Question: 13293/128 . The minimum tick size or price increment in the Treasury-bond market, is generally 1/128 of a point.) Although bonds are typically traded in

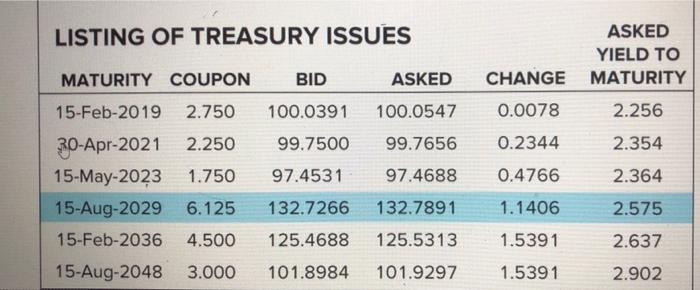

13293/128 . The minimum tick size or price increment in the Treasury-bond market, is generally 1/128 of a point.) Although bonds are typically traded in denominations of $1,000 par value, prices are quoted as a percentage of par. Thus, the bid price should be interpreted as 132.7266% of par, or $1,327.266 for the $1,000 par value bond. Similarly, the ask price at which the bond could be purchased from a dealer is 132.7891% of par, or $1,327.891. The 1.1406% change means that the asked price on this day increased by 1.1406% of par value (equivalently, by a 118/128 of a point) from the previous day's close. Finally, the yield to maturity based on the asked price is 2.575%. 7. Turn back to Figure 2.3 and look at the Treasury bond maturing in August 2048. a. How much would you have to pay to purchase one of these bonds? b. What is its coupon rate? c. What is the yield to maturity of the bond? LISTING OF TREASURY ISSUES ASKED YIELD TO MATURITY MATURITY COUPON BID ASKED CHANGE 2.750 100.0391 100.0547 0.0078 2.256 2.250 99.7500 99.7656 0.2344 2.354 1.750 97.4531 97.4688 0.4766 2.364 15-Feb-2019 30-Apr-2021 15-May-2023 15-Aug-2029 15-Feb-2036 15-Aug-2048 6.125 132.7266 132.7891 1.1406 2.575 4.500 125.4688 125.5313 1.5391 2.637 3.000 101.8984 101.9297 1.5391 2.902

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts