Question: #14 and 15, please show all steps 14. Consider the following probability distribution for stocks A and B: State Probability Return on Stock A Return

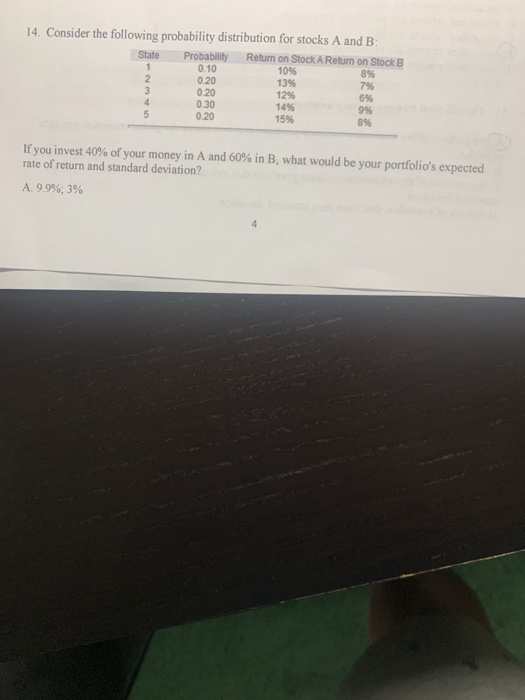

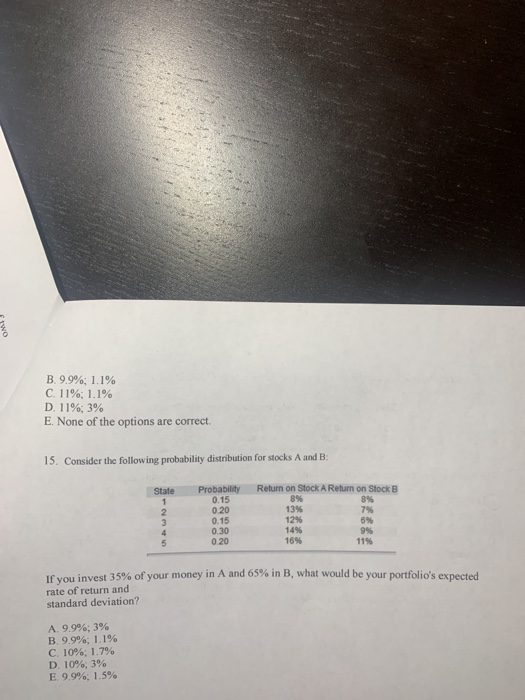

14. Consider the following probability distribution for stocks A and B: State Probability Return on Stock A Return on Stock B 0.10 10% 0.20 1396 0.20 0.30 149 9% 0.20 15% 895 89 73 6% 12 If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation? A. 9.9%; 3% OM B. 9.9%; 1.1% C. 11%; 1.1% D. 11% 3% E. None of the options are correct. 15. Consider the following probability distribution for stocks A and B: State Return on Stock A Return on Stock B 8% 8% 1395 Probability 0.15 0.20 0.15 0.30 020 1296 1496 6% 16% 1196 If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation? A 9.9% 3% B 9.9%; 1.1% C. 10%; 1.7% D. 10% 3% E. 9.9%; 1.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts