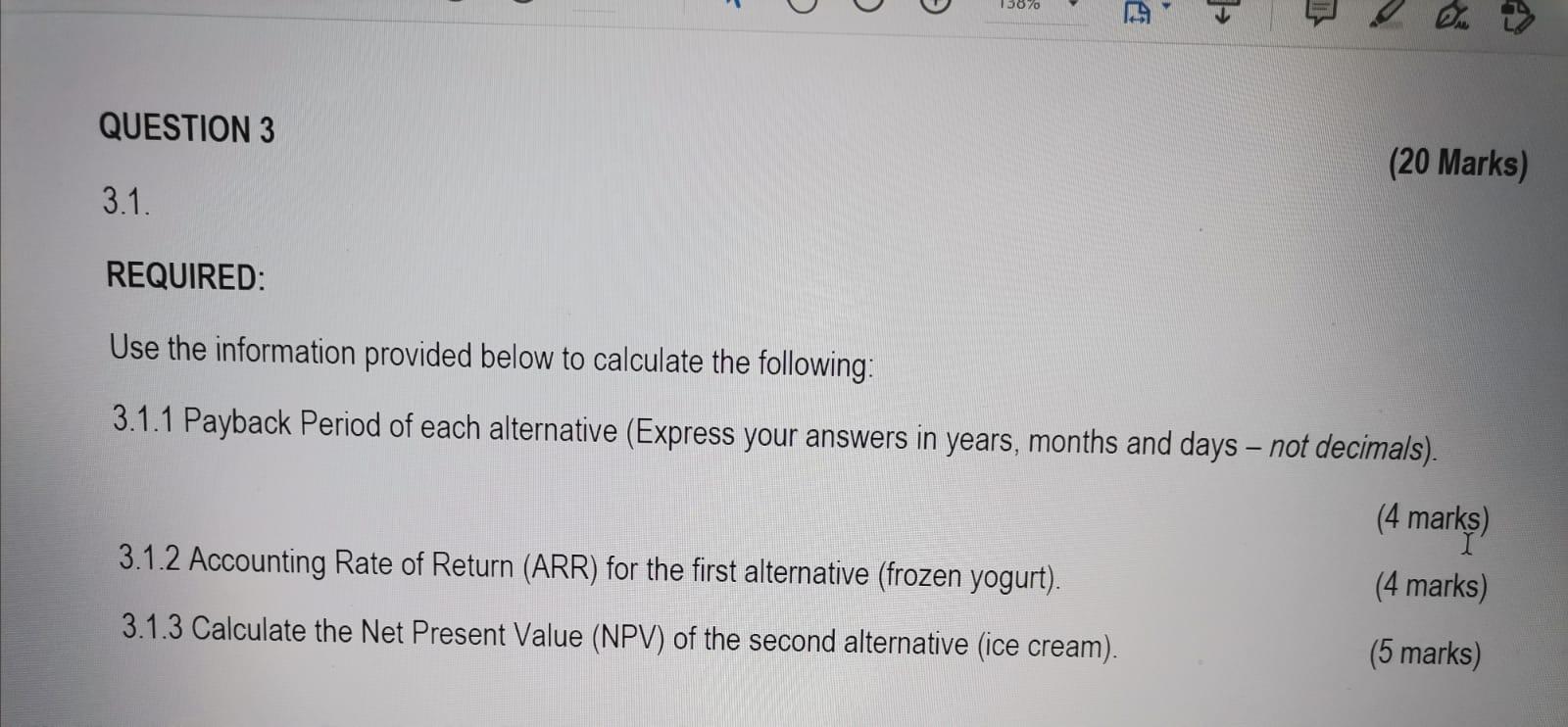

Question: 1307 en > QUESTION 3 (20 Marks) 3.1. REQUIRED: Use the information provided below to calculate the following: 3.1.1 Payback Period of each alternative (Express

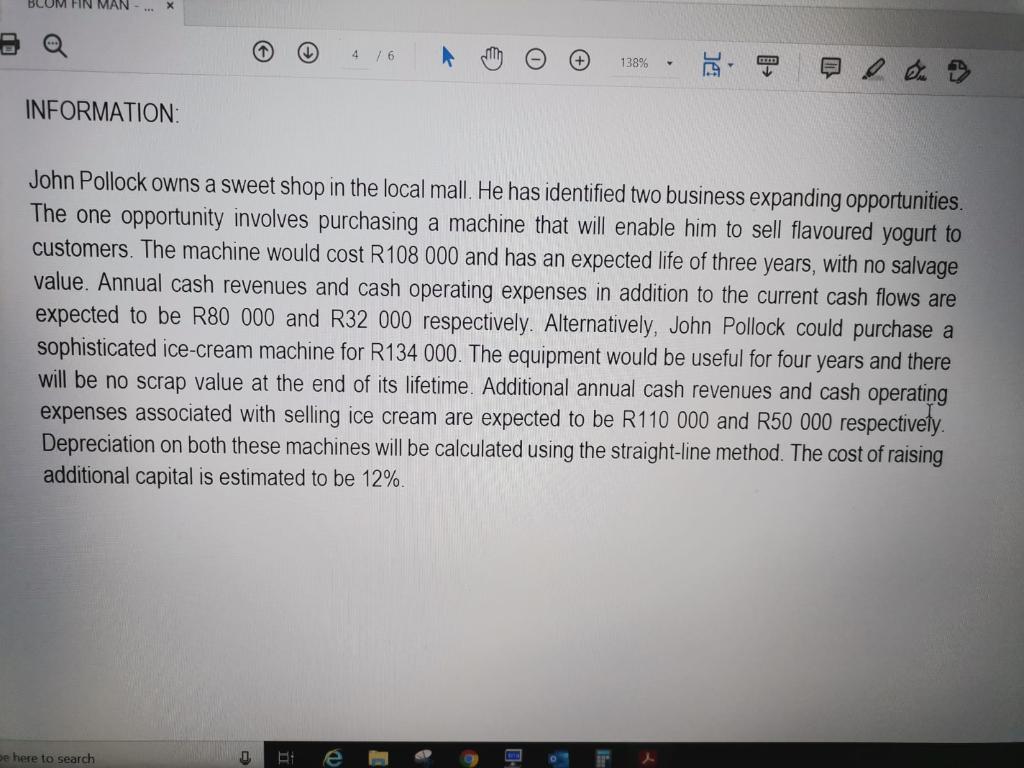

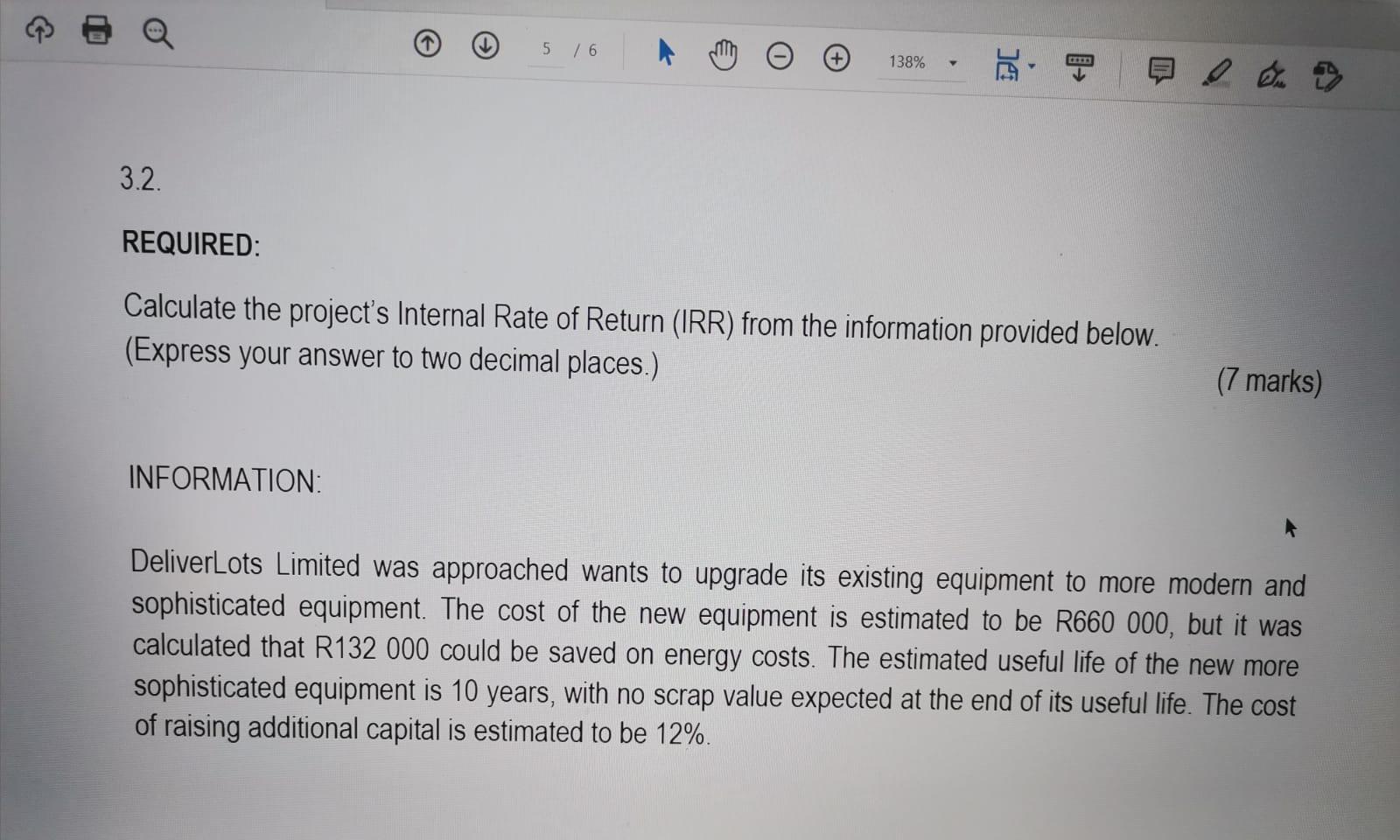

1307 en > QUESTION 3 (20 Marks) 3.1. REQUIRED: Use the information provided below to calculate the following: 3.1.1 Payback Period of each alternative (Express your answers in years, months and days not decimals). (4 marks) 4 3.1.2 Accounting Rate of Return (ARR) for the first alternative (frozen yogurt). (4 marks) 3.1.3 Calculate the Net Present Value (NPV) of the second alternative (ice cream). (5 marks) BCOM FIN MAN 4 / 6 138% INFORMATION John Pollock owns a sweet shop in the local mall. He has identified two business expanding opportunities. The one opportunity involves purchasing a machine that will enable him to sell flavoured yogurt to customers. The machine would cost R108 000 and has an expected life of three years, with no salvage value. Annual cash revenues and cash operating expenses in addition to the current cash flows are expected to be R80 000 and R32 000 respectively. Alternatively, John Pollock could purchase a sophisticated ice-cream machine for R134 000. The equipment would be useful for four years and there will be no scrap value at the end of its lifetime. Additional annual cash revenues and cash operating expenses associated with selling ice cream are expected to be R110 000 and R50 000 respectively. Depreciation on both these machines will be calculated using the straight-line method. The cost of raising additional capital is estimated to be 12%. be here to search 5 / 6 138% 3.2. REQUIRED: Calculate the project's Internal Rate of Return (IRR) from the information provided below. (Express your answer to two decimal places.) (7 marks) INFORMATION: DeliverLots Limited was approached wants to upgrade its existing equipment to more modern and sophisticated equipment. The cost of the new equipment is estimated to be R660 000, but it was calculated that R132 000 could be saved on energy costs. The estimated useful life of the new more sophisticated equipment is 10 years, with no scrap value expected at the end of its useful life. The cost of raising additional capital is estimated to be 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts