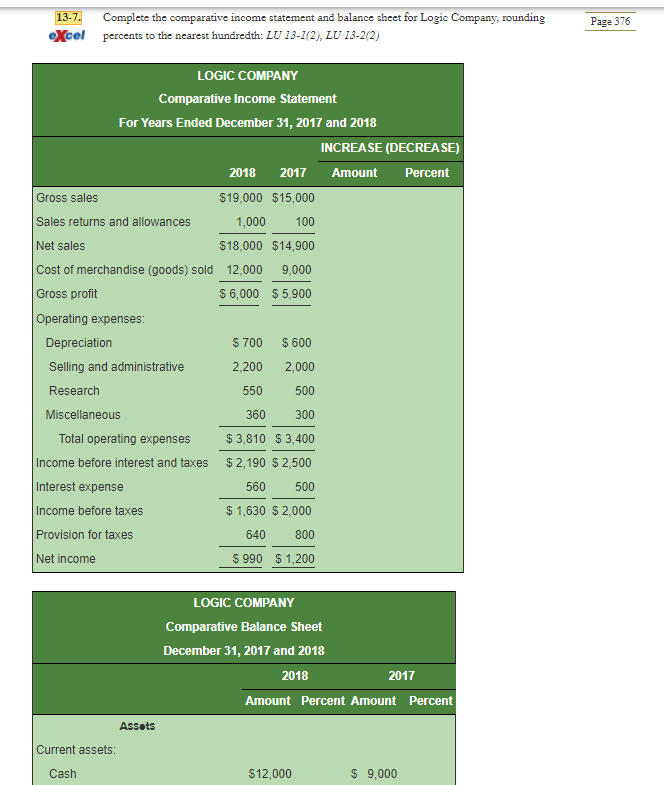

Question: 13-7. Complete the comparative income statement and balance sheet for Logic Company, rounding excel percents to the nearest hundredth: LU 13-1/2), LU 13-2/2) Page 376

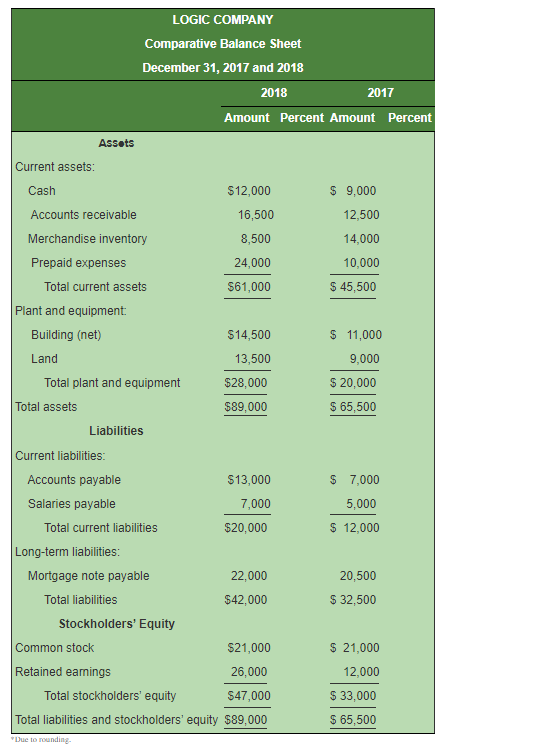

13-7. Complete the comparative income statement and balance sheet for Logic Company, rounding excel percents to the nearest hundredth: LU 13-1/2), LU 13-2/2) Page 376 LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2017 and 2018 INCREASE (DECREASE) 2018 2017 Amount Percent Gross sales $19,000 $15,000 Sales returns and allowances 1,000 100 Net sales $18,000 $14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2.200 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 Amount Percent Amount Percent Assots Current assets: Cash $12,000 $ 9,000 LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 Amount Percent Amount Percent Assets $ 9,000 12,500 14,000 10,000 $ 45,500 $ 11,000 9,000 $ 20,000 $ 65,500 Current assets: Cash $12,000 Accounts receivable 16,500 Merchandise inventory 8,500 Prepaid expenses 24,000 Total current assets $61,000 Plant and equipment Building (net) $14,500 Land 13,500 Total plant and equipment $28,000 Total assets $89,000 Liabilities Current liabilities: Accounts payable $13,000 Salaries payable 7,000 Total current liabilities $20,000 Long-term liabilities: Mortgage note payable 22,000 Total liabilities $42,000 Stockholders' Equity Common stock $21,000 Retained earings 26,000 Total stockholders' equity $47,000 Total liabilities and stockholders' equity $89,000 $ 7,000 5,000 $ 12,000 20,500 $ 32,500 $ 21,000 12,000 $ 33,000 $ 65,500 Due to rounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts