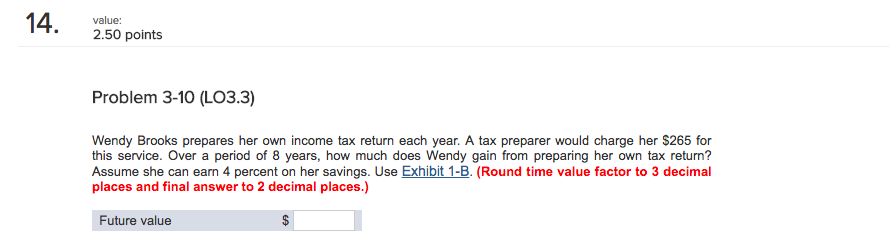

Question: 14. 2.50 points value: Problem 3-10 (LO3.3) Wendy Brooks prepares her own income tax return each year. A tax preparer would charge her $265 for

14. 2.50 points value: Problem 3-10 (LO3.3) Wendy Brooks prepares her own income tax return each year. A tax preparer would charge her $265 for this service. Over a period of 8 years, how much does Wendy gain from preparing her own tax return? Assume she can earn 4 percent on her savings. Use Exhibit 1-B. (Round time value factor to 3 decimal places and final answer to 2 decimal places.) Future value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts