Question: 1-4 please!! Equipment purchased for use by business will decrease in value due to use and age as time goes by. The IRS recognizes this

1-4 please!!

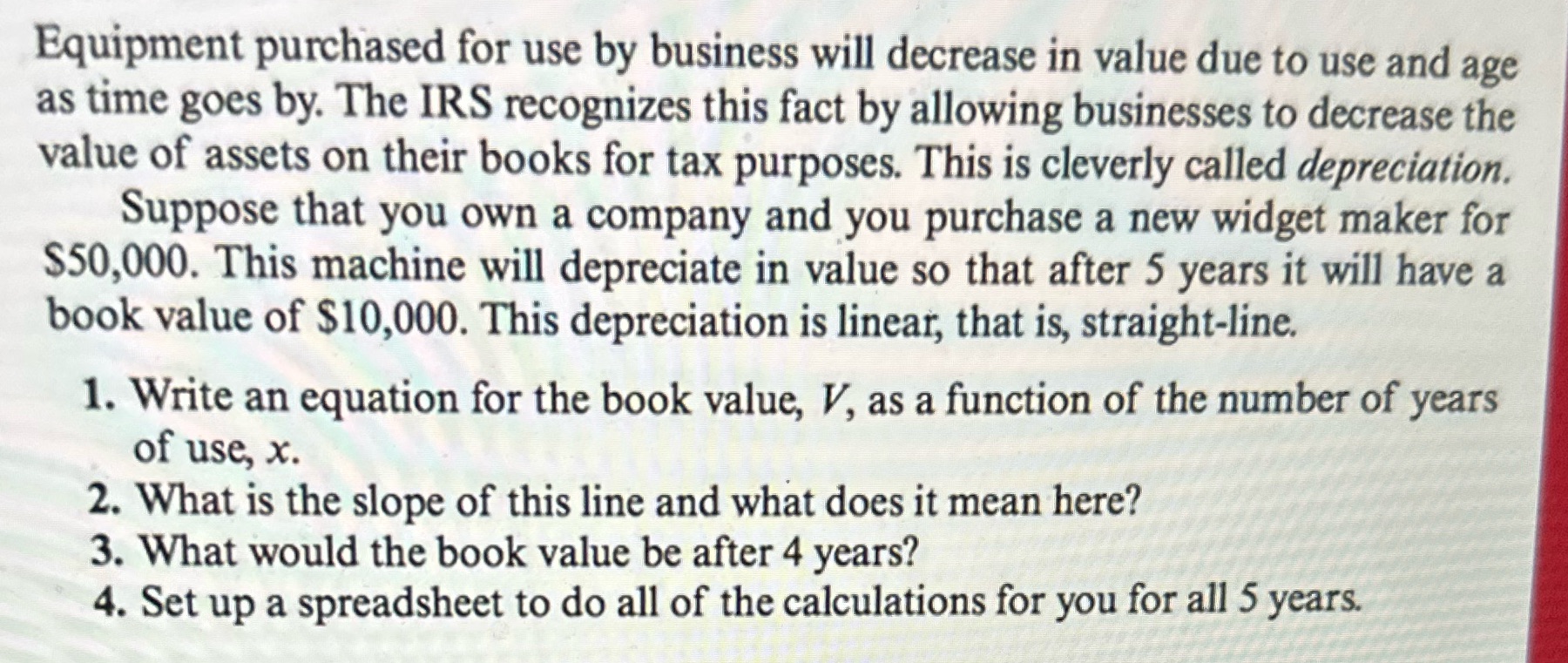

Equipment purchased for use by business will decrease in value due to use and age as time goes by. The IRS recognizes this fact by allowing businesses to decrease the value of assets on their books for tax purposes. This is cleverly called depreciation. Suppose that you own a company and you purchase a new widget maker for $50,000. This machine will depreciate in value so that after 5 years it will have a book value of $10,000. This depreciation is linear, that is, straight-line~ 1. Write an equation for the book value, V, as a function of the number of years of use, x. 2. What is the slope of this line and what does it mean here? 3. What would the book value be after 4 years? 7 4. Set up a spreadsheet to do all of the calculations for you for all 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts