Question: 14. Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The

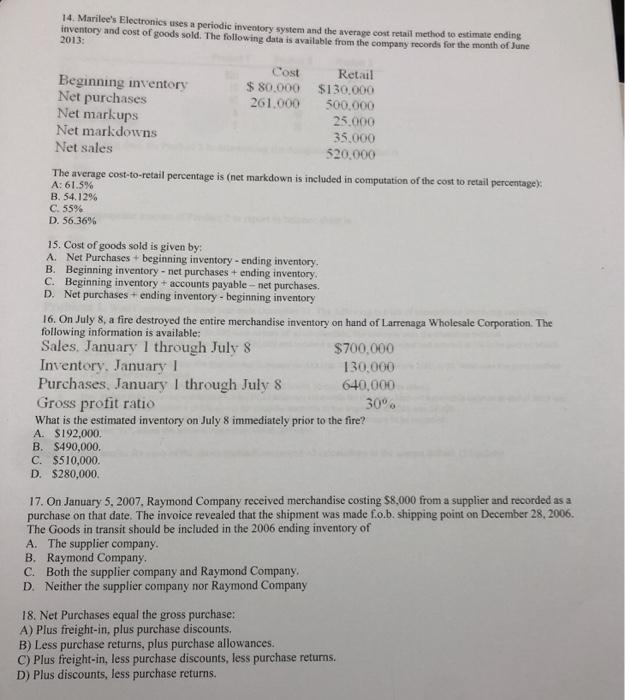

14. Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of June 2013: Beginning inventory Net purchases Net markups Net markdowns Net sales Cost $80,000 261.000 B. 54.12% C. 55% D. 56.36% Retail $130,000 500.000 The average cost-to-retail percentage is (net markdown is included in computation of the cost to retail percentage): A: 61.5% 15. Cost of goods sold is given by: A. Net Purchases + beginning inventory - ending inventory. B. Beginning inventory - net purchases + ending inventory. C. Beginning inventory + accounts payable - net purchases. D. Net purchases + ending inventory - beginning inventory 25.000 35.000 520,000 Inventory. January 1 Purchases, January 1 through July 8 Gross profit ratio 16. On July 8, a fire destroyed the entire merchandise inventory on hand of Larrenaga Wholesale Corporation. The following information is available: Sales, January 1 through July 8 $700,000 130,000 640,000 30% What is the estimated inventory on July 8 immediately prior to the fire? A. $192,000. B. $490,000. C. $510,000. D. $280,000. 17. On January 5, 2007, Raymond Company received merchandise costing $8,000 from a supplier and recorded as a purchase on that date. The invoice revealed that the shipment was made f.o.b. shipping point on December 28, 2006. The Goods in transit should be included in the 2006 ending inventory of A. The supplier company. B. Raymond Company. C. Both the supplier company and Raymond Company. D. Neither the supplier company nor Raymond Company 18. Net Purchases equal the gross purchase: A) Plus freight-in, plus purchase discounts. B) Less purchase returns, plus purchase allowances. C) Plus freight-in, less purchase discounts, less purchase returns. D) Plus discounts, less purchase returns.

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Answer Answer14 Cost to retail ratio55 Explanation Cost to retail ratio 341000620... View full answer

Get step-by-step solutions from verified subject matter experts