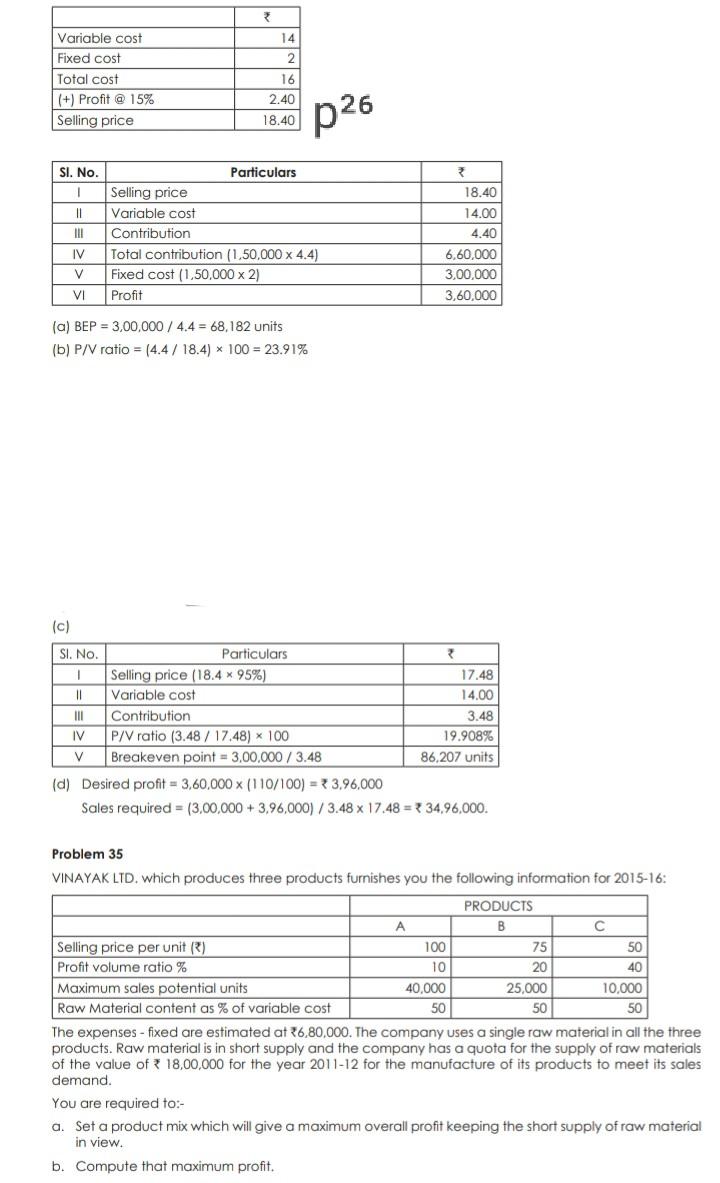

Question: 14 2 Variable cost Fixed cost Total cost (+) Profit @ 15% Selling price 16 2.40 18.40 p26 SI. No. 1 II Particulars Selling price

14 2 Variable cost Fixed cost Total cost (+) Profit @ 15% Selling price 16 2.40 18.40 p26 SI. No. 1 II Particulars Selling price Variable cost Contribution Total contribution (1.50,000 x 4.4) Fixed cost (1.50,000 x 2) Profit 18.40 14.00 4.40 6.60.000 IV V 3,00,000 3,60,000 VI (a) BEP = 3,00,000 / 4.4 = 68,182 units (b) P/V ratio = (4.4 / 18.4) x 100 = 23.91% (c) SI. No. Particulars 1 Selling price (18.4 * 95%) 17.48 II Variable cost 14.00 III Contribution 3.48 IV P/V ratio (3.48 / 17.48) x 100 19.908% V Breakeven point = 3,00.000 / 3.48 86,207 units (d) Desired profit = 3,60,000 X (110/100) = 73,96,000 Sales required = 13,00,000 + 3.96,000) /3.48 x 17.48 = 34.96.000. Problem 35 VINAYAK LTD. which produces three products furnishes you the following information for 2015-16: PRODUCTS B Selling price per unit R) 100 75 50 Profit volume ratio % 10 20 40 Maximum sales potential units 40,000 25,000 10,000 Raw Material content as % of variable cost 50 50 50 The expenses - fixed are estimated at 26,80.000. The company uses a single raw material in all the three products. Raw material is in short supply and the company has a quota for the supply of raw materials of the value of 18,00,000 for the year 2011-12 for the manufacture of its products to meet its sales demand. You are required to:- a. Set a product mix which will give a maximum overall profit keeping the short supply of raw material in view. b. Compute that maximum profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts