Question: 14 -A A Aa to E E E 21 AalbCD AaBBCCD AaBbc AaBbcc AaB X, *' ADA. E STE 1 Normal 1 No Spac... Heading

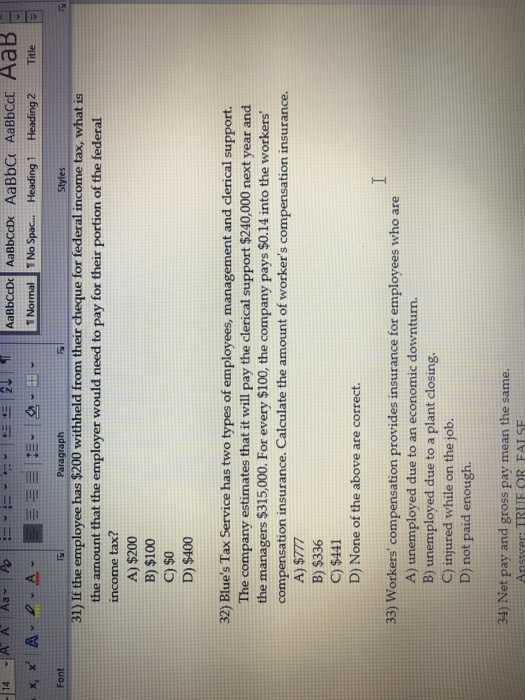

14 -A A Aa to E E E 21 AalbCD AaBBCCD AaBbc AaBbcc AaB X, *' ADA. E STE 1 Normal 1 No Spac... Heading 1 Heading 2 Title Font Paragraph Styles 31) If the employee has $200 withheld from their cheque for federal income tax, what is the amount that the employer would need to pay for their portion of the federal income tax? A) $200 B) $100 C) $0 D) $400 32) Blue's Tax Service has two types of employees, management and clerical support. The company estimates that it will pay the clerical support $240,000 next year and the managers $315,000. For every $100, the company pays $0.14 into the workers' compensation insurance. Calculate the amount of worker's compensation insurance. A) $777 B) $336 C) $441 D) None of the above are correct. 33) Workers' compensation provides insurance for employees who are A) unemployed due to an economic downturn. B) unemployed due to a plant closing. C) injured while on the job. D) not paid enough 34) Net pay and gross pay mean the same. Answer:TRUE OR FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts