Question: 14. Free Cash Flows, when computed from CFO and CFI on the cash flows statement, need to be adjusted by: a. subtracting after-tax interest to

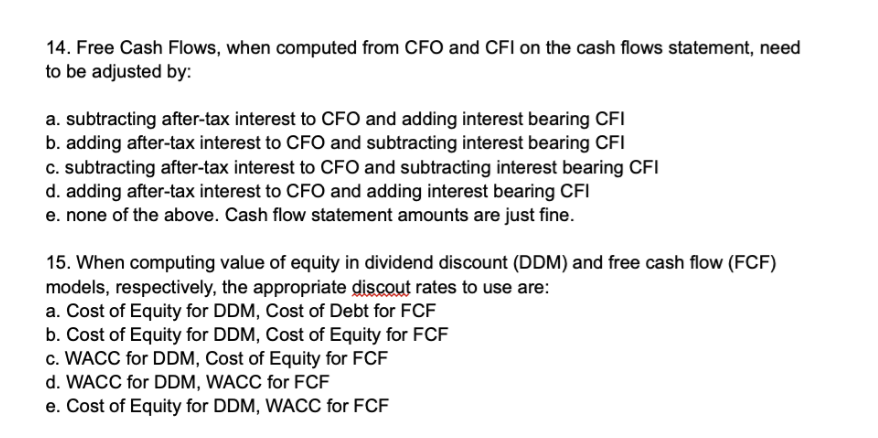

14. Free Cash Flows, when computed from CFO and CFI on the cash flows statement, need to be adjusted by: a. subtracting after-tax interest to CFO and adding interest bearing CFI b. adding after-tax interest to CFO and subtracting interest bearing CFI c. subtracting after-tax interest to CFO and subtracting interest bearing CFI d. adding after-tax interest to CFO and adding interest bearing CFI e. none of the above. Cash flow statement amounts are just fine. 15. When computing value of equity in dividend discount (DDM) and free cash flow (FCF) models, respectively, the appropriate discout rates to use are: a. Cost of Equity for DDM, Cost of Debt for FCF b. Cost of Equity for DDM, Cost of Equity for FCF c. WACC for DDM, Cost of Equity for FCF d. WACC for DDM, WACC for FCF e. Cost of Equity for DDM, WACC for FCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts