Question: 14. Consider the convertible bond by Miser Electronics: par value = $1, 000 coupon rate = 8.5% market price of convertible bond = $900 conversion

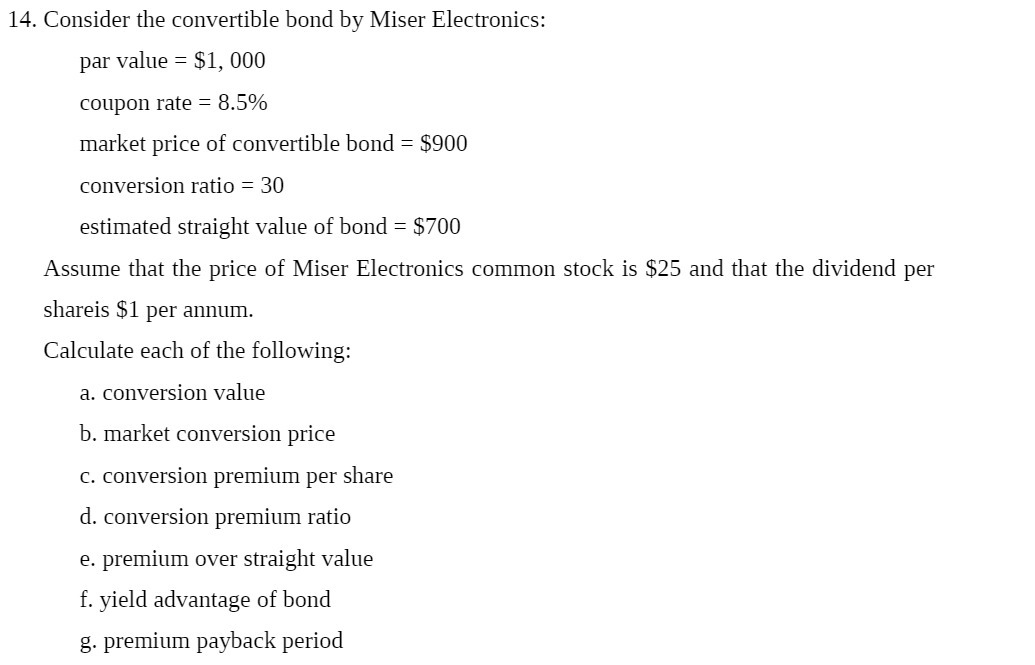

14. Consider the convertible bond by Miser Electronics: par value = $1, 000 coupon rate = 8.5% market price of convertible bond = $900 conversion ratio = 30 estimated straight value of bond = $700 Assume that the price of Miser Electronics common stock is $25 and that the dividend per shareis $1 per annum. Calculate each of the following: a. conversion value b. market conversion price c. conversion premium per share d. conversion premium ratio e. premium over straight Tvalue f. yield advantage of bond g. premium payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts