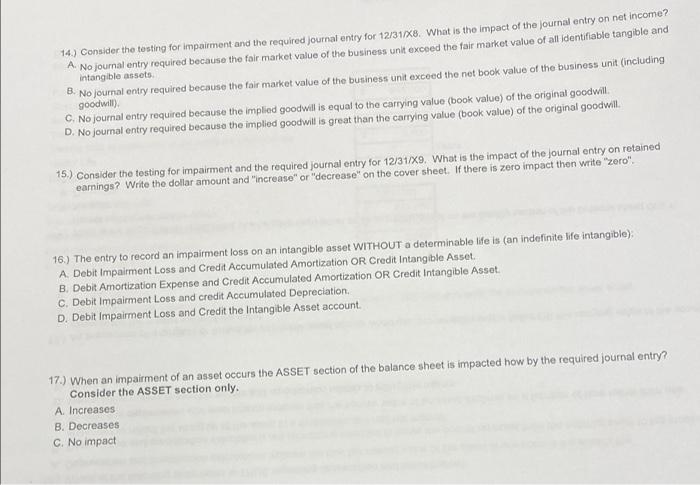

Question: 14.) Consider the testing for impairment and the required journal entry for 12/31/8. What is the impact of the journal entry on net income? A.

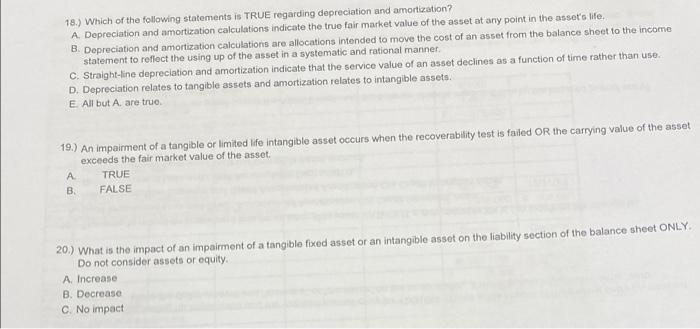

14.) Consider the testing for impairment and the required journal entry for 12/31/8. What is the impact of the journal entry on net income? A. No journal entry required because the foir market value of the business unit exceed the fair market value of all identifiable tangible and intangible assets. B. No journal entry required because the fair market value of the business unit exceed the net book value of the business unit (including goodwilly. C. No journal entry required because the implied goodwill is equal to the carrying value (book value) of the original goodwill. D. No joumal entry required becauso the implied goodwill is great than the carrying value (book value) of the original goodwill. 15.) Consider the testing for impairment and the required journal entry for 12/31/9. What is the impact of the journal entry on retained earnings? Write the dollar amount and "increase" or "decrease" on the cover sheet. If there is zero impact then write "zero". 16.) The entry to record an impairment loss on an intangible asset WITHOUT a determinable life is (an indefinite life intangible): A. Debit Impairment Loss and Credit Accumulated Amortization OR Credit Intangible Asset. B. Debit Amortization Expense and Credit Accumulated Amortization OR Credit Intangible Asset. C. Debit Impairment Loss and credit Accumulated Depreciation. D. Debit Impairment Loss and Credit the Intangible Asset account. 17.) When an impairment of an asset occurs the ASSET section of the balance sheet is impacted how by the required journal entry? Consider the ASSET section only. A. Increases B. Decreases C. No impact 18.) Which of the following statements is TRUE regarding depreciation and amontization? A. Depreciation and amortization calculations indicate the true fair market value of the asset at any point in the asset's life. B. Depreciation and amortization calculations are allocations intended to move the cost of an asset from the balance shoet to the income statement to reflect the using up of the asset in a systematic and rational manner. C. Straight-line depreciation and amortization indicate that the service value of an asset declines as a function of time rather than use: D. Depreciation relates to tangible assets and amortization relates to intangible assets. E. All but A are true. 19.) An impairment of a tangible or limited Ife intangible asset occurs when the recoverablity test is failed OR the carrying value of the asset exceeds the fair market value of the asset. A. TRUE B. FALSE 20.) What is the impact of an impairment of a tangible fixed asset or an intangible asset on the liability section of the balance sheet ONLY Do not consider assets or equity. A. Increase B. Decrease C. No impact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts