Question: 1-34 General Journal please During Year 10 , Pacilio Security Services experienced the following transactions: 1. Paid the sales tax payable from Year 9. 2.

1-34 General Journal please

1-34 General Journal please

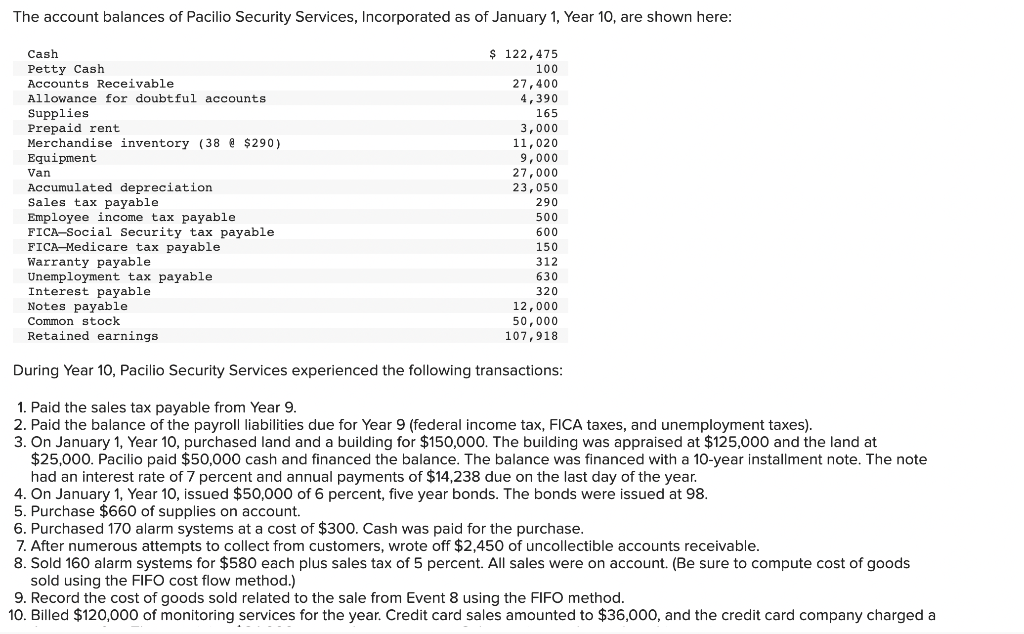

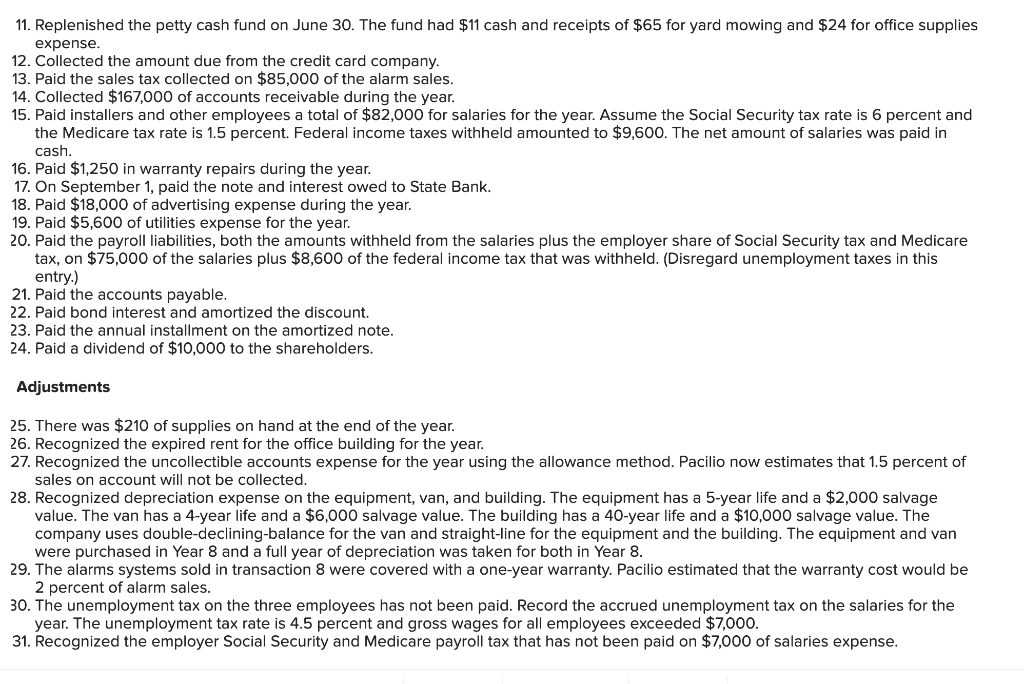

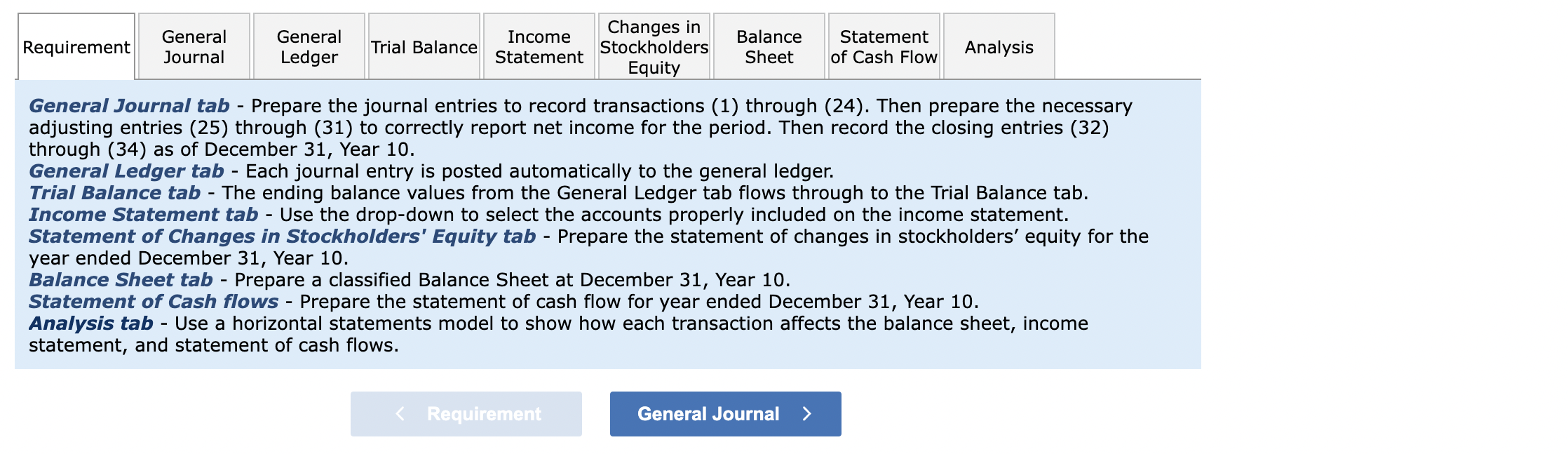

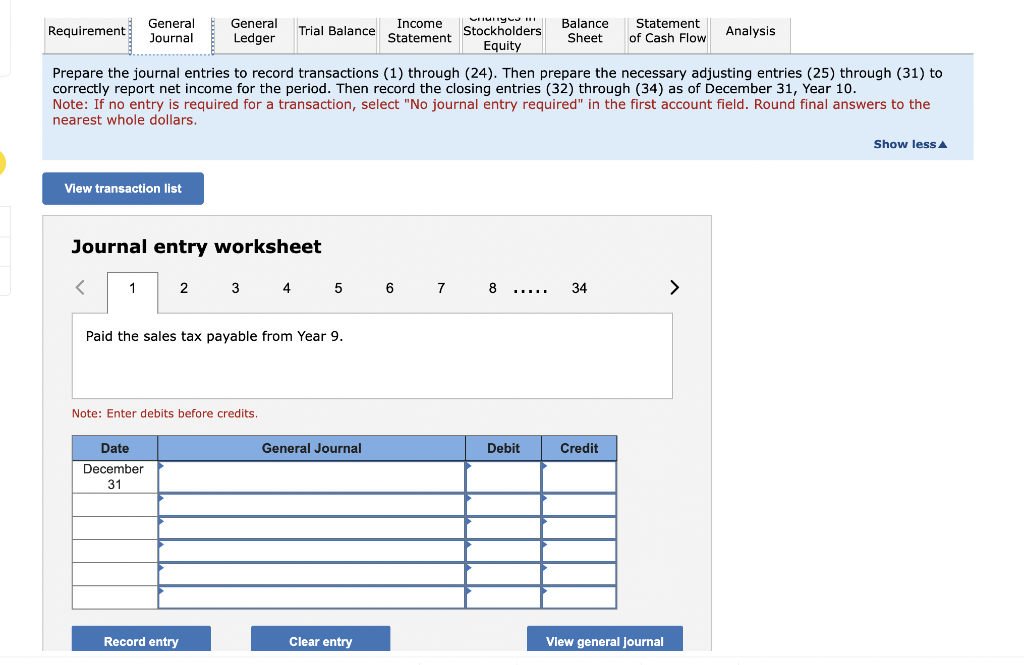

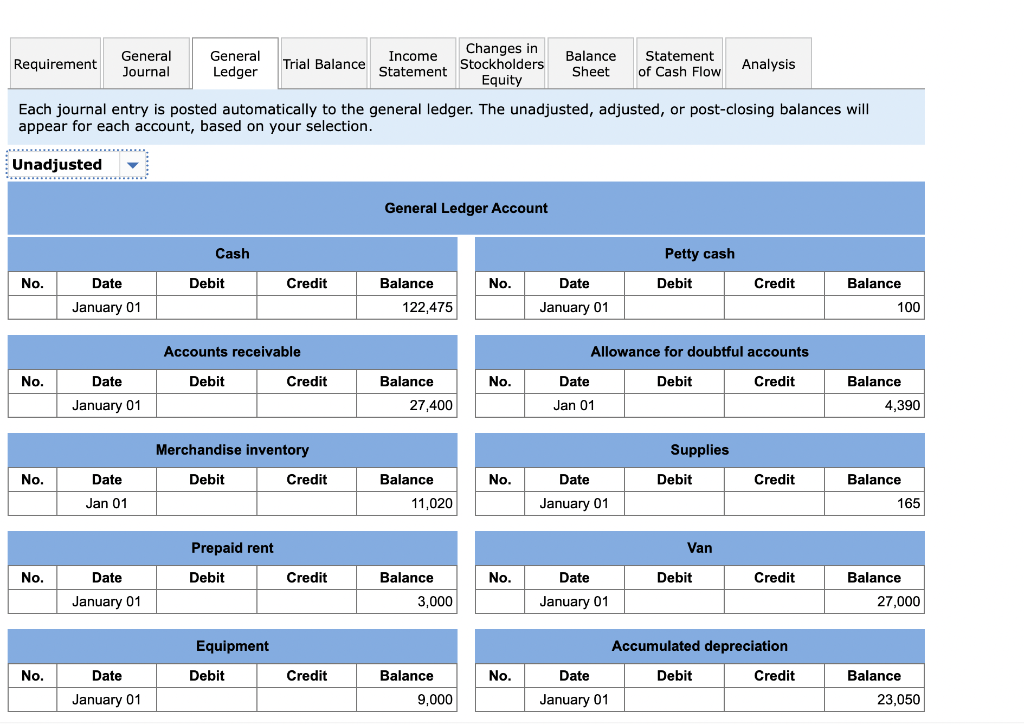

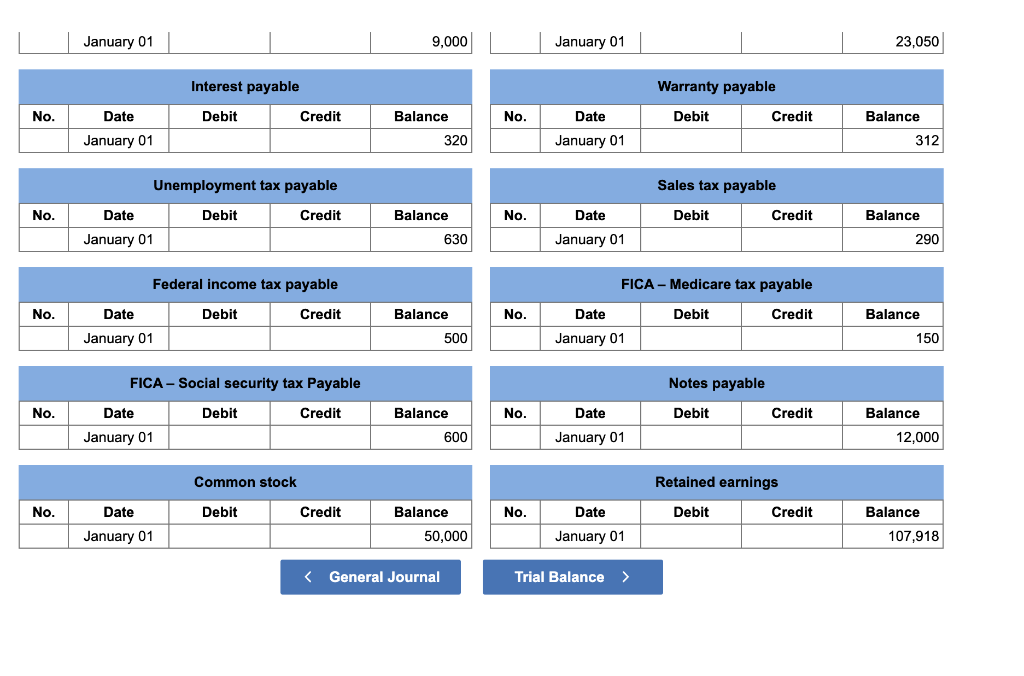

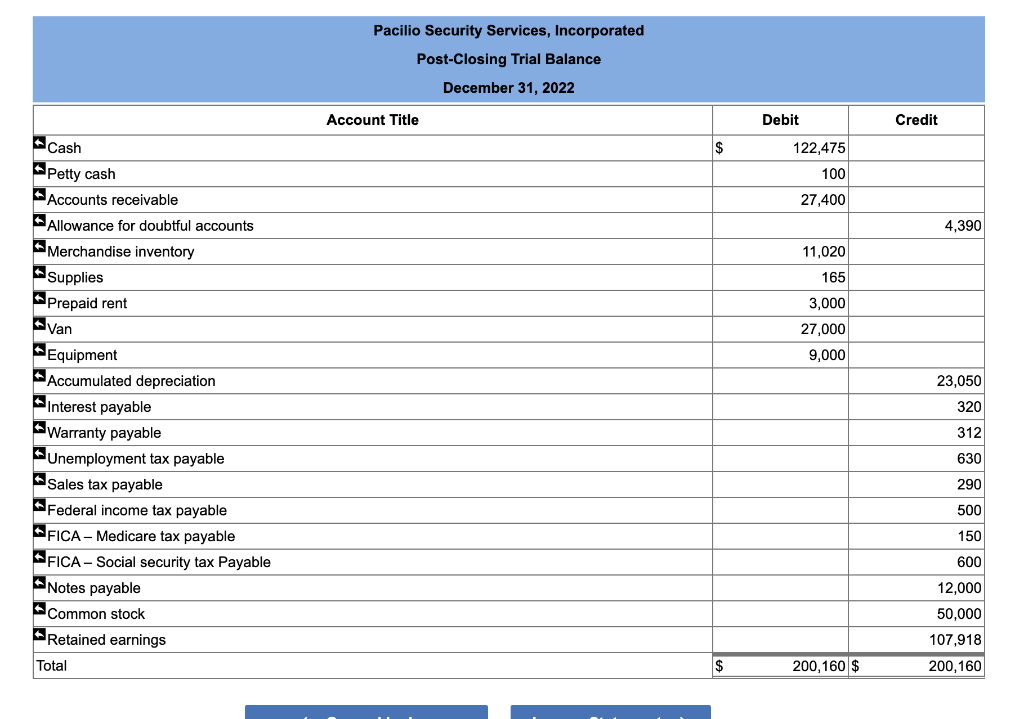

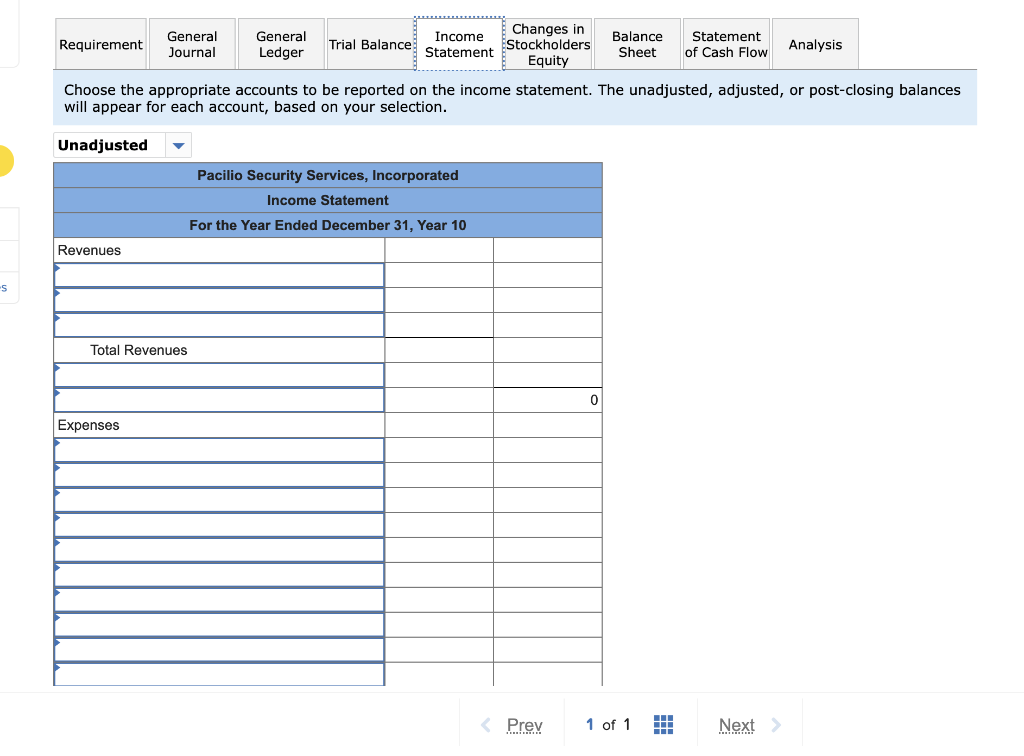

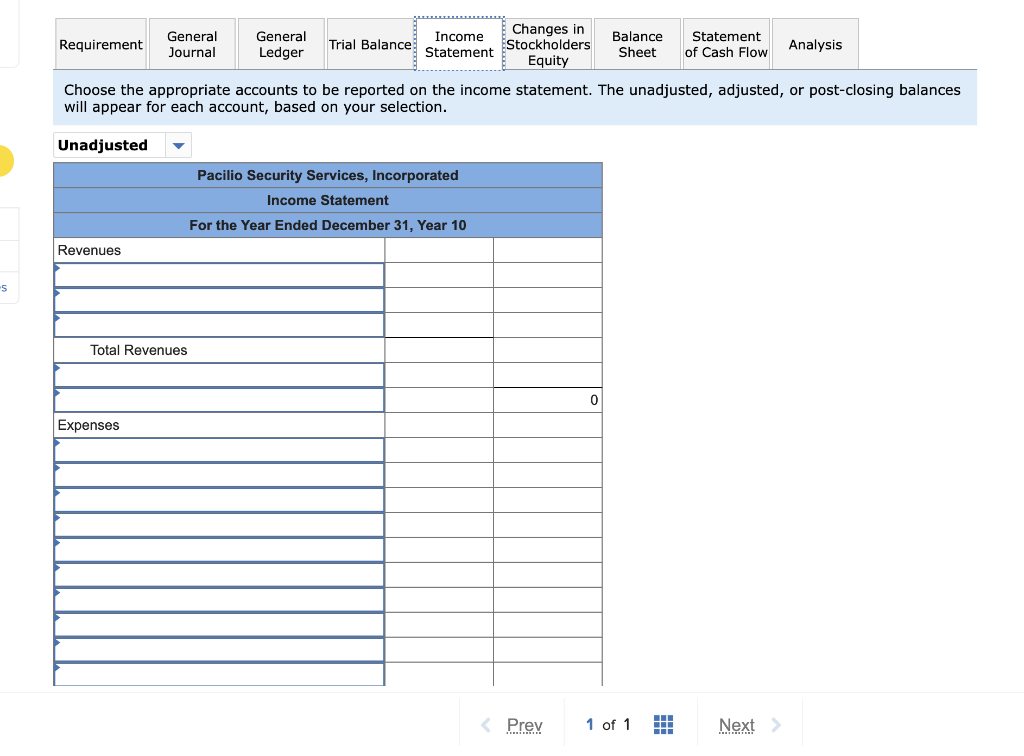

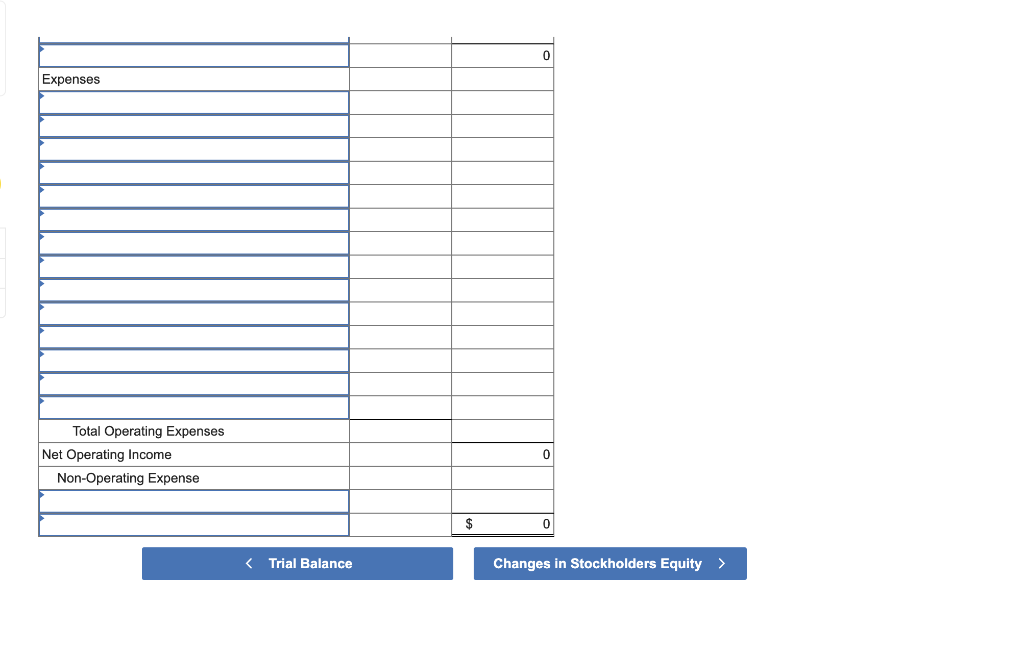

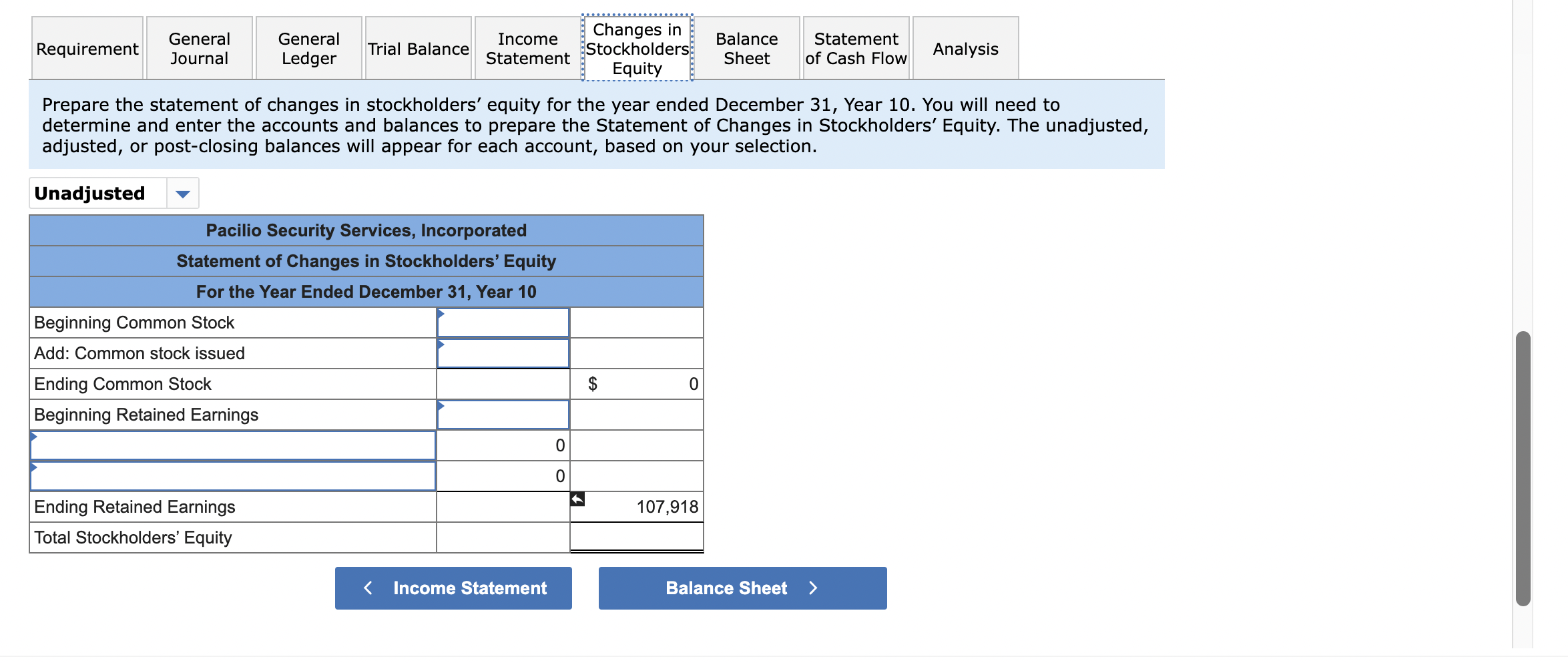

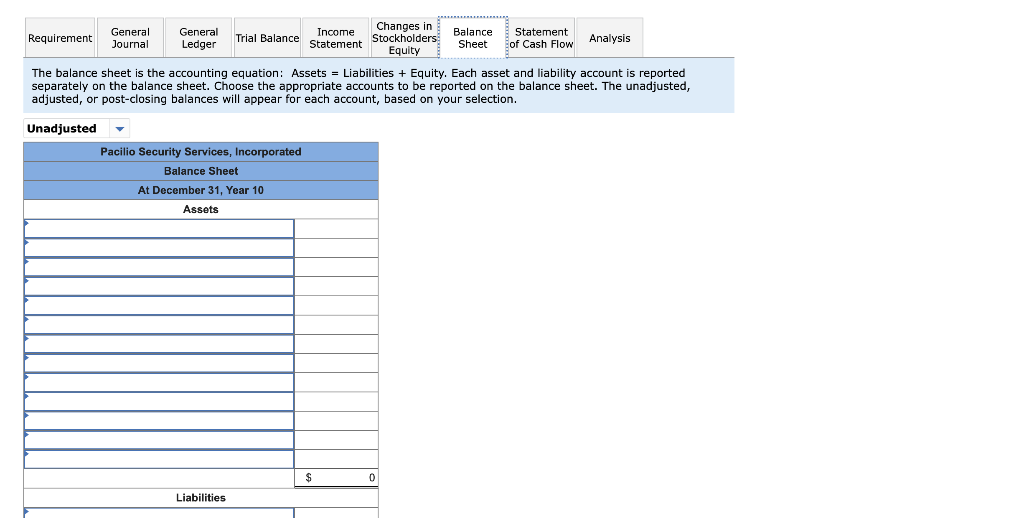

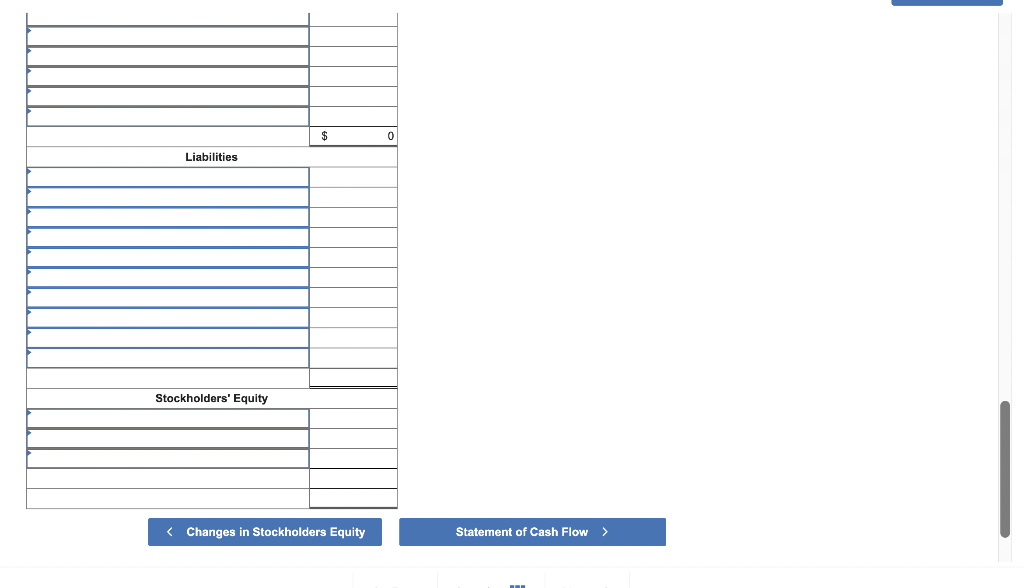

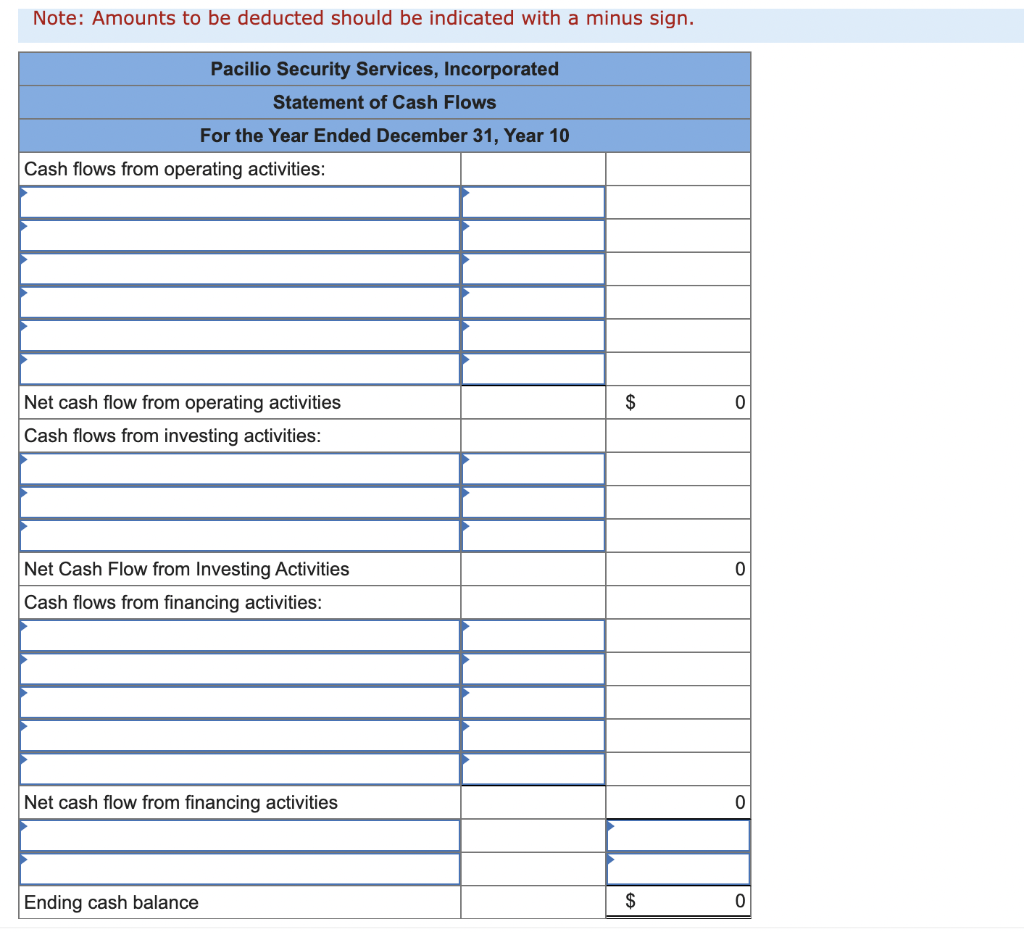

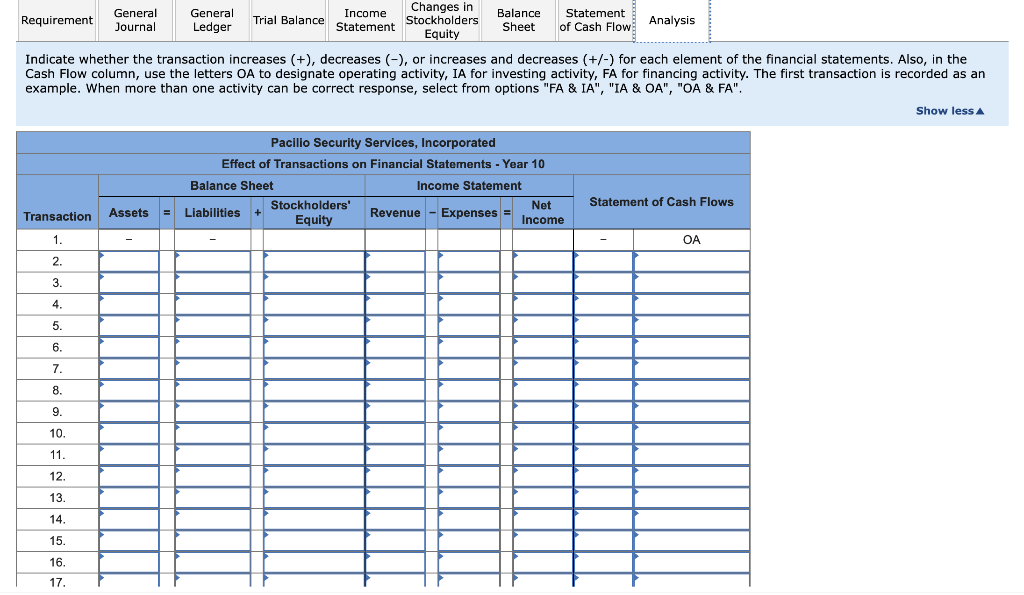

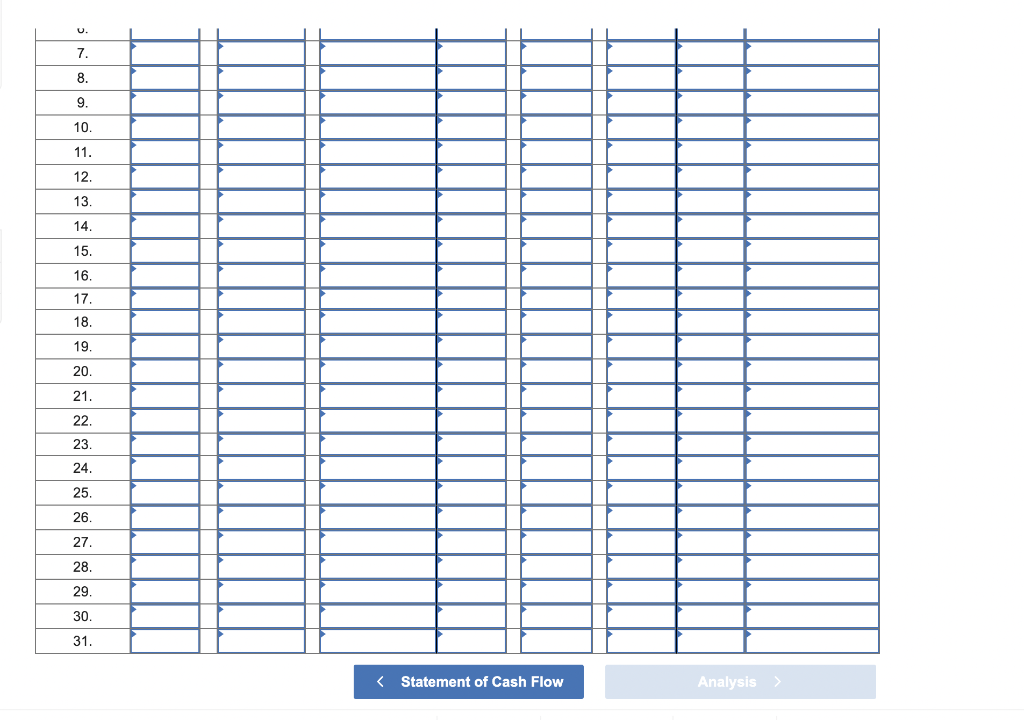

During Year 10 , Pacilio Security Services experienced the following transactions: 1. Paid the sales tax payable from Year 9. 2. Paid the balance of the payroll liabilities due for Year 9 (federal income tax, FICA taxes, and unemployment taxes). 3. On January 1, Year 10, purchased land and a building for $150,000. The building was appraised at $125,000 and the land at $25,000. Pacilio paid $50,000 cash and financed the balance. The balance was financed with a 10year installment note. The note had an interest rate of 7 percent and annual payments of $14,238 due on the last day of the year. 4. On January 1 , Year 10 , issued $50,000 of 6 percent, five year bonds. The bonds were issued at 98 . 5. Purchase $660 of supplies on account. 6. Purchased 170 alarm systems at a cost of $300. Cash was paid for the purchase. 7. After numerous attempts to collect from customers, wrote off $2,450 of uncollectible accounts receivable. 8. Sold 160 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.) 9. Record the cost of goods sold related to the sale from Event 8 using the FIFO method. 10. Billed $120,000 of monitoring services for the year. Credit card sales amounted to $36,000, and the credit card company charged a 11. Replenished the petty cash fund on June 30 . The fund had $11 cash and receipts of $65 for yard mowing and $24 for office supplies expense. 12. Collected the amount due from the credit card company. 13. Paid the sales tax collected on $85,000 of the alarm sales. 14. Collected $167,000 of accounts receivable during the year. 15. Paid installers and other employees a total of $82,000 for salaries for the year. Assume the Social Security tax rater the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $9,600. The net amount of salaries was paid in cash. 16. Paid $1,250 in warranty repairs during the year. 17. On September 1 , paid the note and interest owed to State Bank. 18. Paid $18,000 of advertising expense during the year. 19. Paid $5,600 of utilities expense for the year. 20. Paid the payroll liabilities, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax, on $75,000 of the salaries plus $8,600 of the federal income tax that was withheld. (Disregard unemployment taxes in this entry.) 21. Paid the accounts payable. 22. Paid bond interest and amortized the discount. 23. Paid the annual installment on the amortized note. 24. Paid a dividend of $10,000 to the shareholders. Adjustments 25. There was $210 of supplies on hand at the end of the year. 26. Recognized the expired rent for the office building for the year. 27. Recognized the uncollectible accounts expense for the year using the allowance method. Pacilio now estimates that 1.5 percent of sales on account will not be collected. 28. Recognized depreciation expense on the equipment, van, and building. The equipment has a 5 -year life and a $2,000 salvage value. The van has a 4-year life and a $6,000 salvage value. The building has a 40 -year life and a $10,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment and the building. The equipment and were purchased in Year 8 and a full year of depreciation was taken for both in Year 8. 29. The alarms systems sold in transaction 8 were covered with a one-year warranty. Pacilio estimated that the warranty cost would be 2 percent of alarm sales. 30. The unemployment tax on the three employees has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent and gross wages for all employees exceeded $7,000. 31. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $7,000 of salaries expense. General Journal tab - Prepare the journal entries to record transactions (1) through (24). Then prepare the necessary adjusting entries (25) through (31) to correctly report net income for the period. Then record the closing entries (32) through (34) as of December 31, Year 10. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 10 . Balance Sheet tab - Prepare a classified Balance Sheet at December 31, Year 10. Statement of Cash flows - Prepare the statement of cash flow for year ended December 31 , Year 10. Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, income statement, and statement of cash flows. Prepare the journal entries to record transactions (1) through (24). Then prepare the necessary adjusting entries ( 25 ) through ( 31 ) to correctly report net income for the period. Then record the closing entries (32) through (34) as of December 31 , Year 10. Note: If no entry is required for a transaction, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars. Journal entry worksheet Each journal entry is posted automatically to the general ledger. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Unemployment tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 630 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Sales tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 290 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Federal income tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ FICA - Social security tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Notes payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 12,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 50,000 \\ \hline \end{tabular} > Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 10 . You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted adjusted, or post-closing balances will appear for each account, based on your selection. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. > Note: Amounts to be deducted should be indicated with a minus sign. Indicate whether the transaction increases (+), decreases (), or increases and decreases (+/) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an example. When more than one activity can be correct response, select from options "FA \& IA", "IA \& OA", "OA \& FA". \begin{tabular}{|l|l|l|l|l|l|l|} \hline 7. & & & & & & \end{tabular} During Year 10 , Pacilio Security Services experienced the following transactions: 1. Paid the sales tax payable from Year 9. 2. Paid the balance of the payroll liabilities due for Year 9 (federal income tax, FICA taxes, and unemployment taxes). 3. On January 1, Year 10, purchased land and a building for $150,000. The building was appraised at $125,000 and the land at $25,000. Pacilio paid $50,000 cash and financed the balance. The balance was financed with a 10year installment note. The note had an interest rate of 7 percent and annual payments of $14,238 due on the last day of the year. 4. On January 1 , Year 10 , issued $50,000 of 6 percent, five year bonds. The bonds were issued at 98 . 5. Purchase $660 of supplies on account. 6. Purchased 170 alarm systems at a cost of $300. Cash was paid for the purchase. 7. After numerous attempts to collect from customers, wrote off $2,450 of uncollectible accounts receivable. 8. Sold 160 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.) 9. Record the cost of goods sold related to the sale from Event 8 using the FIFO method. 10. Billed $120,000 of monitoring services for the year. Credit card sales amounted to $36,000, and the credit card company charged a 11. Replenished the petty cash fund on June 30 . The fund had $11 cash and receipts of $65 for yard mowing and $24 for office supplies expense. 12. Collected the amount due from the credit card company. 13. Paid the sales tax collected on $85,000 of the alarm sales. 14. Collected $167,000 of accounts receivable during the year. 15. Paid installers and other employees a total of $82,000 for salaries for the year. Assume the Social Security tax rater the Medicare tax rate is 1.5 percent. Federal income taxes withheld amounted to $9,600. The net amount of salaries was paid in cash. 16. Paid $1,250 in warranty repairs during the year. 17. On September 1 , paid the note and interest owed to State Bank. 18. Paid $18,000 of advertising expense during the year. 19. Paid $5,600 of utilities expense for the year. 20. Paid the payroll liabilities, both the amounts withheld from the salaries plus the employer share of Social Security tax and Medicare tax, on $75,000 of the salaries plus $8,600 of the federal income tax that was withheld. (Disregard unemployment taxes in this entry.) 21. Paid the accounts payable. 22. Paid bond interest and amortized the discount. 23. Paid the annual installment on the amortized note. 24. Paid a dividend of $10,000 to the shareholders. Adjustments 25. There was $210 of supplies on hand at the end of the year. 26. Recognized the expired rent for the office building for the year. 27. Recognized the uncollectible accounts expense for the year using the allowance method. Pacilio now estimates that 1.5 percent of sales on account will not be collected. 28. Recognized depreciation expense on the equipment, van, and building. The equipment has a 5 -year life and a $2,000 salvage value. The van has a 4-year life and a $6,000 salvage value. The building has a 40 -year life and a $10,000 salvage value. The company uses double-declining-balance for the van and straight-line for the equipment and the building. The equipment and were purchased in Year 8 and a full year of depreciation was taken for both in Year 8. 29. The alarms systems sold in transaction 8 were covered with a one-year warranty. Pacilio estimated that the warranty cost would be 2 percent of alarm sales. 30. The unemployment tax on the three employees has not been paid. Record the accrued unemployment tax on the salaries for the year. The unemployment tax rate is 4.5 percent and gross wages for all employees exceeded $7,000. 31. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $7,000 of salaries expense. General Journal tab - Prepare the journal entries to record transactions (1) through (24). Then prepare the necessary adjusting entries (25) through (31) to correctly report net income for the period. Then record the closing entries (32) through (34) as of December 31, Year 10. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 10 . Balance Sheet tab - Prepare a classified Balance Sheet at December 31, Year 10. Statement of Cash flows - Prepare the statement of cash flow for year ended December 31 , Year 10. Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, income statement, and statement of cash flows. Prepare the journal entries to record transactions (1) through (24). Then prepare the necessary adjusting entries ( 25 ) through ( 31 ) to correctly report net income for the period. Then record the closing entries (32) through (34) as of December 31 , Year 10. Note: If no entry is required for a transaction, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars. Journal entry worksheet Each journal entry is posted automatically to the general ledger. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Unemployment tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 630 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Sales tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 290 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Federal income tax payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ FICA - Social security tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Notes payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 12,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & January 01 & & & 50,000 \\ \hline \end{tabular} > Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31 , Year 10 . You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted adjusted, or post-closing balances will appear for each account, based on your selection. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. > Note: Amounts to be deducted should be indicated with a minus sign. Indicate whether the transaction increases (+), decreases (), or increases and decreases (+/) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an example. When more than one activity can be correct response, select from options "FA \& IA", "IA \& OA", "OA \& FA". \begin{tabular}{|l|l|l|l|l|l|l|} \hline 7. & & & & & & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts