Question: 14. Accountable vs. Nonaccountable Plans. (Obj. 3) Amanda operates her business as a sole proprietorship. Amanda has two full-time employees. She reimburses each employee $250

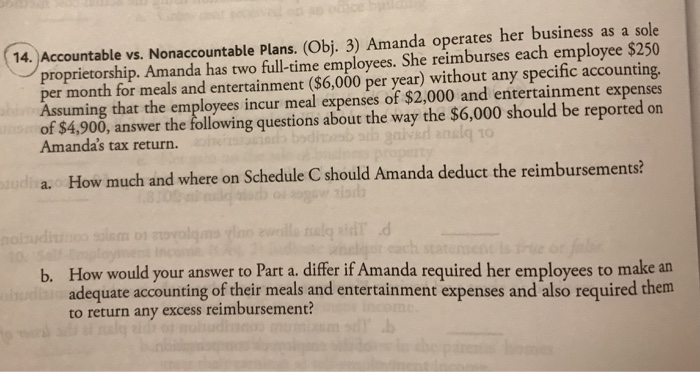

14. Accountable vs. Nonaccountable Plans. (Obj. 3) Amanda operates her business as a sole proprietorship. Amanda has two full-time employees. She reimburses each employee $250 per month for meals and entertainment ($6,000 per year) without any specific accounting, Assuming that the employees incur meal expenses of $2,000 and entertainment expenses of $4.900, answer the following questions about the way the $6,000 should be reported on Amanda's tax return. studa. How much and where on Schedule C should Amanda deduct the reimbursements? b. How would your answer to Part a. differ if Amanda required her employees to make an adequate accounting of their meals and entertainment expenses and also required them to return any excess reimbursement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts