Question: 14 & 15 14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the

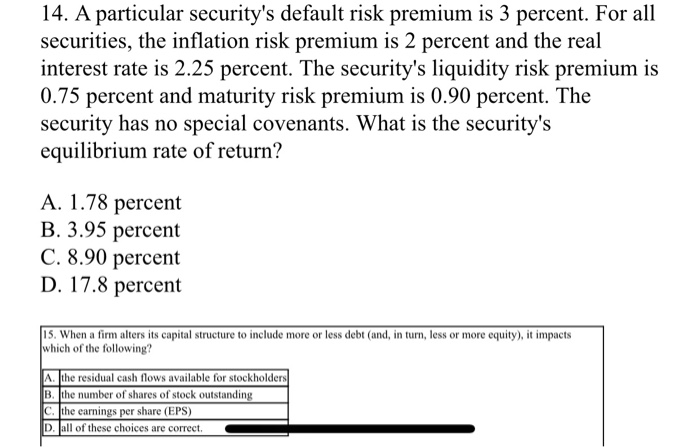

14. A particular security's default risk premium is 3 percent. For all securities, the inflation risk premium is 2 percent and the real interest rate is 2.25 percent. The security's liquidity risk premium is 0.75 percent and maturity risk premium is 0.90 percent. The security has no special covenants. What is the security's equilibrium rate of return? A. 1.78 percent B. 3.95 percent C. 8.90 percent D. 17.8 percent IS. When a firm alters its capital structure to include more or less debt and, in turn, less or more equity), it impacts which of the following? A. the residual cash flows available for stockholders B. the number of shares of stock outstanding c. the earnings per share (EPS) D. all of these choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts