Question: 1-4 help pleaae B C D E F G Decisions Set VALUE VALID RANGE QTR 0 QTR 1 QTR 2 QTR 3 Initial Reserve Allocation

1-4 help pleaae

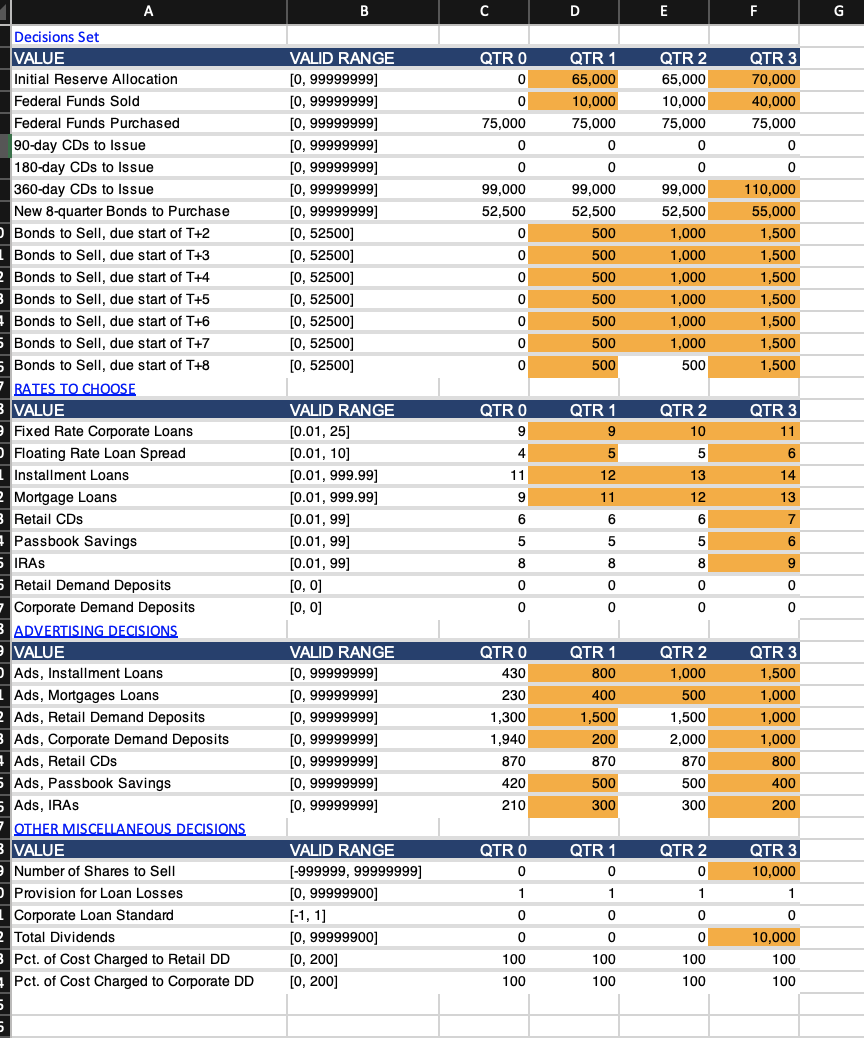

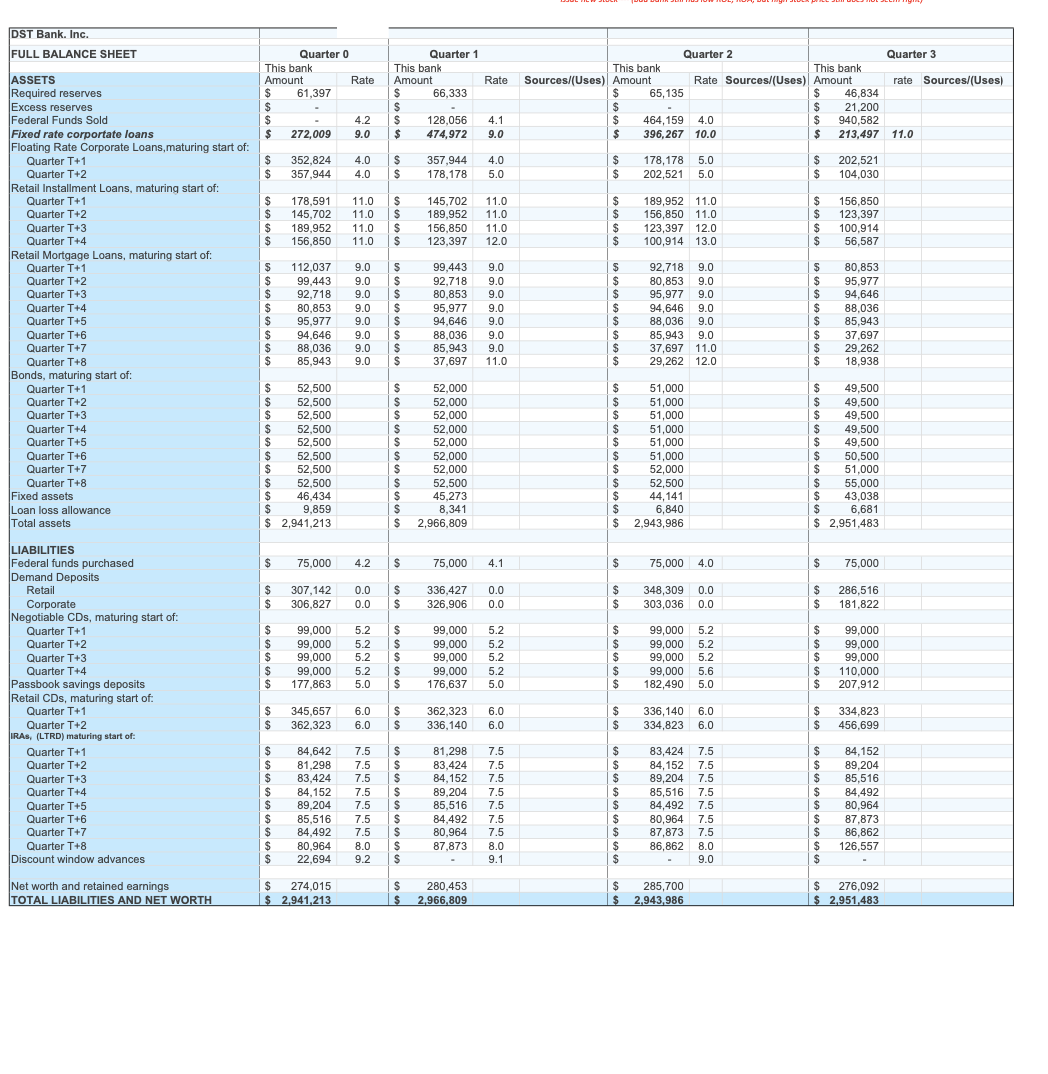

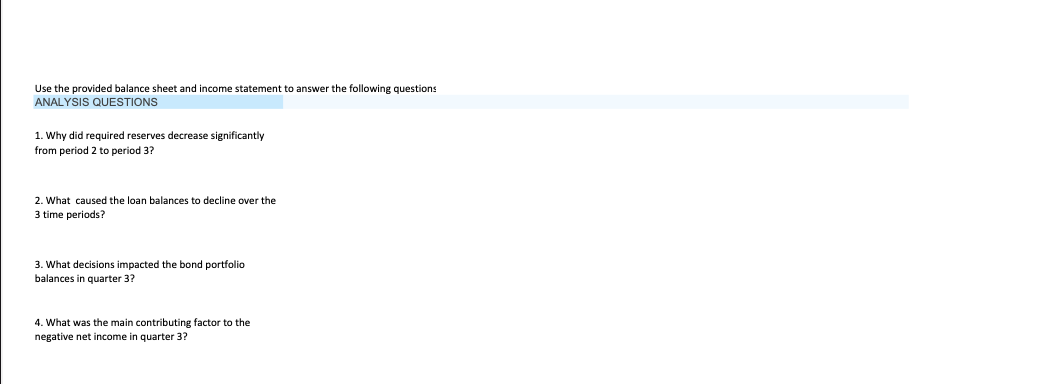

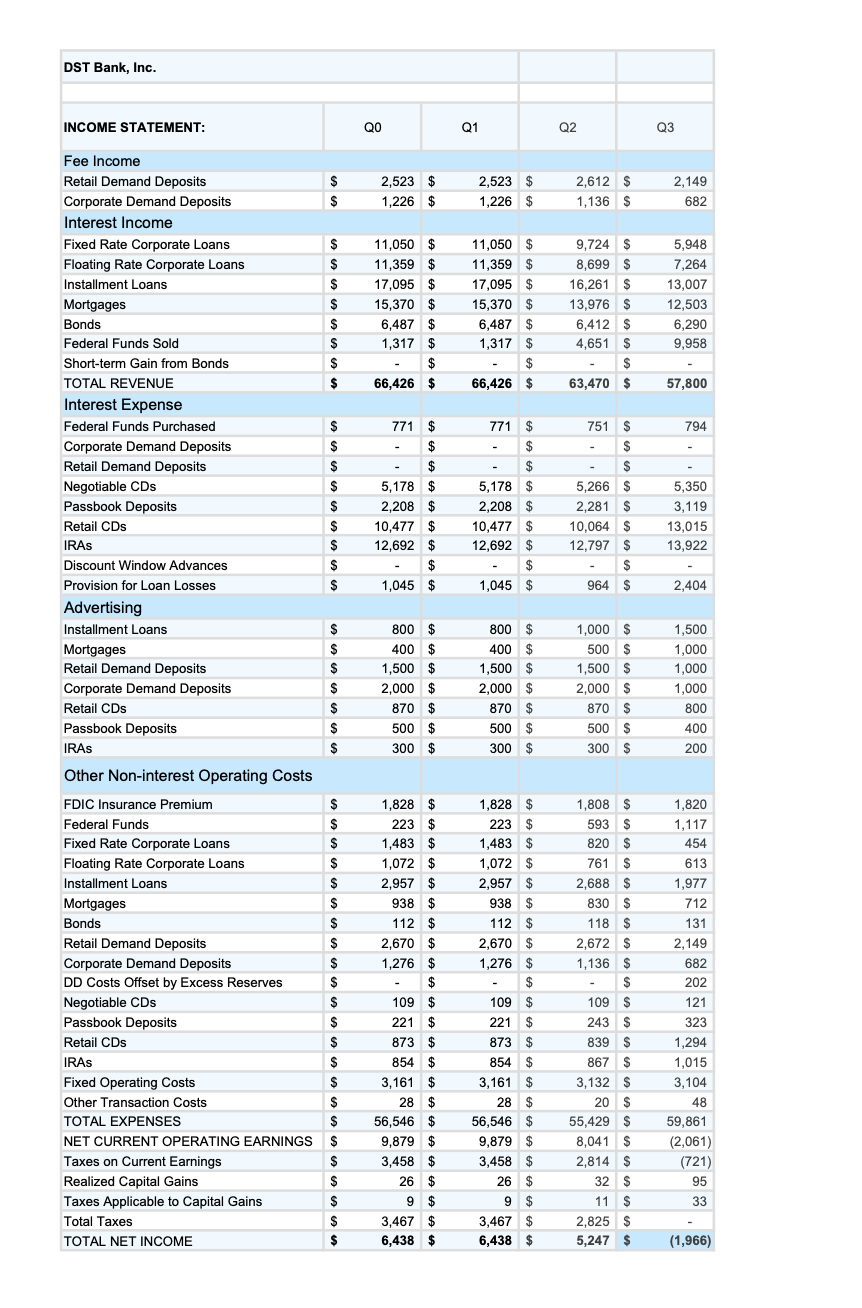

B C D E F G Decisions Set VALUE VALID RANGE QTR 0 QTR 1 QTR 2 QTR 3 Initial Reserve Allocation [0, 99999999] 0 65,000 65,000 70,000 Federal Funds Sold [0, 99999999] 10,000 10,000 40,000 Federal Funds Purchased [0, 99999999] 75,000 75,000 75,000 75,000 90-day CDs to Issue 10, 99999999] 0 0 0 0 180-day CDs to Issue [0, 99999999] 360-day CDs to Issue [0, 99999999] 99,000 99,000 99,000 110,000 New 8-quarter Bonds to Purchase [0, 99999999] 52,500 52,500 52,500 55,000 Bonds to Sell, due start of T+2 [0, 52500] 0 500 1,000 1,500 Bonds to Sell, due start of T+3 [0, 52500] 0 500 1,000 1,500 Bonds to Sell, due start of T+4 [0, 52500] 0 500 1,000 1,500 Bonds to Sell, due start of T+5 [0, 52500] 0 500 1,000 1,500 Bonds to Sell, due start of T+6 [0, 52500] 0 500 1,000 1,500 Bonds to Sell, due start of T+7 [0, 52500] 500 1,000 1.500 Bonds to Sell, due start of T+8 [0, 52500] 500 500 1,500 RATES TO CHOOSE VALUE VALID RANGE QTR 0 QTR 1 QTR 2 QTR 3 Fixed Rate Corporate Loans [0.01, 25] 9 10 1 Floating Rate Loan Spread [0.01, 10] 5 6 Installment Loans [0.01, 999.99] 11 12 13 14 Mortgage Loans [0.01, 999.99] 9 11 12 13 Retail CDs [0.01, 99] 6 6 7 Passbook Savings [0.01, 99] 5 6 IRAS [0.01, 99] 8 9 Retail Demand Deposits [0, 0] 0 0 Corporate Demand Deposits [0, 0] O O ADVERTISING DECISIONS VALUE VALID RANGE QTR 0 QTR 1 QTR 2 QTR 3 Ads, Installment Loans [0, 99999999] 430 800 1,000 1,500 Ads, Mortgages Loans [0, 99999999] 230 100 500 1,000 Ads, Retail Demand Deposits [0, 99999999] 1,300 1,500 1,500 1,000 Ads, Corporate Demand Deposits [0, 99999999] 1,940 200 2,000 1,000 Ads, Retail CDs [0, 99999999] 870 370 370 30 Ads, Passbook Savings 10, 99999999] 120 500 500 100 Ads, IRAs [0, 99999999] 210 300 300 200 OTHER MISCELLANEOUS DECISIONS VALUE VALID RANGE QTR 0 QTR 1 QTR 2 QTR 3 Number of Shares to Sell [-999999, 99999999] 0 10,000 Provision for Loan Losses [0, 99999900] 1 1 1 Corporate Loan Standard [-1, 1] 0 0 0 Total Dividends [0, 99999900] 0 0 0 10,000 Pct. of Cost Charged to Retail DD [0, 200 100 00 100 100 Pct. of Cost Charged to Corporate DD [0, 200] 100 100 100 100DST Bank. Inc. FULL BALANCE SHEET Quarter 0 Quarter 1 Quarter 2 Quarter This bank This bank This bank This bank ASSETS Amount Rate Amount Rate Sources/(Uses)|Amount Rate Sources/(Uses)| Amount rate Sources/(Uses) Required reserves 61,397 66,333 65,135 $ 46,834 Excess reserves $ 21,200 Federal Funds Sold 4.2 128,056 4.1 464,159 4.0 940,582 Fixed rate corportate loans 272,009 90 474,972 0 0 396,267 10.0 213,497 11.0 Floating Rate Corporate Loans, maturing start of: Quarter T+1 $ 352,824 4.0 357,944 4.0 178, 178 5.0 202,521 Quarter T+2 357.944 178.178 202,521 5.0 104,030 Retail Installment Loans, maturing start of: Quarter T+1 178,591 1.0 145,702 11.0 189,952 11.0 156,850 Quarter T+2 145,702 1.0 189,952 11.0 156,850 11.0 123,397 60 60 60 6A Quarter T+3 189,952 1.0 156,850 11.0 123,397 12.0 100,914 Quarter T+4 156,850 10 123.397 12.0 100.914 13.0 56.587 Retail Mortgage Loans, maturing start of: Quarter T+1 112,037 9.0 99,443 90 92,718 9.0 80,853 Quarter T+2 99.443 92.718 9.0 80,853 9.0 95,977 Quarter T+3 92,718 9.0 80,853 90 95,977 9.0 94,646 Quarter T+4 80,853 9.0 95 977 9.0 94.646 9.0 88.036 69 69 69 69 69 69 69 60 Quarter T+5 95,977 9.0 94.646 9.0 86,036 9.0 85,943 Quarter T+6 94.646 90 88.036 9.0 85,943 9.0 37,697 Quarter T+7 88,036 9.0 85,943 90 37,697 11.0 29,262 Quarter T+8 85,943 37,697 11.0 29,262 12.0 S 18,938 Bonds, maturing start of: Quarter T+1 52,500 52,000 51,000 49,500 Quarter T+2 52.500 52,000 51,000 49,500 Quarter T+3 52,500 52,000 51,000 19,500 Quarter T+4 2,500 52,000 51,000 19,500 Quarter T+5 52,500 2,00 51,000 49,500 Quarter T+6 52,500 52,000 51,000 69 69 69 69 69 69 69 69 69 69 69 60.500 Quarter T+7 52.500 52,000 52,000 51,000 Quarter T+8 52,500 52,50 52,500 55,000 Fixed assets 46,434 .5,273 14,141 43,038 Loan loss allowance 9,859 8,341 6,840 6,681 Total assets 2,941,213 2,966,809 2,943,986 $ 2 LIABILITIES Federal funds purchased 75,000 4.2 75,000 4.1 75,000 4.0 75,000 Demand Deposits Retail 307,142 336,427 0.0 348,309 0.0 286,516 Corporate 306,827 00 326,906 0.0 303,036 0.0 81.822 Negotiable CDs, maturing start of: Quarter T+1 99,000 5.2 99,000 5.2 99,000 5.2 99,000 Quarter T+2 39,000 5.2 99.000 5.2 99,000 5.2 99.000 Quarter T+3 99,000 5.2 99,000 62 99,000 5.2 99,00 Quarter T+4 99,000 5.2 99,000 5.2 99,000 5.6 110,000 Passbook savings deposits 77,863 5.0 176,637 50 82,490 5.0 207,912 Retail CDs, maturing start of Quarter T+1 345,657 6.0 362.323 6.0 336,140 6.0 334,823 Quarter T+2 362,323 336,140 60 334.823 6.0 60 6 456,699 IRAS, (LTRD) maturing start of: Quarter T+1 84,642 7.5 81,298 7.5 83,424 84,152 Quarter T+2 81,298 7.5 83,424 7.5 84.152 19,204 Quarter T+3 83.424 7.5 34. 152 7.5 89,204 7.5 85,516 Quarter T+4 84.152 89,204 75 85,516 7.5 84.492 Quarter T+5 39.204 7.5 85.516 7.5 84,492 7.5 60 69 60 60 60 60 60 69 69 80,964 Quarter T+6 85,516 7.5 84,492 7.5 80,964 7.5 87,873 Quarter T+7 34,492 7.5 80,964 7.5 87,873 7.5 86,862 Quarter T+8 80,964 8.0 87,873 8.0 86,862 8.0 26,557 Discount window advances 22.694 9.2 91 20 Net worth and retained earnings 274,015 280,453 285,700 $ 276,092 TOTAL LIABILITIES AND NET WORTH 2,941,213 2,966,809 2,943,986 $ 2 2,951,483Use the provided balance sheet and income statement to answer the following questions ANALYSIS QUESTIONS 1. Why did required reserves decrease significantly from period 2 to period 3? 2. What caused the loan balances to decline over the 3 time periods? 3. What decisions impacted the bond portfolio balances in quarter 3? 4. What was the main contributing factor to the negative net income in quarter 3?DST Bank, Inc. INCOME STATEMENT: QO Q1 Q2 Q3 Fee Income Retail Demand Deposits 2,523 $ 2,523 $ 2,612 $ 2,149 Corporate Demand Deposits 1,226 $ 1,226 $ 1,136 $ 682 Interest Income Fixed Rate Corporate Loans 11,050 $ 11,050 $ 9,724 $ 5,948 Floating Rate Corporate Loans 11,359 11,359 $ 8,699 S 7.264 Installment Loans 17,095 $ 17,095 $ 16,261 $ 13,007 Mortgages 15,370 $ 15,370 $ 13,976 $ 12,503 Bonds 6,487 $ 6,487 $ 6,412 $ 6,290 Federal Funds Sold 1,317 $ 1,317 $ 4,651 $ 9,958 Short-term Gain from Bonds $ $ TOTAL REVENUE 66,426 $ 66,426 $ 63,470 $ 57,800 Interest Expense Federal Funds Purchased 771 $ 771 $ 751 $ 794 Corporate Demand Deposits $ Retail Demand Deposits $ Negotiable CDs 5,178 $ 5,178 $ 5,266 $ 5,350 Passbook Deposits 2,208 $ 2,208 $ 2,281 3, 119 Retail CDs 10,477 $ 10,477 $ 10,064 $ 13,015 IRAS 12,692 $ 12,692 $ 12,797 S 13,922 Discount Window Advances $ Provision for Loan Losses 1,045 1,045 $ 964 2,404 Advertising Installment Loans 800 $ 800 $ 1,000 $ 1,500 Mortgages 400 $ 100 $ 500 S 1,000 Retail Demand Deposits 1,500 $ 1,500 $ 1,500 $ 1,000 Corporate Demand Deposits 2,000 $ 2,000 $ 2,000 $ 1,000 Retail CDs 870 $ 870 $ 870 800 Passbook Deposits 500 $ 500 $ 500 $ 400 IRAs 300 $ 300 $ 300 $ 200 Other Non-interest Operating Costs FDIC Insurance Premium 1,828 $ 1,828 $ 1,808 $ 1,820 Federal Funds 223 $ 223 $ 593 $ 1,117 Fixed Rate Corporate Loans 1,483 $ 1,483 $ 820 S 454 Floating Rate Corporate Loans 1,072 $ 1,072 $ 761 S 613 Installment Loans 2,957 $ 2,957 $ 2,688 S 1,977 Mortgages 938 $ 938 $ 830 712 Bonds 112 $ 112 $ 118 $ 131 Retail Demand Deposits 2,670 $ 2,670 $ 2,672 $ 2,149 Corporate Demand Deposits 1,276 $ 1,276 $ 1,136 $ 682 DD Costs Offset by Excess Reserves $ $ 202 Negotiable CDs 109 $ 109 $ 109 $ 121 Passbook Deposits 221 $ 221 $ 243 $ 323 Retail CDs 873 $ 873 $ 839 S 1,294 IRAS 854 $ 854 $ 867 1,015 Fixed Operating Costs 3, 161 $ 3, 161 $ 3,132 3,104 Other Transaction Costs 28 $ 28 $ 20 $ 48 TOTAL EXPENSES 56,546 $ 56,546 $ 55,429 $ 59,861 NET CURRENT OPERATING EARNINGS 9,879 $ 9,879 $ 8,041 $ (2,061) Taxes on Current Earnings 3,458 $ 3,458 $ 2,814 $ (721) Realized Capital Gains 26 $ 26 $ 32 $ 95 Taxes Applicable to Capital Gains 9 $ 9 $ 11 $ 33 Total Taxes 3,467 $ 3,467 $ 2,825 $ TOTAL NET INCOME 6,438 $ 6,438 $ 5,247 $ (1,966)