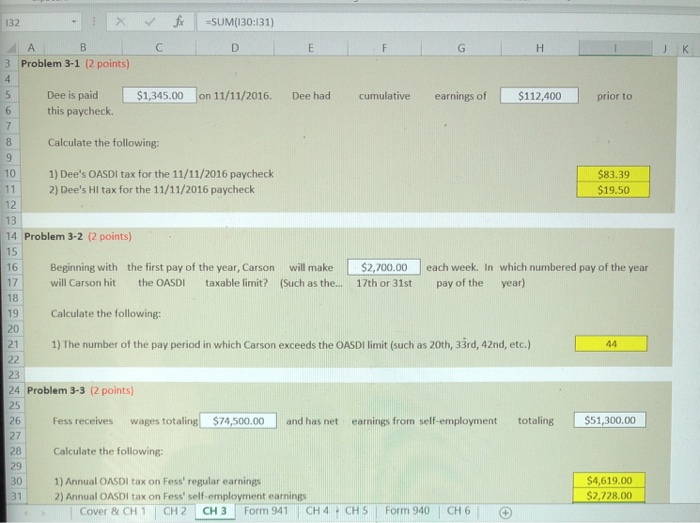

Question: 132 3 Problem 3-1 (2 points) 5 Dee is paid $1,345.00 on 11/11/2016. Dee had cumulative earnings of $112,400 prior to 6 this paycheck. 8

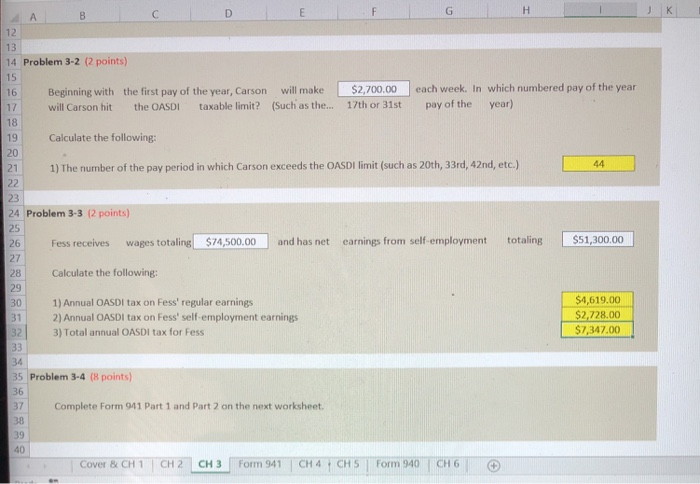

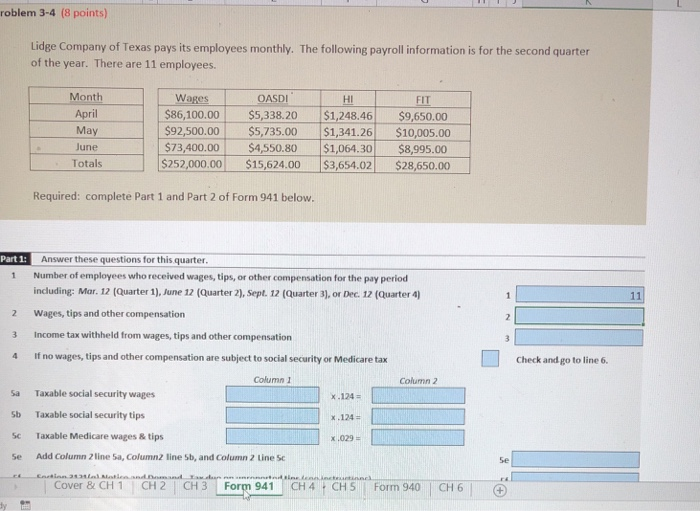

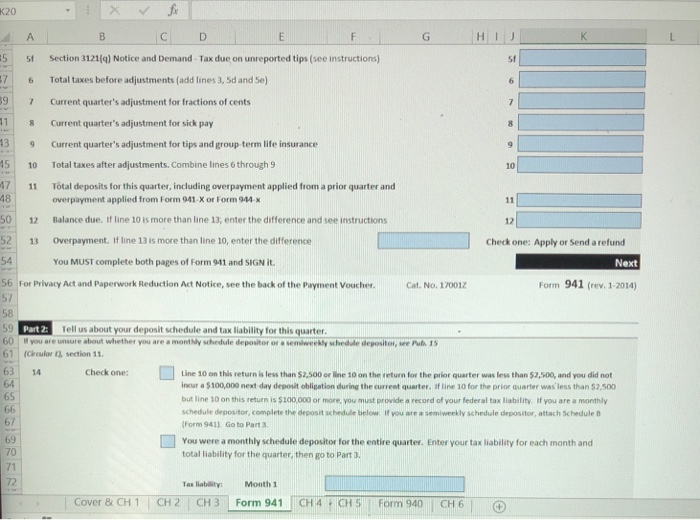

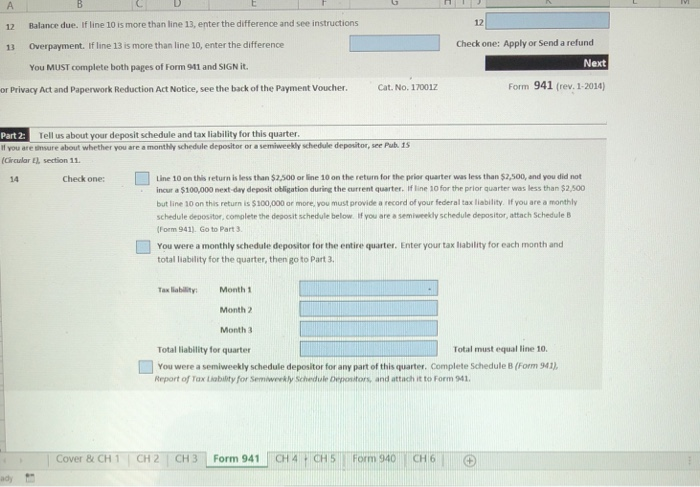

132 3 Problem 3-1 (2 points) 5 Dee is paid $1,345.00 on 11/11/2016. Dee had cumulative earnings of $112,400 prior to 6 this paycheck. 8 Calculate the following: 10 1) Dee's OASDI tax for the 11/11/2016 paycheck 11 2) Dee's HI tax for the 11/11/2016 paycheck 12 $83.39 $19.50 14 Problem 3-2 (2 points) 15 16 Beginning with the first pay of the year, Carson will make S2,700.00 each week. In which numbered pay of the year 17 will Carson hit the OASDI taxable limit? (Such as the.... 17th or 31st pay of the year) 18 19 Calculate the following: 20 21 1) The number of the pay period in which Carson exceeds the OASDI limit (such as 20th, 33rd, 42nd, etc.] 24 Problem 3-3 (2 points) 25 26 Fess receives wages totaling 27 28 29 $74,500.00 and has net earnings from self-employment totaling $51,300.00 Calculate the following: 1) Annual OASDI tax on Fess' regular earnings 2) Annual OASDI tax on Fess' self-employment earnings $4,619.00 $2,728.00 | Cover & CH 1 | CH 2 I CH 3 | Form 941 | CH 4 tCHs i Forrn 940 | CH 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts